- BTC’s price increased by over 10% in the last seven days.

- A few market indicators looked bearish on the coin.

Bitcoin’s [BTC] price action continued to remain bullish as it traded above the $65k mark. While that happened, long-term investors’ confidence in the coin also surged. But will that be enough to sustain this bull rally? Let’s find out.

Bitcoin is holding strong

CoinMarketCap’s data revealed that Bitcoin’s price had risen by more than 10% in the last seven days. In fact, in the last 24 hours alone, the king of crypto’s value surged by over 3%.

At the time of writing, BTC was trading at $65,362.47 with a market capitalization of over $1.289 trillion.

In the meantime, IntoTheBlock recently posted a tweet highlighting an interesting development. As per the tweet, long-term Bitcoin holders showed confidence last week, adding to their holdings.

It was interesting to note that this increase in LTH confidence in BTC increased while several major players indulged in sell-offs. For example, AMBCrypto reported earlier that the German government sold all of its BTC holdings, bringing its balance to zero.

Apart from that, another notable development happened in the recent past related to Mt. Gox. Lookonchain’s latest tweet pointed out that Mt. Gox moved 44,527 BTC, worth over $2.84 billion, to an internal wallet.

The motive behind this movement might be for repayment. Mt. Gox currently holds 138,985 BTC, which is worth $8.87 billion.

Will this be enough for BTC?

AMBCrypto then planned to take a look at other datasets to see whether LTH’s confidence in BTC would be enough to sustain the bull rally.

Our analysis of CryptoQuant’s data revealed that BTC’s exchange reserve was dropping, meaning that buying pressure on the token was high.

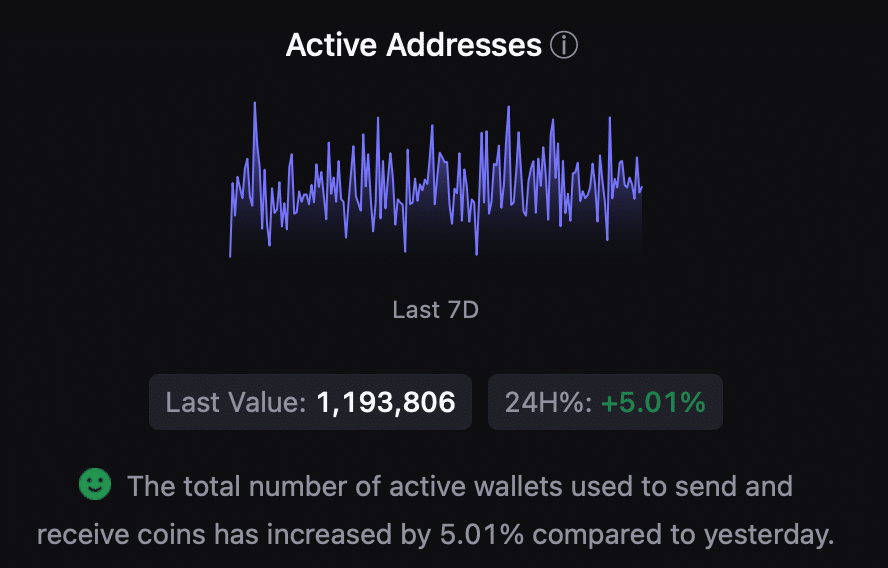

Its Coinbase premium was green, which suggested that buying sentiment was strong among US investors. On top of that, BTC’s network activity was rising, which was evident from the increase in its active addresses compared to the last day.

Source: CryptoQuant

However, at the time of writing, BTC’s fear and greed index had a reading of 75%, indicating that the market was in a “greed” phase.

Whenever the metric hits this level, it suggests that the chances of a price correction are high. Therefore, we assessed the king of crypto’s daily chart to better understand what to expect.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

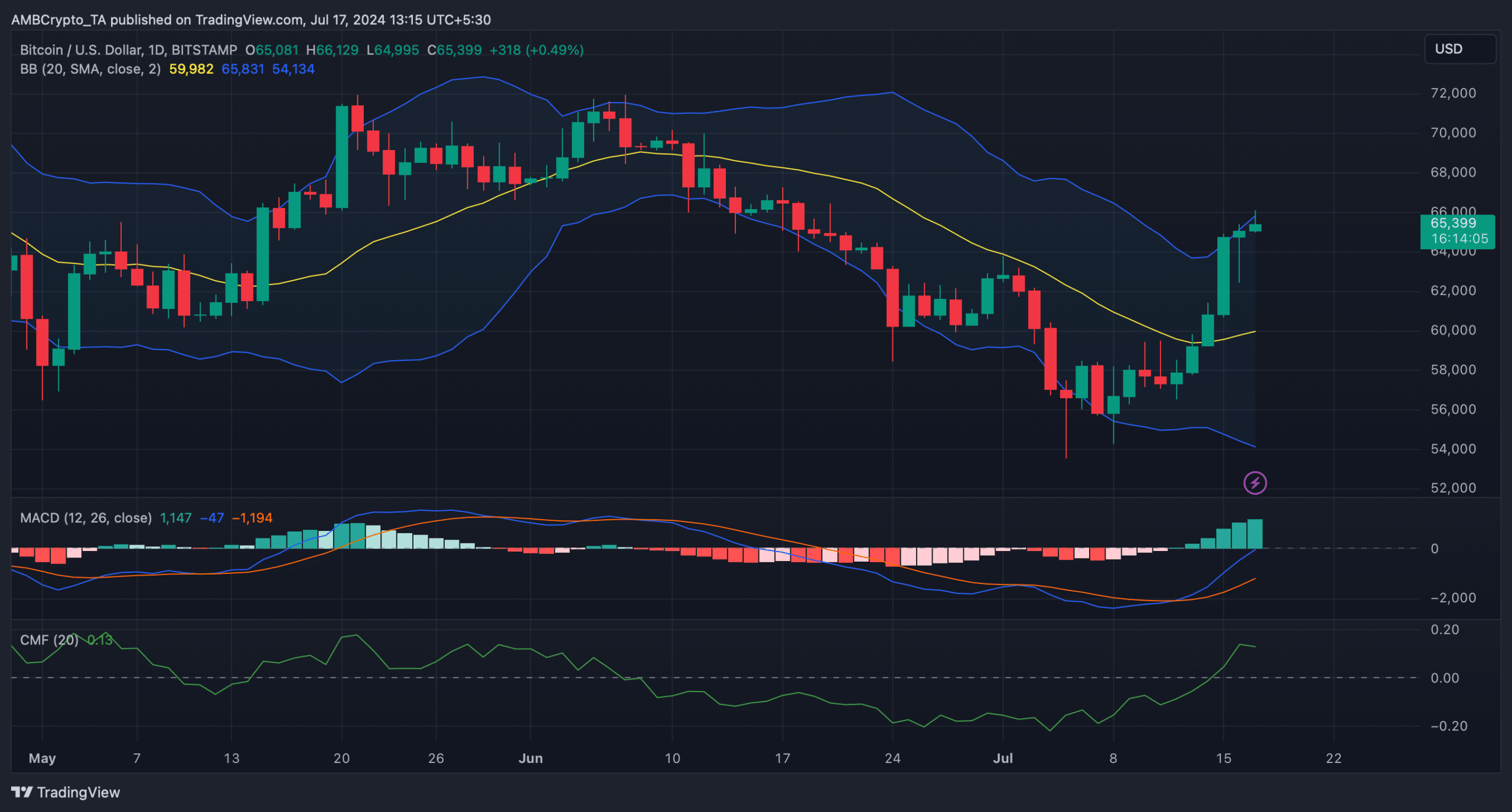

We found that BTC’s price had touched the upper limit of the Bollinger Bands. Its Chaikin Money Flow (CMF) also registered a downtick.

Both the indicators hinted at a price correction. Nonetheless, the MACD remained in buyers’ favor as it displayed a bullish advantage.

Source: TradingView

Powered by WPeMatico