- Chainlink has a bullish market structure at press time.

- The dip might extend toward $16, bulls can enter at this liquidity cluster.

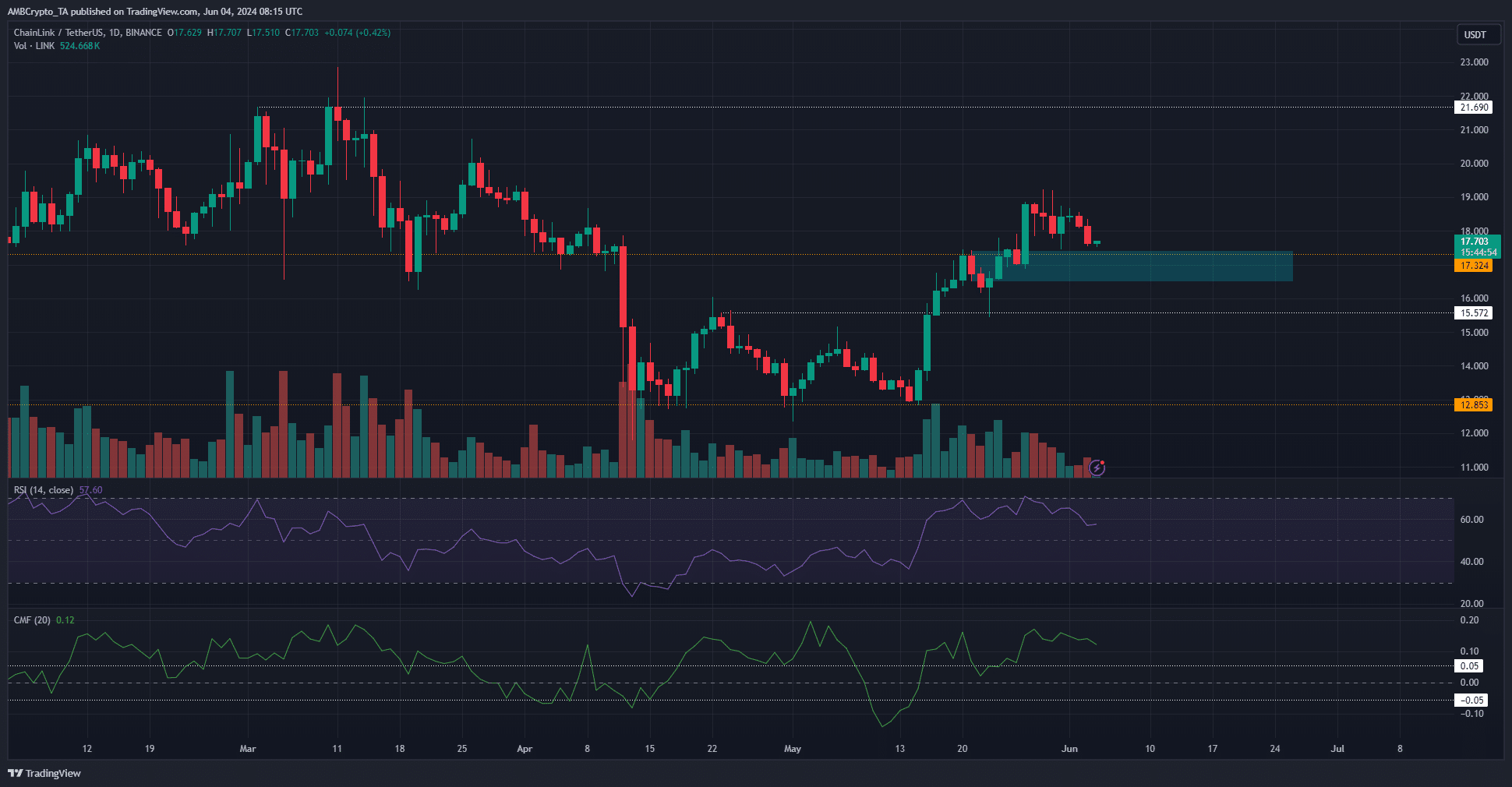

Chainlink [LINK] saw a break out past the $17.1 resistance level last week. The price approached this level at press time and is expected to rebound higher after testing it as support. The technical indicators were bullish too.

The Chainlink price prediction is that we will likely have a double-digit percentage rally in the next month or two. However, the higher timeframe trend lacked bullishness as LINK ranged between $12 and $21 since November 2023.

The daily chart showed an intense bullishness

Source: LINK/USDT on TradingView

After climbing above the $16.04 level in mid-May, the market structure was bullish once more. The RSI on the daily chart showed a reading of 57.6 to reflect upward momentum was favored.

The Chaikin Money Flow’s +0.12 reading signaled strong capital flow into the market. It emphasized firm buying pressure. Therefore, Chainlink is expected to perform well in the coming days.

