- Ethereum whale sends 5,000 ETH to an exchange.

- Spot ETF approval is yet to impact the ETH price trend.

An Ethereum [ETH] whale recently transferred around $15 million worth of assets to an exchange. This action occurred shortly after news emerged of ETF approvals in Hong Kong.

Has the whale’s transfer affected the price, and has the ETF approval also influenced the price?

Ethereum whale takes profit

Data from Lookonchain reveals that an Ethereum whale recently moved 5,000 ETH to the Kraken exchange, valuing over $15.4 million at the time of transfer.

Further analysis showed that the same whale withdrew 96,638 ETH from Coinbase back in September 2022. At this time, ETH was valued at around $1,567, bringing the value of the withdrawal to over $151.4 million.

This suggests that the recent transfer was likely made to realize profits, given ETH’s surge to over $3,000. Presently, the whale wallet holds 76,638 ETH, now valued at over $233.5 million.

Ethereum continues decline

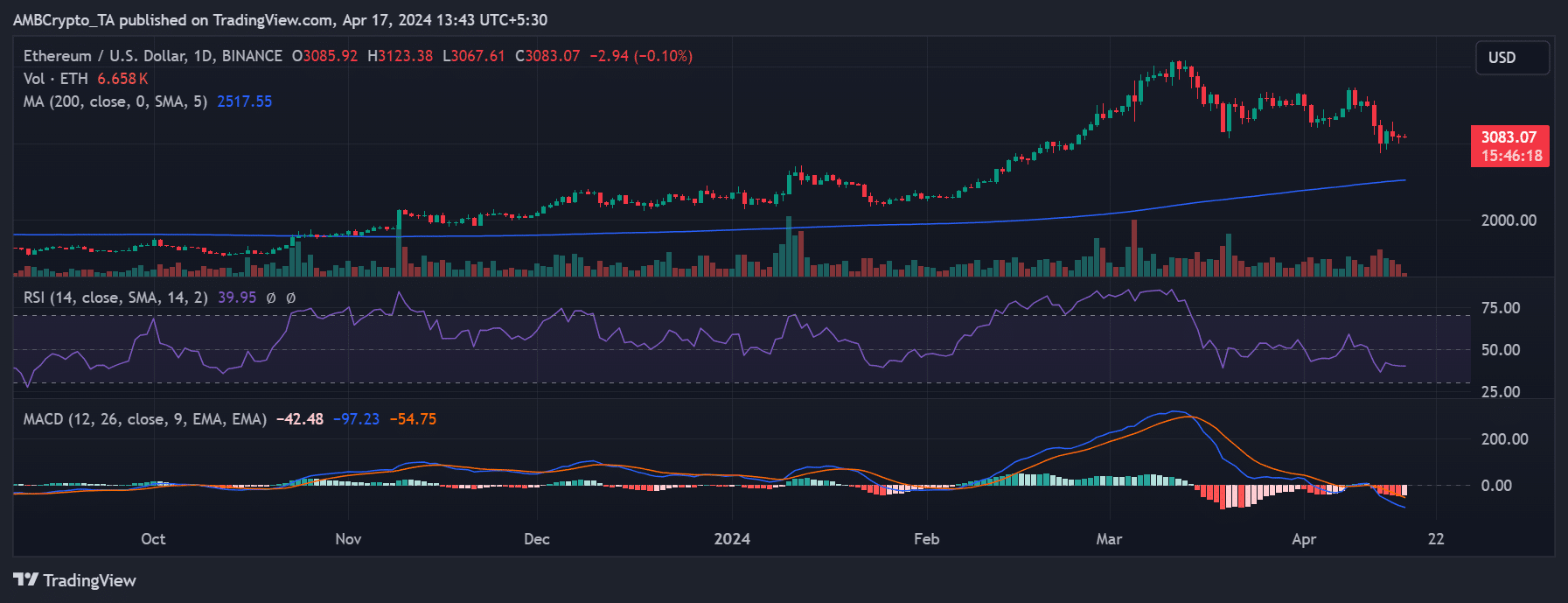

An analysis of the Ethereum daily timeframe chart reveals a recent lack of profitability. Over the past three days, ETH has experienced a consistent downward trend following a 4% increase on the 14th of April.

Despite these declines, it has retained the initial 4% gain from the beginning of the week.

Source: Trading View

As of the time of writing, ETH was trading at around $3,080, marking a decrease of less than 1%.

Furthermore, these declines have intensified ETH’s bearish trend, evident from its Relative Strength Index (RSI) hovering around 40 and its Moving Average Convergence Divergence (MACD) indicating a trend below zero.

These metrics collectively indicate a strong bearish momentum for ETH, despite earlier positive news from Hong Kong earlier in the week.

