- Long-term holders’ confidence in ARB was low.

- ARB was up by 6%, and most market indicators were bullish.

Last month was quite a bloodbath for several cryptos, including Arbitrum [ARB], as it shed a substantial amount of its value. As a result, all ARB investors were pushed out of business.

However, the last 24 hours witnessed some gains. Will this allow investors’ market positions to change?

Arbitrum’s critical state

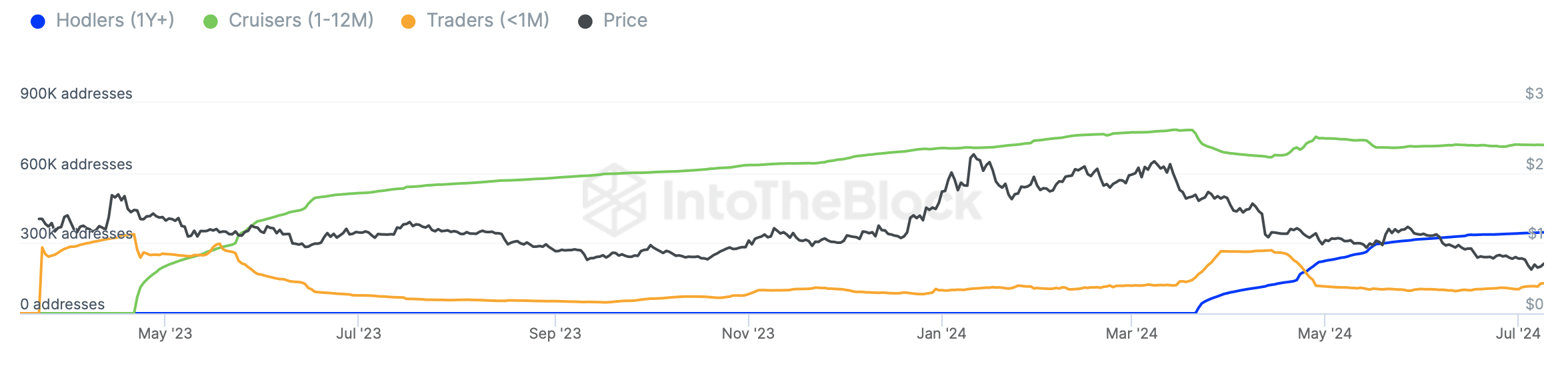

CoinMarketCap’s data revealed that Arbitrum’s price declined by more than 25% in the last month. Meanwhile, IntoTheBlock posted a tweet highlighting a surprising development.

As per the tweet, 0% of ARB investors were “in the money” at press time.

AMBCrypto’s analysis revealed that ARB had a breakeven price of $0.67–$0.74. This meant that most investors bought the token at a higher price than the aforementioned level.

In fact, investors who were hounding ARB for 1–2 months were substantially more than long-term holders, who had been holding the token for over a year, reflecting less confidence among long-term investors.

Source: IntoTheBlock

However, the last 24 hours showed some signs of recovery, which, if sustained, might allow some investors to earn profits. The token’s price had surged by more than 6% over the last day.

At the time of writing, ARB was trading at $0.7197 with a market capitalization of over $2.32 billion, making it the 34th largest crypto.

Will ARB remain bullish?

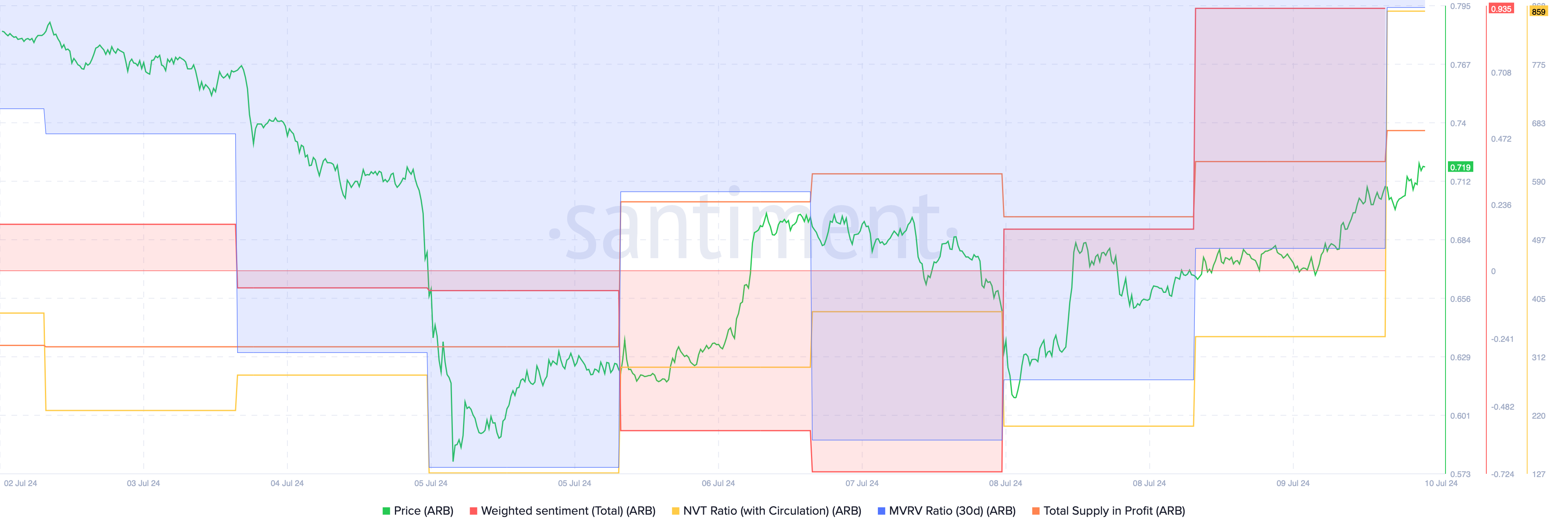

Since the last 24 hours were in investors’ favor, AMBCrypto planned to analyze the token’s on-chain data to understand the odds of ARB sustaining the uptrend.

As per our analysis of Santiment’s data, Arbitrum’s weighted sentiment improved sharply in the last few days. This clearly meant that bullish sentiment around the token was dominant in the market.

Thanks to the recent price uptick, ARB’s supply in profit also increased last week. Another bullish signal was the MVRV ratio, which improved on the 9th of July.

Regardless, the NVT ratio registered a sharp spike. A rise in the metric means that an asset is overvalued, which hinted at a price correction in the coming days.

Source: Santiment

We then checked the token’s daily chart to better understand in which direction it’s headed. Notably, most market indicators were bullish on the token.

For instance, the Chaikin Money Flow (CMF) registered a sharp uptick.

Realistic or not, here’s ARB’s market cap in BTC’s terms

The Relative Strength Index (RSI) moved northward. ARM’s MACD displayed a bullish crossover. All of these hinted at a continued price rise.

On top of that, ARB’s price had touched the lower limit of the Bollinger Bands, which usually results in price rebounds.

Source: TradingView

Powered by WPeMatico