- Citi analysts have tipped Coinbase’s COIN for a +30% rally to $345

- They also cited increasing regulatory clarity in crypto as the major catalyst

Citigroup analysts have upgraded Coinbase shares (COIN) to ‘BUY.’ According to them, COIN could hit $345 on the charts, a 33% potential rally from its press time price of around $260.

The Citi analysts, led by Peter Christiansen, opined that the improving regulatory landscape around crypto is a major catalyst for the stated bullish outlook for COIN.

“Shifts in the U.S. Election landscape and the Supreme Court’s overturning of the long-standing Chevron precedent has changed our view on Coinbase’s regulatory risks.”

Given the increasingly conducive regulatory crypto space, Citi is now projecting an “upside opportunity” that could attract more institutional and retail capital to Coinbase and COIN.

“Potentially unlocking sidelined institutional capital, investment, and increased crypto-native and traditional finance collaboration.”

More catalysts for Coinbase

Apart from the likely easing risks on the regulatory front, the analysts pointed out some crypto-native positive factors that could further bolster Coinbase and its stock.

Coinbase’s Base, an Ethereum [ETH] L2, has seen massive traction. It is viewed by Citi analysts as “customer engagement” ripe for long-term opportunities.

To maximize on this front, the analysts have implored Coinbase to focus on increasing its Base market share to tap into possible long-term opportunities. They also cautioned that raising transaction fees could undermine active users and limit opportunities.

“The focus is on engagement, which can be measured by transactions and active users. Raising transaction fees or neglecting to lower them when the opportunity arises can create friction or give competitors a comparative advantage.”

Interestingly, the lack of a staking feature on recent U.S spot ETH ETFs was also deemed a positive catalyst. This is true for investors seeking staked ETH yields, forcing them to opt for Coinbase exchange, driving up volumes. Part of the analysis read,

“Investors who still want native yield on ETH will still have to purchase these assets on digital asset exchanges (such as Coinbase) versus within an ETF – this can support higher-margin trading volumes versus a relatively small custody fee that would be gained from ETF inflows.”

According to Citi, retail ETH flows could be staked directly into the Ethereum network. This would likely earn more rewards than the ETF fees from retail flows.

Christiansen and his team believe that the only setback and invalidation of this bullish outlook for COIN would be the continuation of the current administration’s enforcement approach.

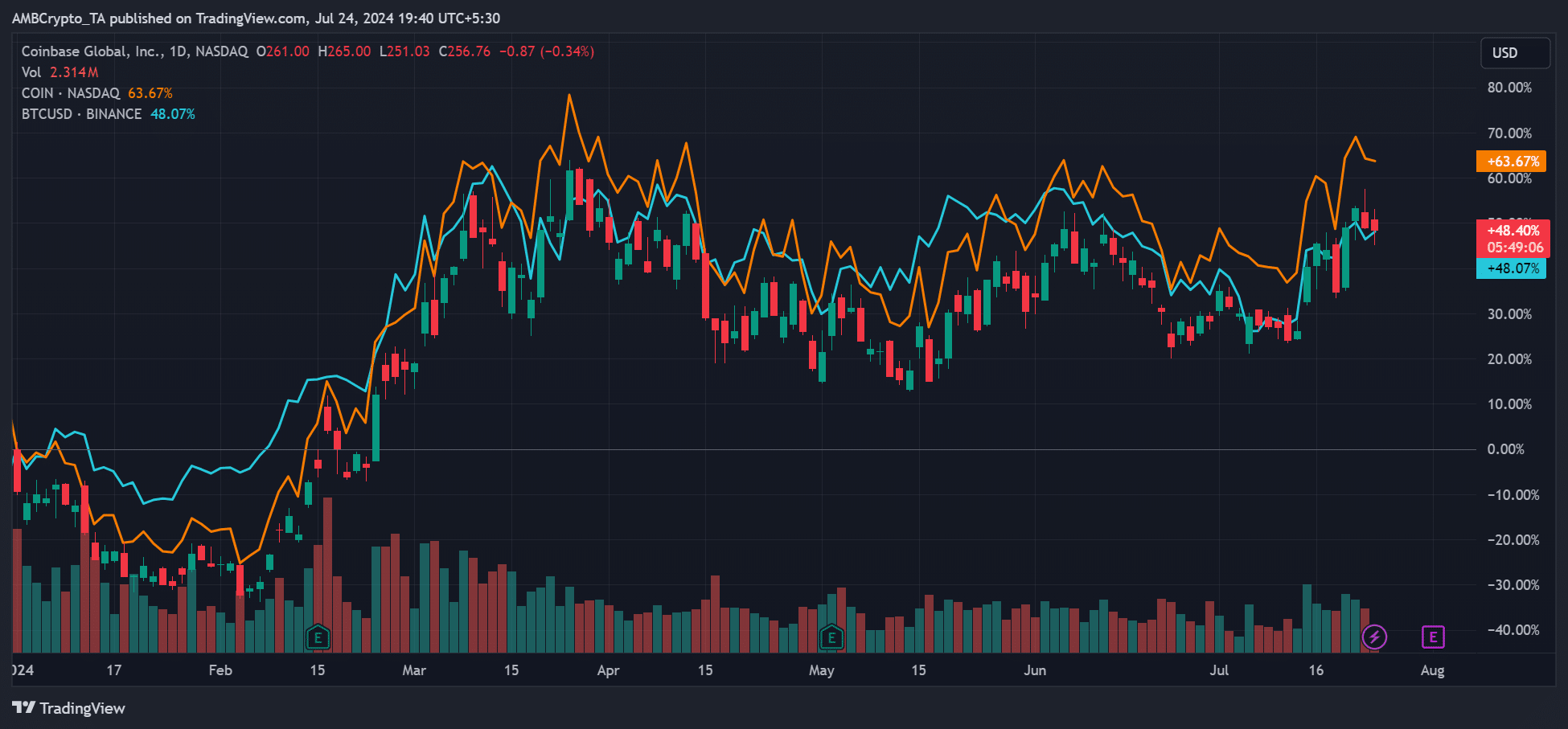

Meanwhile, at the time of writing, COIN was up 63% based on YTD (year-to-date). Compared to Bitcoin’s [BTC] 48% over the same period, COIN holders were better off with extra 15% gains.

Source: COIN vs BTC performance

Powered by WPeMatico