- BTC was able to reclaim the $60,000 price range after days off it.

- The number of active addresses declined in the past week.

Despite recent struggles in its price trend over the past few weeks, Bitcoin [BTC] has managed to climb back into the $60,000 price range. During this challenging period, large investors, often referred to as whales, continued to acquire more Bitcoin.

The price of Bitcoin, as well as the general crypto market, has seen an increase in the last 24 hours, coinciding with the news of an assassination attempt on former US president Donald Trump.

This event has sparked market speculation that Trump’s chances of winning the next election might have increased following the incident.

Whales add more Bitcoin to holdings

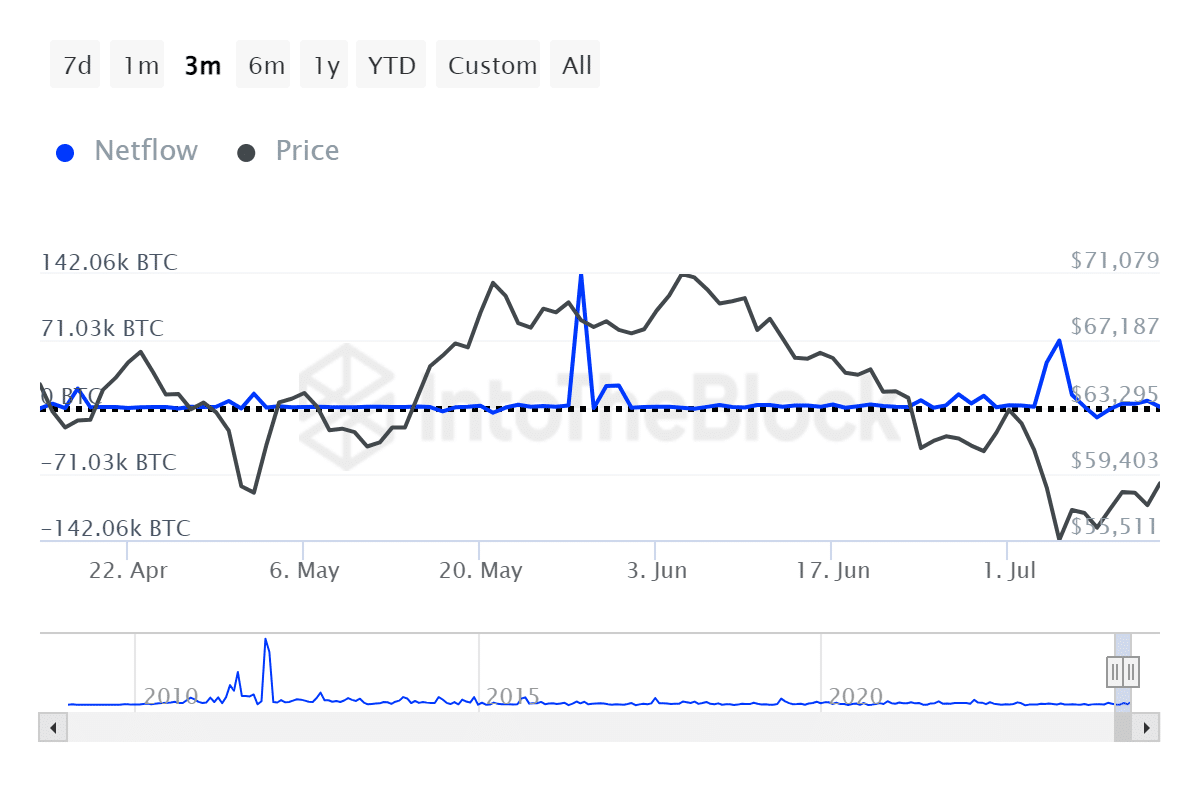

Data from IntoTheBlock revealed that Bitcoin whales actively accumulated more coins over the past week.

The analysis indicated that approximately 71,000 BTC were added to whale wallets, which, given Bitcoin’s average price of around $57,000 last week, translates to an acquisition worth over $4 billion.

This significant investment highlighted the confidence these large holders have in Bitcoin’s future value.

Source: IntoTheBlock

Further analysis of other data showed that wallets holding between 1,000 and 10,000 BTC have been particularly active, suggesting that this segment of investors is driving much of the recent whale activity.

