- Bitcoin showed signs of recovery with a 2.7% increase, trading above $60,842 at press time.

- Analysts predicted either all-time highs or a drop to $48K, based on upcoming economic data.

Bitcoin [BTC] is once again at a critical juncture. After reaching an all-time high of over $73,000 in March, Bitcoin has gone through a rollercoaster ride, marked by significant fluctuations.

Currently, Bitcoin showed signs of recuperation, having increased by 2.7% in the last 24 hours to a trading value of approximately $60,842.

The recent weeks have seen Bitcoin oscillate within a narrow range, hinting at an underlying uncertainty in market sentiment.

This period of consolidation came after a series of declines and recoveries. Given this, the question now is whether Bitcoin can sustain this nascent recovery and embark on a path back to its peak levels.

Technical outlook from analysts

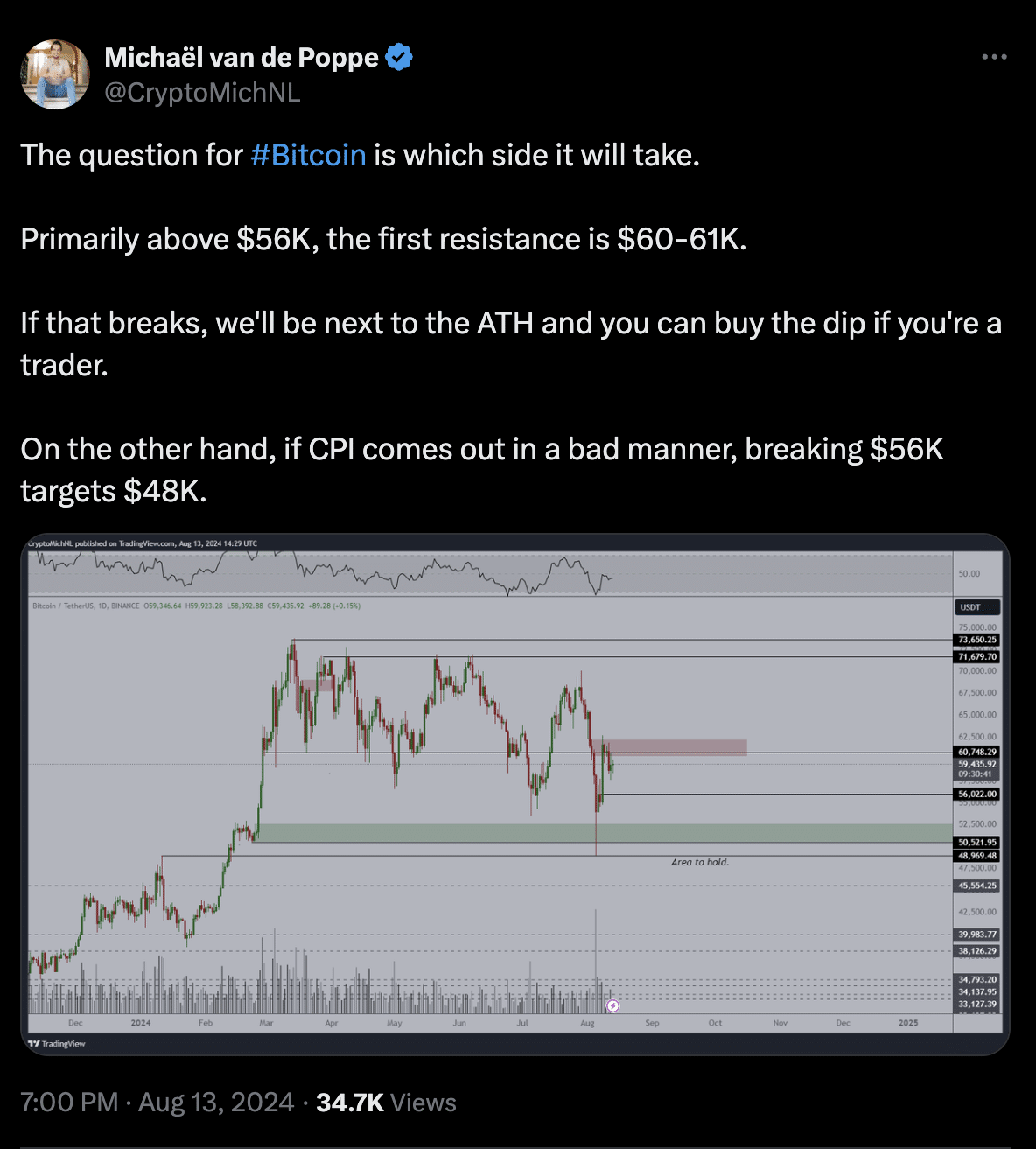

Michael Van De Poppe, a notable figure in the crypto analysis space, has recently offered his insights into Bitcoin’s potential directions.

He outlines a bifurcated path depending on key resistance levels and upcoming economic indicators, explaining,

“If Bitcoin maintains support above $56,000 and breaks through the $60-61K resistance, the path to retesting its all-time highs is clear.”

Conversely, adverse developments, such as a disappointing Consumer Price Index (CPI) data, could push Bitcoin down towards the $48,000 mark.

Source: Micheal Van De Poppe on X

Adding to the discussion, another esteemed analyst, RektCapital, emphasized the importance of trading volume in confirming the recovery’s strength. He remarked,

“Increased buy-side volume is promising, but sustaining this momentum is crucial for overcoming recent highs.“

A daily close above approximately $61,700 would signal a strong bullish confirmation.

Is Bitcoin heading for another dip?

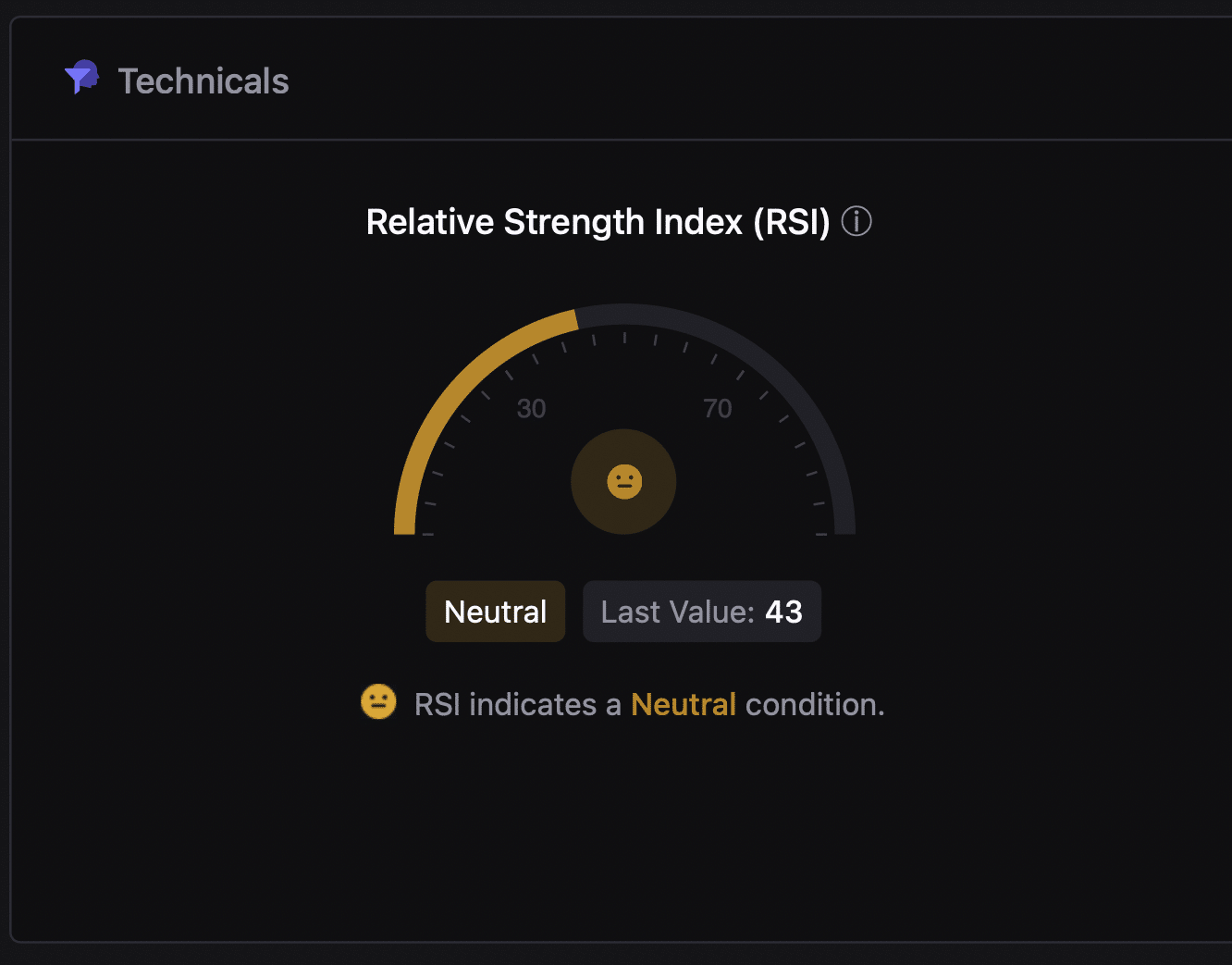

In terms of Bitcoin’s technical health, the Relative Strength Index (RSI), a tool used to gauge market momentum and potential price reversals, stood at 43 at press time.