The former resistance zone at $17 has now been flipped to support and the bulls are expected to hold the price above the $16.5-$17 region.

The recent dip from $19 came alongside a drop in trading volume, which reinforced the idea of weak selling pressure and continued gains.

The next magnetic zone for LINK lines up with the technical findings

Source: Hyblock

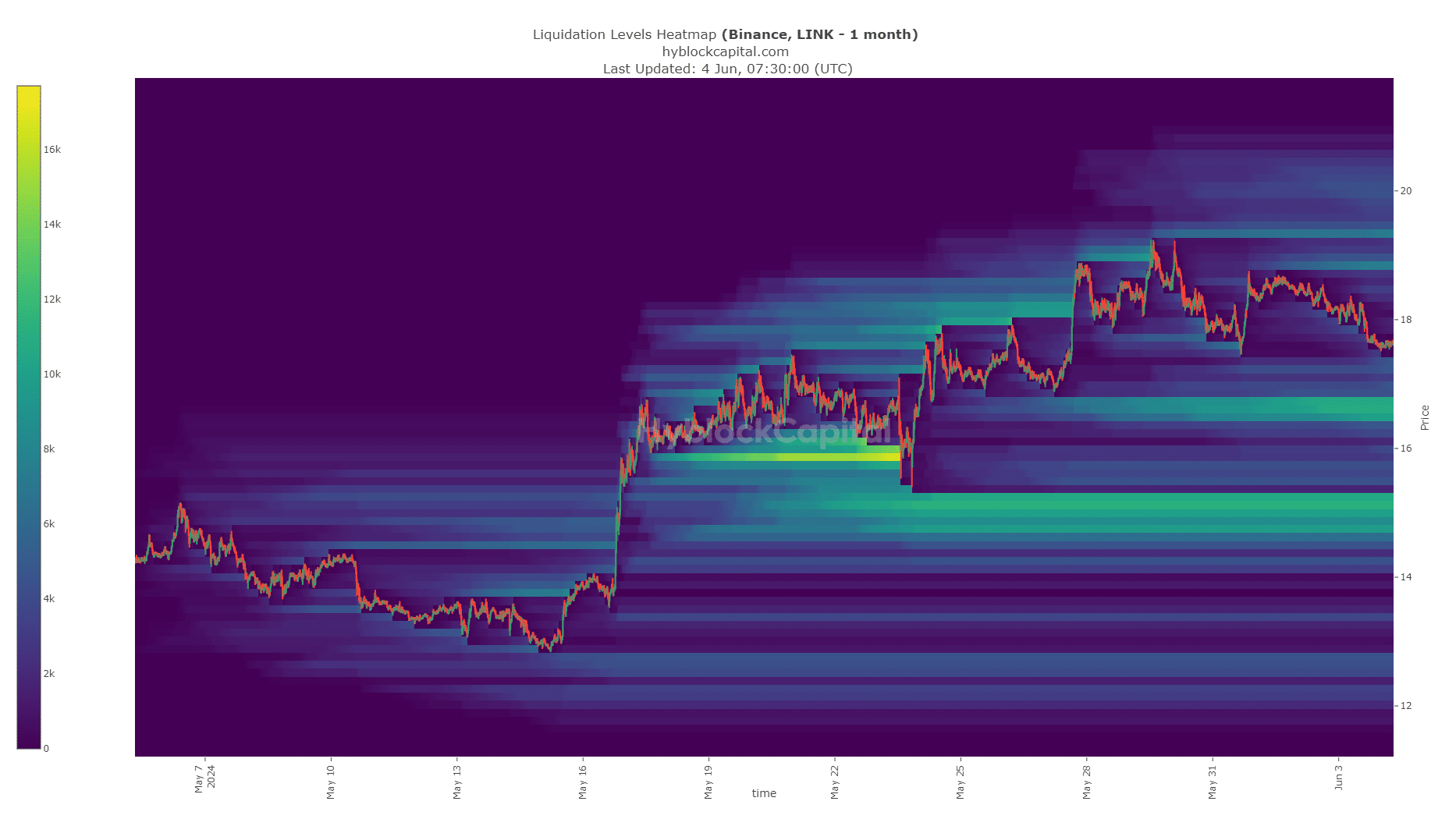

The liquidation levels showed a cluster of long liquidations at the $16.48-$16.7 area. This lined up with the demand zone highlighted on the 1-day price chart.

Read Chainlink’s [LINK] Price Prediction 2024-25

Below the $16.5 liquidity pocket, the next cluster lies at $14.8-$15.4. The Chainlink price prediction is that we see a strong bounce from the $16.5 support zone to $19-$20, and possibly higher if Bitcoin [BTC] begins to trend upward too.

A drop below $16.3 would indicate the bulls are weak, and the drop might then stabilize around $15.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico