- Bitcoin’s price went just under the $70k mark.

- Metrics suggest that BTC will witness a further price correction.

Bitcoin’s [BTC] value has been somewhat in a consolidation phase near the $70k mark for quite a few days. If the latest analysis is to be believed, then investors might not witness an unprecedented price rise in the near term.

Therefore, AMBCrypto planned to check BTC’s metrics to see what to expect from it in the coming week.

Bitcoin has problems ahead

According to CoinMarketCap, BTC’s value just dropped under the $70k mark. The token’s value went down marginally in the last 24 hours. At press time, it was trading at $69,973.35 with a market capitalization of over $1.38 billion.

However, it was interesting to note that, despite the recent drop, over 97% of BTC holders were in profit. Additionally, as per IntoTheBlock’s data, the market for BTC was still bullish.

In the meantime, Michael van de Poppe, a popular crypto analyst, posted a tweet highlighting Bitcoin’s current state. As per the tweet, the chances of BTC reaching $100k anytime soon were low, as we were still following the path of the 4-year cycle.

Additionally, the tweet mentioned that BTC consolidating in between $60k and its ATH seemed likely to happen.

Will BTC’s price fall further next week?

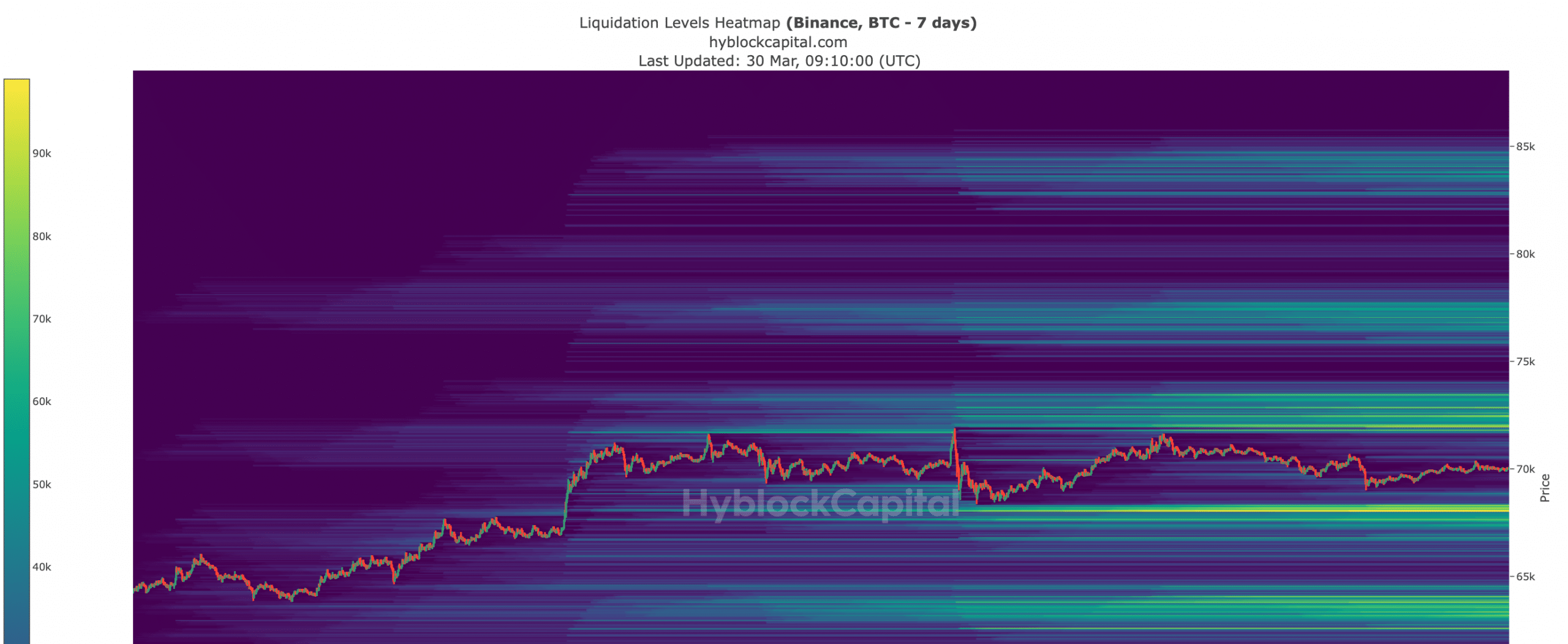

AMBCrypto checked BTC’s metrics to find out whether BTC will continue to remain less volatile in the upcoming week. Our analysis of Hyblock Capital’s data also revealed a similar scenario to the aforementioned analysis.

We found that northward BTC’s liquidation will increase sharply to $72k. High liquidity might act as strong resistance for the king of cryptos and restrict its price from moving up.

Similarly, southward BTC’s support lies near $69k. If it fails to test that support, then BTC’s price might as well reach $63k.

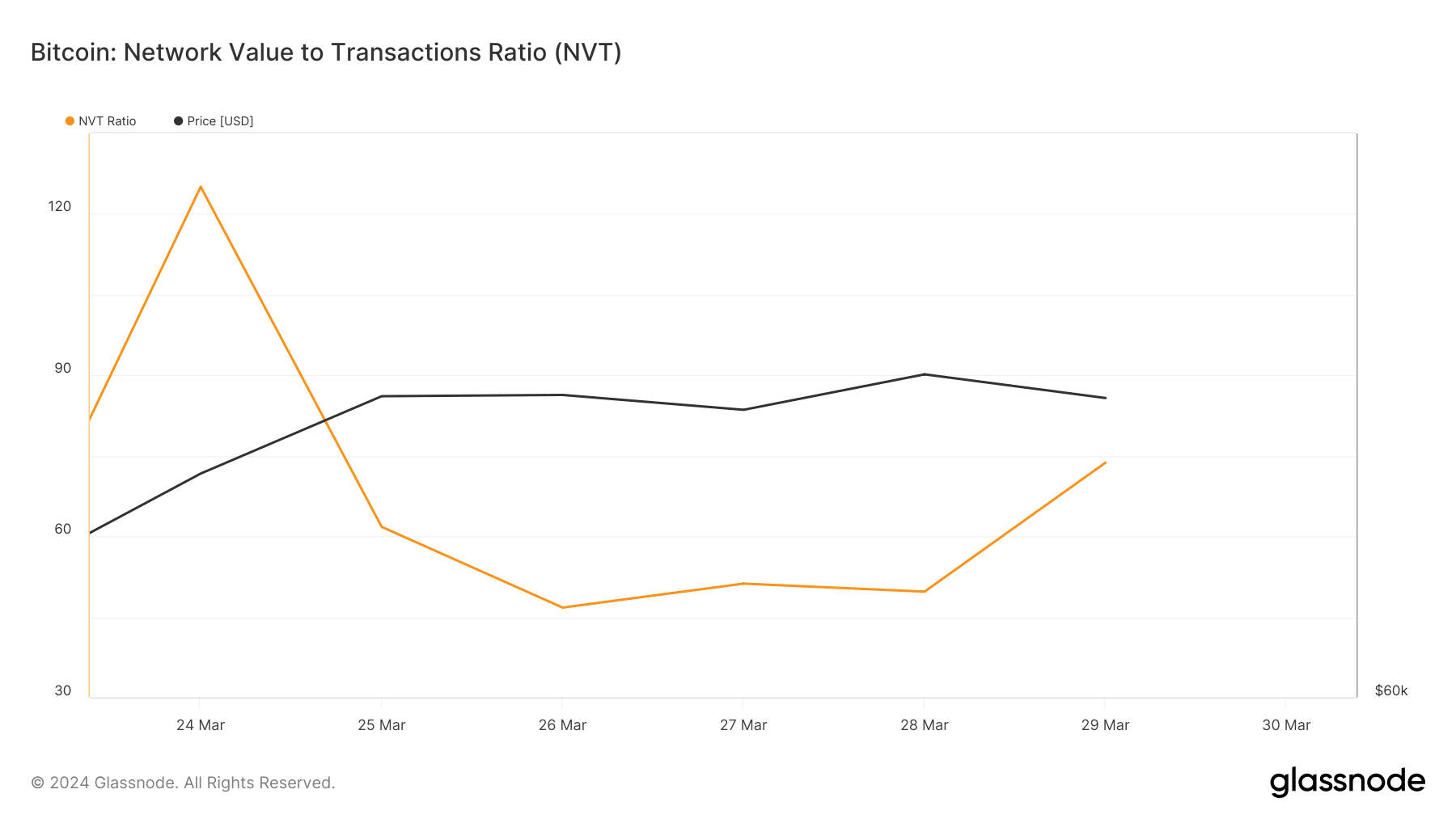

Source: Glassnode

An analysis of Glassnode’s data revealed that BTC’s network-to-value (NVT) ratio increased in the last few days. Whenever the metric rises, it indicates that an asset is overvalued, suggesting that the chances of a price correction are high.

Source: Glassnode

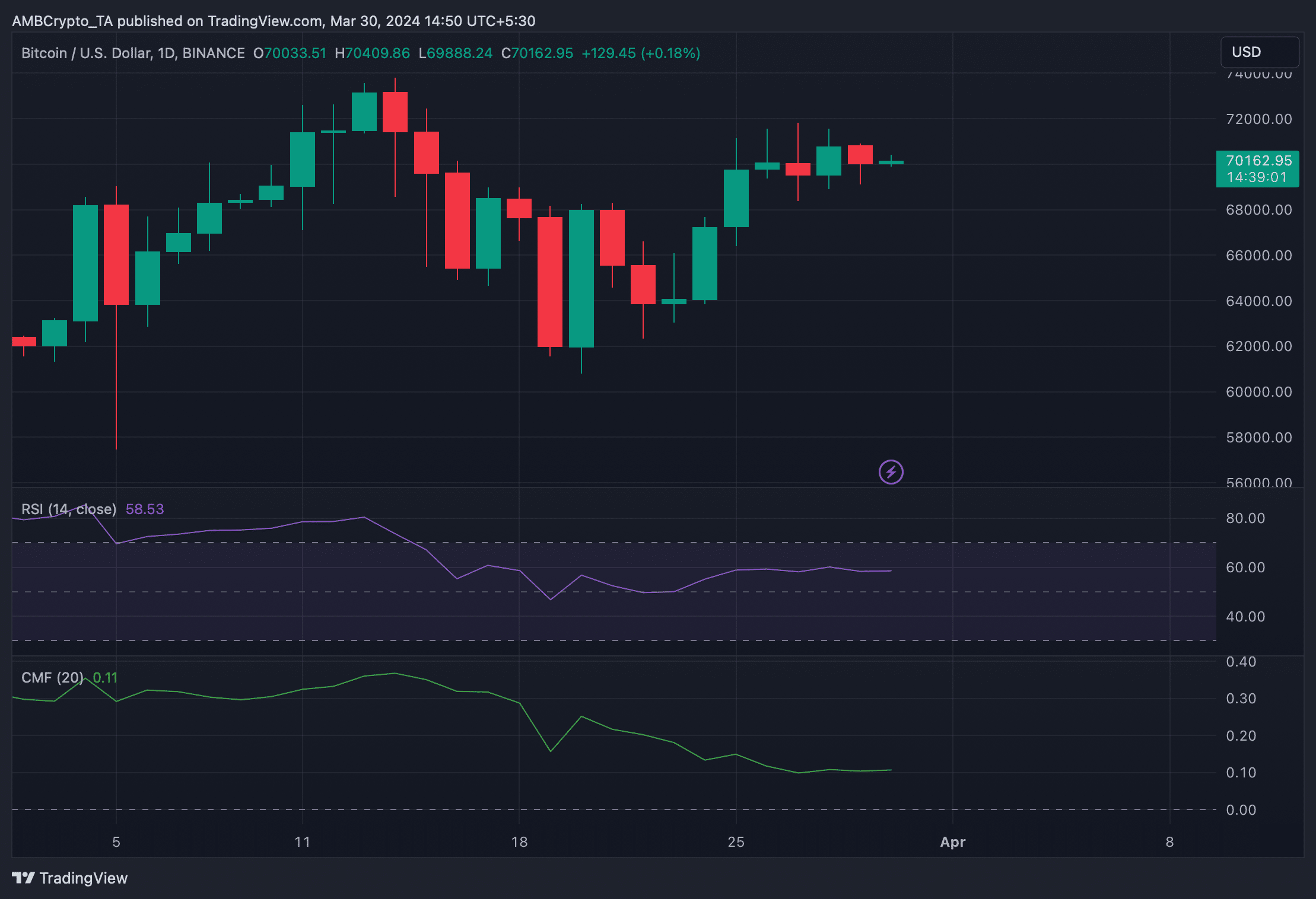

To double-check whether a price correction next week is inevitable, AMBCrypto took a look at its daily chart. We found that BTC’s Relative Strength Index (RSI) took a sideways path.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On top of that, its Chaikin Money Flow (CMF) also followed a similar route. The indicators, combined with other metrics, gave a bearish notion.

Therefore, the chances of BTC reaching its support level were high. However, considering the unpredictability of the crypto market, nothing can be said with the utmost certainty.

Source: TradingView

Powered by WPeMatico