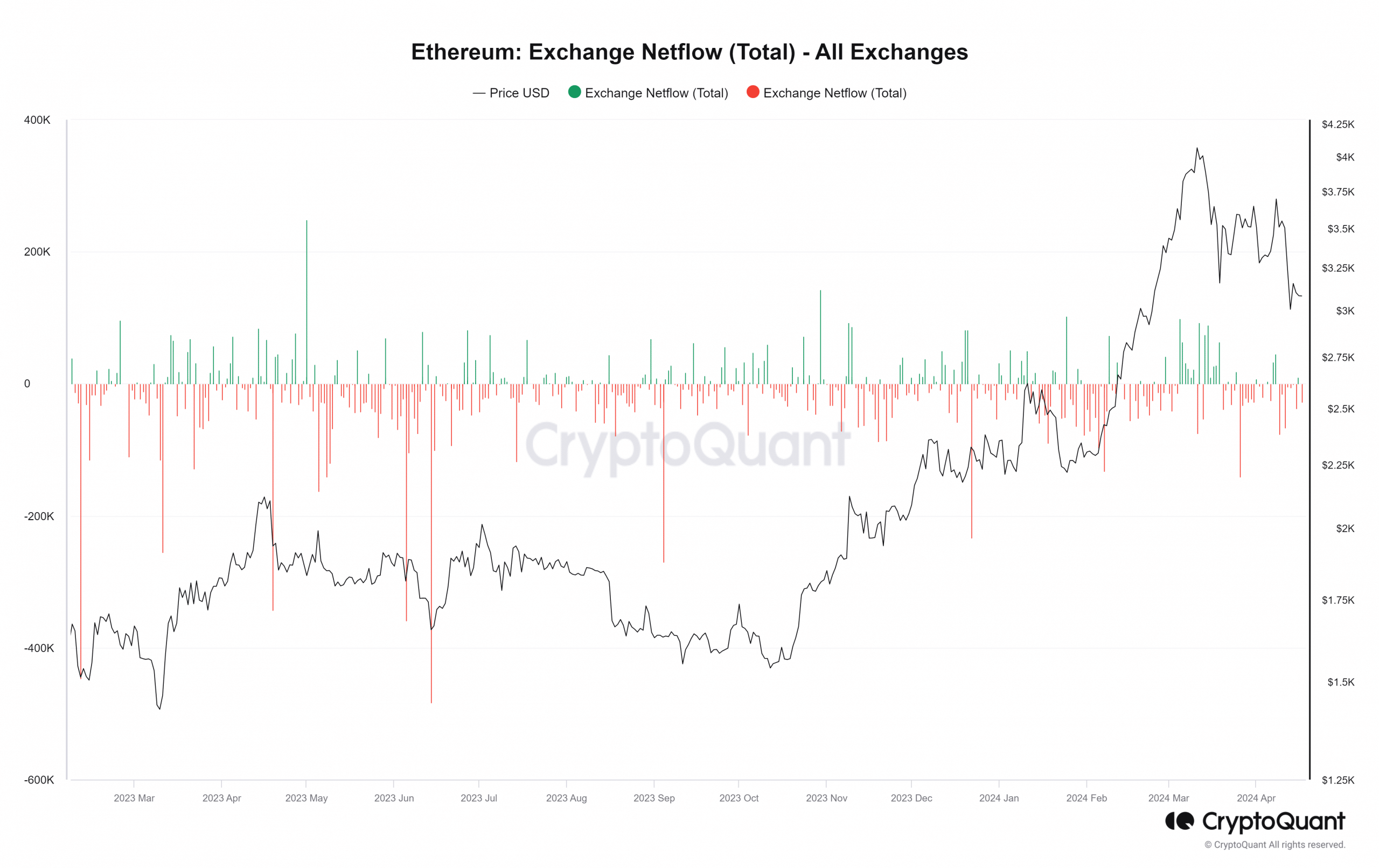

As of press time, Ethereum’s netflow data indicated a trend of increased ETH leaving exchanges.

However, by the end of trading on the 16th of April, there was a positive netflow, with 10,230 ETH flowing into exchanges. Nevertheless, as of press time, over 27,000 ETH outflows have been recorded.

Source: CryptoQuant

ETF approval yet to impact the ETH price trend

Multiple reports have stated that Hong Kong recently approved several spot Ethereum ETF proposals alongside spot Bitcoin ETF proposals.

Surprisingly, the approval hasn’t stirred any notable reaction in the Ethereum price. This lack of response could be attributed to the absence of an official statement from the SEC regarding the approval.

Investors should be cautious about celebrating prematurely, considering the past occurrence of fake news regarding spot BTC ETF approvals.

Read Ethereum’s [ETH] Price Prediction 2024-25

Even upon official confirmation, the impact on the market might be insignificant due to lower trading volumes.

Different from the substantial ETF volumes witnessed in the United States for BTC, the volume anticipated from the Hong Kong market might not suffice to drive significant market movements.

Powered by WPeMatico