As of this writing, these wallets collectively hold over 4.7 million BTC. This trend not only underscores the bullish sentiment among major investors but also indicates a possible consolidation of wealth within the network.

Bitcoin breaks immediate resistance

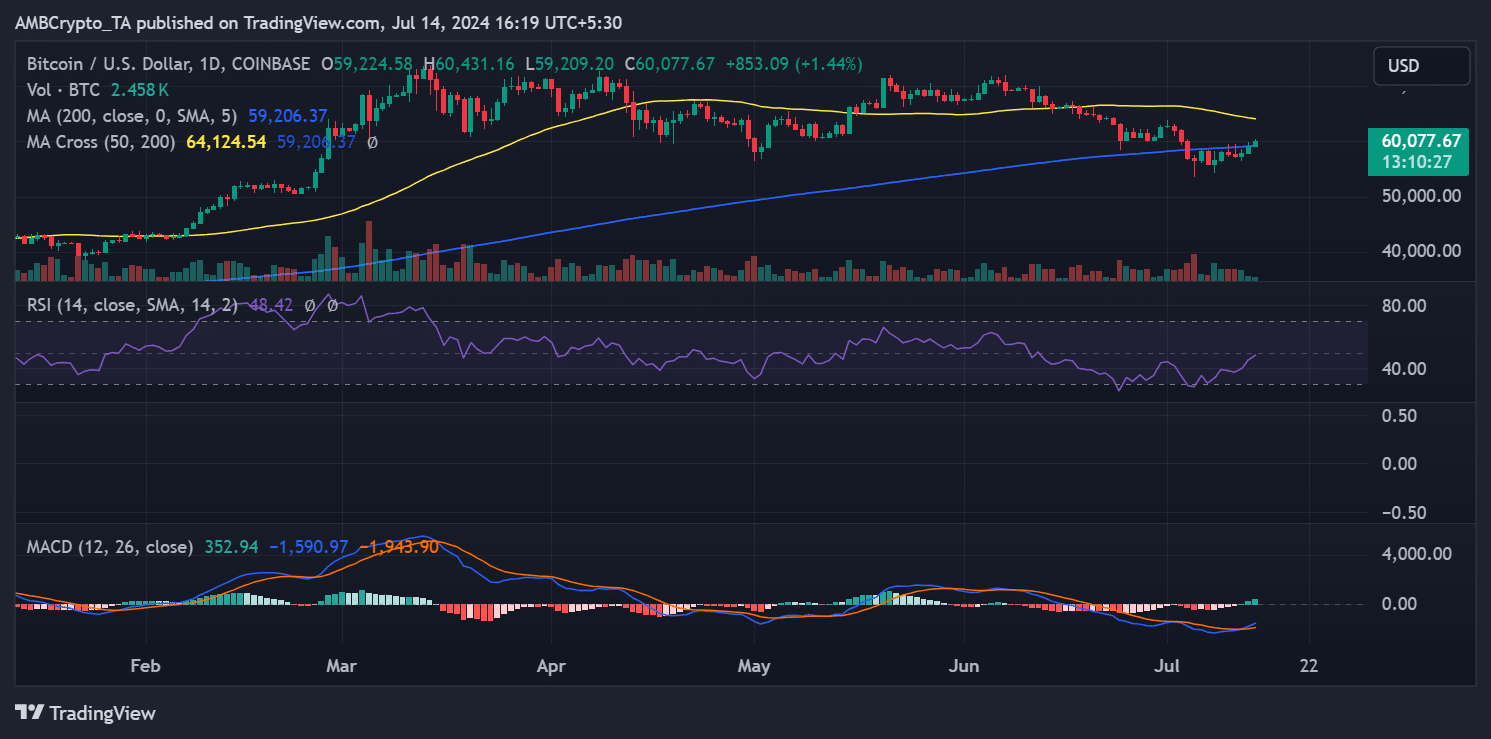

Analysis of Bitcoin on a daily timeframe showed a sequence of uptrends towards the end of last week, according to a chart study by AMBCrypto.

