- Bitcoin pushed to noteworthy short-term zone, raising possibility of short-term profit-taking.

- Recent sell shocks have retail traders on the sidelines, will price discovery trigger the next wave of FOMO?

Bitcoin [BTC] jumped above $66,000 on 17th July for the first time in three weeks, riding on a strong bullish wave fueled by multiple factors, including Trump surviving an assassination attempt.

This fresh rally has triggered hopes among BTC holders, of a potential push into price discovery.

While the latest bullish performance indicates the return of confidence among Bitcoin investors, not everyone is convinced that it will be a smooth ride to a new ATH.

BTC’s pump has so far pushed above its short-term holder realized price. A situation that could change the tide or present a sell wall.

The price crossing above its short-term holder realized price signals that Bitcoin’s short-term traders may be compelled to take profits. Expectations of more upside would however ward off the bears especially if there is not enough excitement in the market.

Retail traders are still on the sidelines

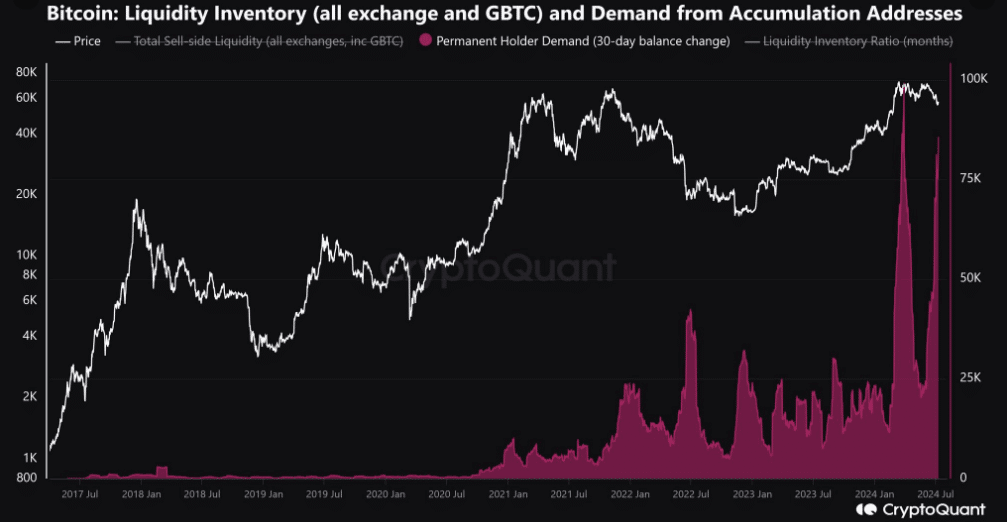

Data also indicates that there was low retail participation in the latest rally. In other words, whales and institutions have fueled the rally that we have witnessed in the last two weeks.

A sign that the retail class are still fearful about the impact of the Mt. Gox Bitcoin sell-off.

What we know so far is that Bitcoin is about $8,000 away from a significant rally. It also has room for more upside before retesting the next major resistance level.

However, profit-taking from investors that bought the dip will likely yield some resistance and a potential pullback within the next few days.

For now, any incoming sell pressure has to contend with strong demand from institutions aping into Bitcoin ETFs. The retest of sub $60,000 prices presented an unexpected opportunity for many whales and retail investors to dollar-cost average into Bitcoin.

What does the current market environment mean for Bitcoin?

Bitcoin’s bearish conditions for most of June and the first week of July may have eroded retail investor confidence. This may explain why we are seeing low participation, along with the extended high interest rates which have negatively affected retail’s purchasing power.

On the flip side, the demand from institutions may revive excitement in the market. This coincides with observations indicating that long-term holder demand is also ramping up.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s growing long-term holder inventory is a healthy long-term signal that might support the expectations of higher prices.

A continued upside would set the stage for retail FOMO within the next few days or weeks. A situation that could present yet more opportunities for liquidations and potentially sizable pullbacks.

Powered by WPeMatico