- ‘Silk Road’ discussions might fuel a possible return to $69,000 and above

- The liq levels signaled a bullish bias that could leave shorts in ruins

On 4 April, Bitcoin [BTC] bounced back above $69,000 before it fell to $67,500 hours later. According to AMBCrypto’s analysis, there were specific reasons for the rebound. One of the more significant ones was the 10,000 BTCs the U.S. government sold.

When sales like these happen, the expected reaction is a fall in price. However, the opposite happened because of the reaction of the broader market to the development.

The bumpy path looks like a good option

For those unfamiliar, the BTC sold was from Silk Road, a marketplace that took advantage of Bitcoin to facilitate the sale of illicit goods.

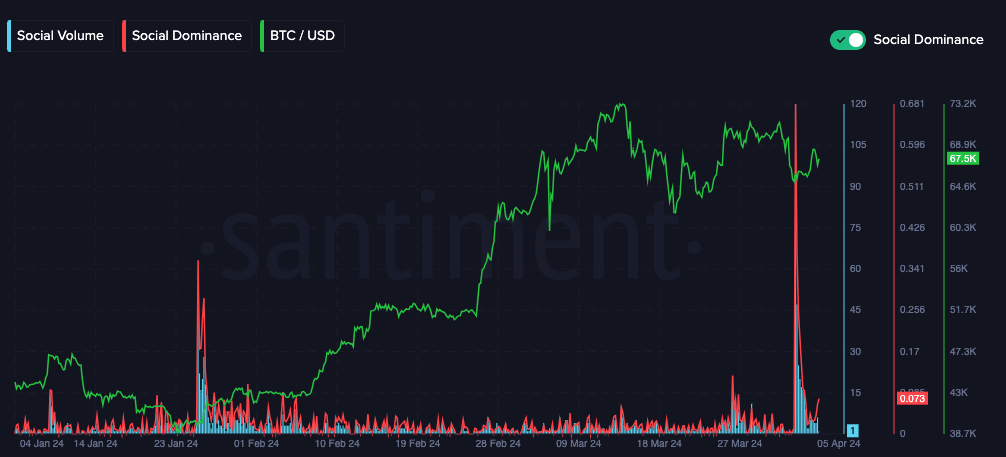

Based on our analysis, market participants displayed Fear, Uncertainty, and Doubt (FUD) since more BTC seized could be sold later in the year. Using Santiment’s social tool, we noticed that the word “Silk Road” jumped among participants, indicating that they were scared of the implications on Bitcoin.

Source: Santiment

In January, there were also talks about the same issue which triggered an uptick in social volume. At the time, Bitcoin’s price appreciated.

Therefore, if crowd expectations continue to languish in FUD, the price of the coin might retest $69,000. However, if the dust settles, BTC might end up trading sideways unless there is a wave of buying pressure that changes the tone.