On 12th July, BTC recorded a nearly 1% increase, pushing its price close to $58,000. The following day, it experienced a more significant rise of over 2%, reaching above $59,000.

Most recently, a further increase of over 1% has propelled Bitcoin back into the $60,000 range, with the cryptocurrency trading at approximately $60,030, marking a 1.3% rise.

The notable rise in its price coincided precisely with the breaking news of the assassination attempt on Donald Trump. This timing suggests that the event may have influenced market movements, as investors often react to major geopolitical events.

It presents speculative opportunities based on their interpretations of the news.

Source: TradingView

The current movements in Bitcoin’s price have influenced its Relative Strength Index (RSI), pushing it close to the neutral line, though not surpassing it. This suggests that while BTC was still in a bear trend, the bearish momentum was weakening.

Additionally, BTC has managed to break through the resistance formed by its long moving average (blue line). However, it still faces resistance at around $64,000, which is indicated by its short moving average (yellow line).

This mixed technical picture underscores a critical transition phase in Bitcoin’s market sentiment, possibly gearing towards a more sustained recovery.

Active addresses decline

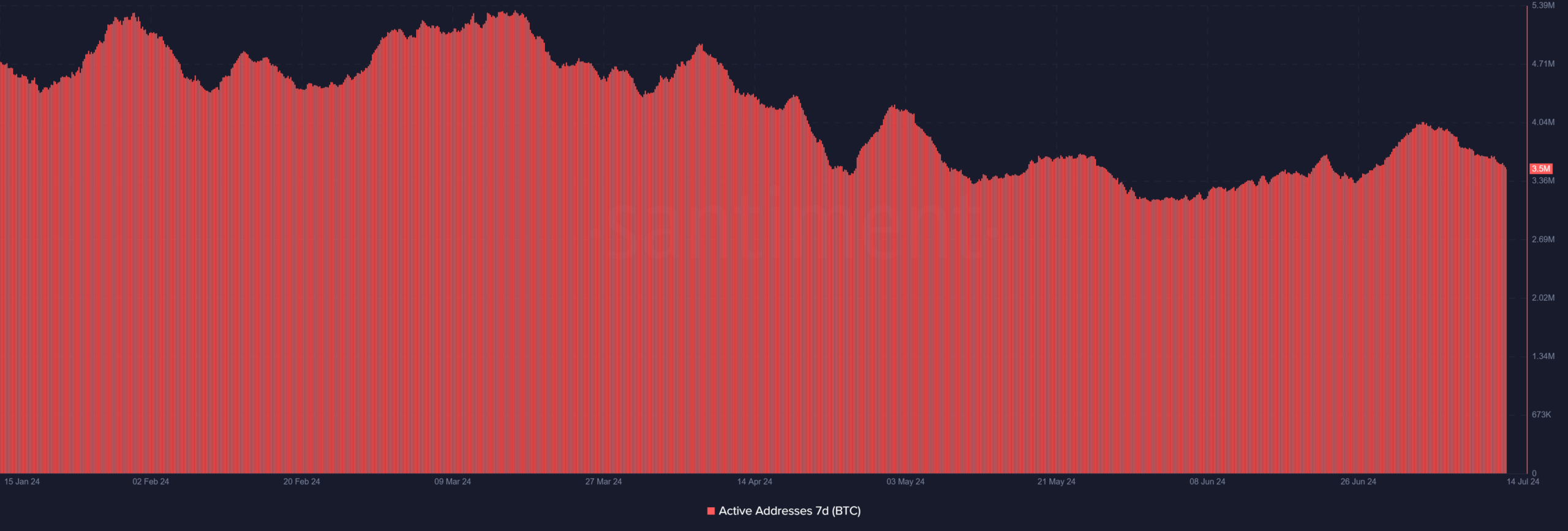

Despite the recent uptrend in Bitcoin’s price and significant accumulation by whales, there has been a noticeable decline in the number of active addresses in recent days.

Source: Santiment

Read Bitcoin (BTC) Price Prediction 2024-25

An analysis of the seven-day daily active addresses chart on Santiment revealed a decline in active participation. At the beginning of the past week, the number of active addresses was approximately 3.9 million.

However, according to the latest data, this number has decreased to around 3.5 million.

Powered by WPeMatico