This neutral reading suggested that Bitcoin was neither overbought nor oversold, providing little directional bias and highlighting the market’s current indecision.

Source: CryptoQuant

Is your portfolio green? Check out the BTC Profit Calculator

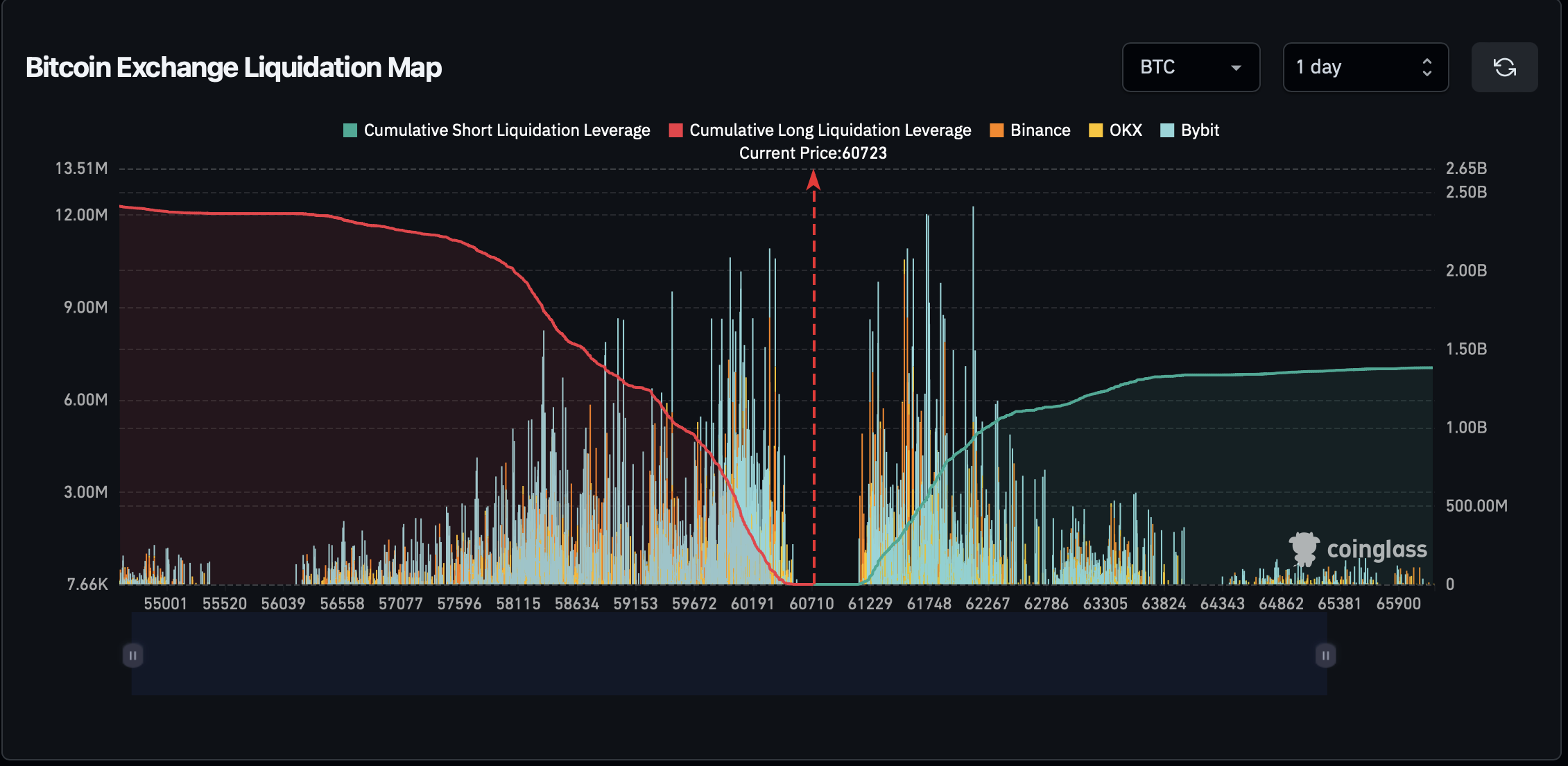

Moreover, liquidation data from Coinglass revealed a significant tilt towards short positions. If Bitcoin’s price ascends, it could trigger liquidations worth $2.41 billion, adding fuel to the upward movement.

However, a price drop could liquidate around $1.38 billion in long positions, intensifying a downward trend.

Source: Coinglass

Powered by WPeMatico