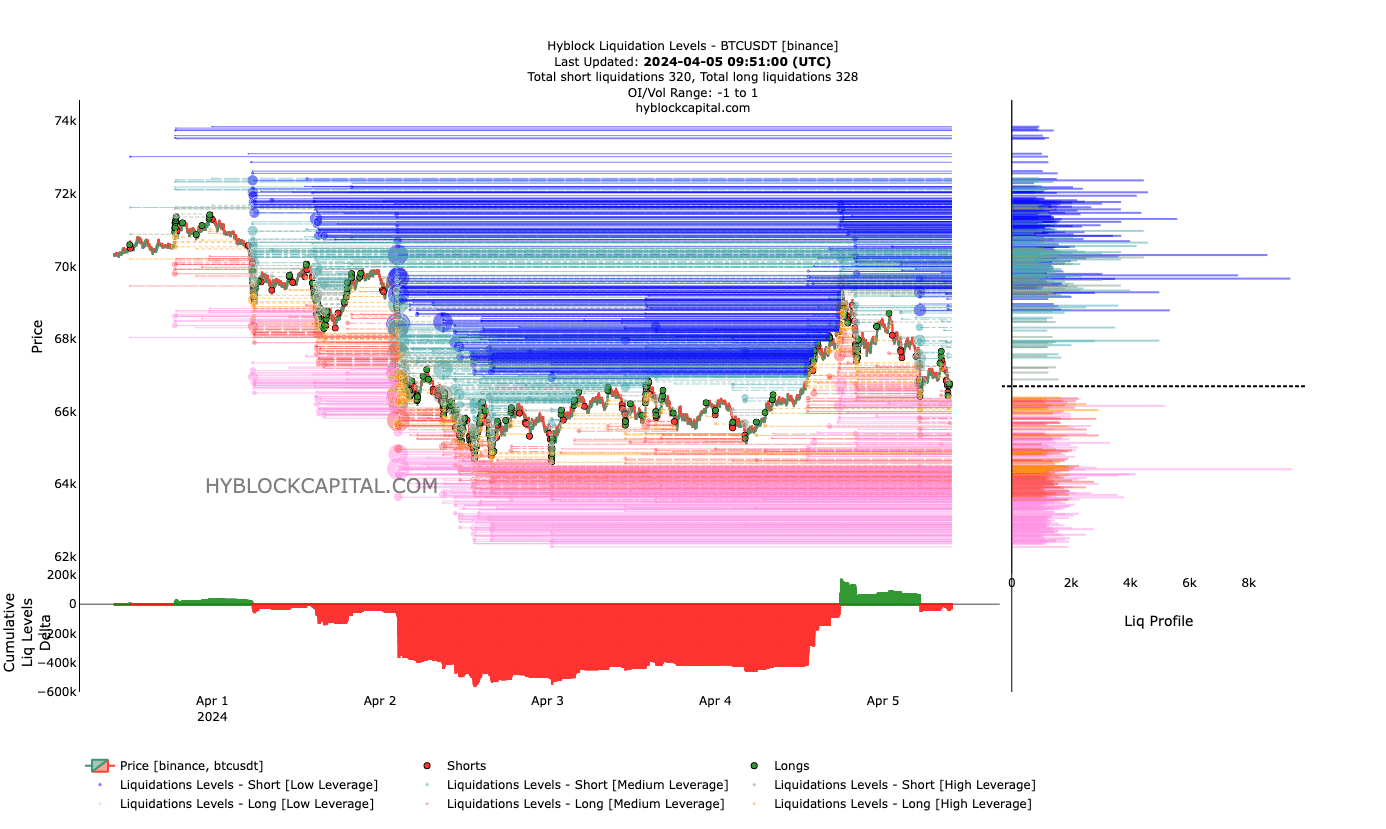

Meanwhile, AMBCrypto also looked at the liquidation levels. According to our analysis of the indicator, there is a cluster of liquidity from $68,000 to $71,000, indicating that the price of Bitcoin might rise toward these levels.

Careful shorts! This is not your time

If this is the case, shorts with high leverage positions might see their funds wiped out.

Besides that, we also considered the Cumulative Liquidation Levels Delta (CLLD). The CLLD is the sum of the difference between long liquidations and shorts. When positive, the CLLD indicates that there are more long liquidations.

On the other hand, a negative reading of the CLLD suggests that long liquidations are more than shorts.

Source: Hyblock

However, the indicator does more than identify short or long differences as it also gives insights into the price action. From the chart above, we can see that Bitcoin registered a slight dip. As a result, shorts have been trying to take advantage of the decline. On the contrary, long liquidation levels were getting hit as the price slowly recovered.

This trend indicates a bullish bias for the coin. If care is not taken, shorts who insist on capitalizing on the movement might be liquidated.

Is your portfolio green? Check the Bitcoin Profit Calculator

Going forward, Bitcoin’s price might climb back towards $70,000. However, traders might need to be wary as volatility could be intense. In light of the prevailing price action, anyone who opens a high-leverage position could fall victim to forceful position closure.

Powered by WPeMatico