- Bitcoin raises mixed sentiments among traders as its price trends between $70k and $71k.

- Skeptics argue that Bitcoin is unfit to be considered even close to traditional asset classes.

Despite a brief decline, Bitcoin [BTC] has once again climbed to $71,000, surpassing expectations set before the halving event. Yet, amidst this heightened demand, Bitcoin skeptics stay strong in their criticism, often comparing its worth to traditional asset classes.

This prompts a crucial question – How is Bitcoin being evaluated and understood in the broader financial landscape?

Bitcoin’s resilience amidst growing skepticism

Yassine Elmandjra, Director of Digital Assets at Ark Invest, in a recent conversation at the Bitcoin Investors Day in New York, weighed in on the ongoing debate. He emphasized that Bitcoin’s lack of yield generation, unlike bonds, is what poses a challenge in its evaluation. He said,

“I think much of bitcoin’s skepticism stems from, you know, its inability to fit neatly within traditional asset class frameworks especially from a fundamental valuation standpoint.”

Separately, Chris Kuiper, Director of Research for Fidelity Digital Assets, highlighted, that Bitcoin’s price movements have closely aligned with changes in inflation expectations, particularly when measured over a five-year horizon. He said,

“If your inflation expectation is going from 3% a year to 6%, that’s a huge change and Bitcoin tracked that perfectly during COVID and post-COVID, with all the money creation.”

On remarks that Bitcoin is not an inflation hedge, Kuiper exclaimed,

“I think it is!”

This sentiment was further confirmed by the Woodbull Charts which highlighted the drop in Bitcoin’s own inflation rate from 3.72% in 2020 to 1.7% in 2024.

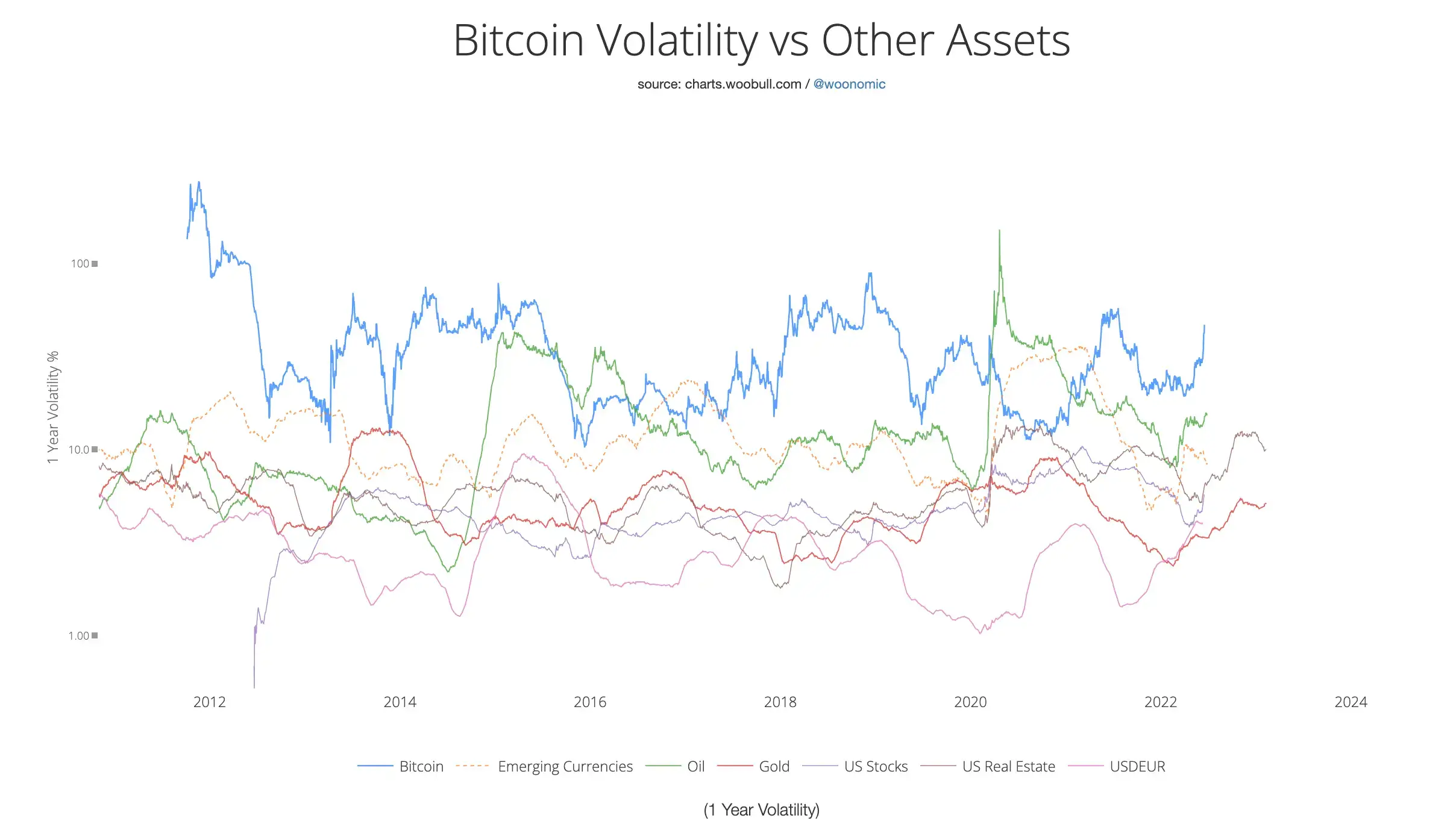

However, when examining the 1-year volatility chart of Bitcoin alongside other asset classes, a stark contrast emerges. Bitcoin’s volatility stands out at 46.95%, whereas gold, exhibits significantly lower volatility, of just 5.6%.

This comparison underscores the notable difference in price fluctuations between Bitcoin and gold over the past year.

In response, Matthew Siegel from VanEck noted that Bitcoin’s effectiveness as an inflation hedge might have been affected by recent policy decisions, causing a temporary setback. He noted,

“We always have to remind ourselves this is an emerging market asset, frontier market asset. Americans are into it because we can speculate easily with our ETFs”

What lies ahead?

With the uncertainty regarding whether the upcoming Bitcoin halving event will have a similar effect on price as previous ones. Kuiper acknowledged that the halving event coincides with election cycles and liquidity cycles. This indicates that multiple factors can influence price trends.

Thus, despite lacking a clear comparison from the past, the experts believe that the halving event will likely dampen certain aspects of price volatility.

Powered by WPeMatico