- Bitcoin reclaimed $100k, albeit briefly, with both internal and external factors signaling a potential Q1 breakout

- History tells us that the crypto market has a knack for defying mainstream predictions

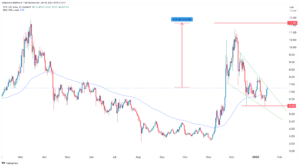

The latest economic data has put the Fed in a tough spot. No surprise, the crypto market wasted no time reacting. With a 4% hike in market cap, top coins are back in the green, and Bitcoin soon reclaimed $100k, albeit briefly – A level it hasn’t seen in over a week. Coincidence or strategy? This surge seemed to be perfectly in line with Trump’s upcoming inauguration.

Clearly, the stage is set. With all these factors in play, is it still too bold to predict Bitcoin’s new all-time high by the end of this month?

If anticipation outweighs execution…

The crypto market’s reaction to the latest inflation data was no fluke. December’s Core CPI inflation dropped to 3.2%, beating the 3.3% forecast. This unexpected dip has sparked rate-cut optimism, evident in the 4% jump.

This could be the turning point investors have been waiting for. With inflation cooling, the Fed may rethink cutting borrowing costs. Lower interest rates could make leverage cheaper for traders, potentially flooding the crypto market with fresh capital.

The Open Interest (OI) now sitting above $64 billion speaks volumes. With the leverage ratio on Binance spiking, we could see even more action if the Fed pulls the trigger – something you’ll want to keep a close eye on in the coming days.

Source: CryptoQuant

However, here’s the catch – The 3.61% jump in Bitcoin, just as the report dropped, wasn’t purely based on the inflation data. It’s a mix of “anticipation” around potential rate cuts, Trump’s crypto-friendly SEC overhaul proposal, and his upcoming return to the White House.

Together, these factors are setting the stage for a potential $102k breakthrough for BTC. However, hitting a new all-time high isn’t just about anticipation. It needs real “execution.” As we’ve seen it time and again – the market loves to defy mainstream expectations. Could this be another one of those moments?

A peek to the other side of Bitcoin

To break its all-time high, Bitcoin would need a 10% surge from its press time price of $99.8k. Last year, during the Trump pump, BTC surged a whopping 9% in a single day. However, this time, the stakes are much higher.

The next FOMC meeting is just 13 days away, and it could shape the entire landscape for 2025. The market is holding its breath, with a 97.3% chance of a rate cut hanging in the balance. Will the Fed deliver, or will investor hopes be dashed once again?

Source: FedWatch

While a 10% surge seems within reach, brace for major volatility in the days ahead. Short-term traders are likely to focus on quick profits rather than long-term holds. Add Trump’s renewed push for tariffs on countries like Denmark and Canada and it’s easy to see why the Fed might hesitate on rate cuts.

Read Bitcoin’s [BTC] Price Prediction 2025-26

With so many unpredictable factors at play, the road ahead could be bumpy for Bitcoin, making it crucial for investors to stay alert. The next few days would determine whether the market’s optimism holds strong – or falters.

Powered by WPeMatico