- Funds attracted inflows despite SOL’s bearish price action.

- The prospect of improving network health might have driven investors towards SOL.

Digital asset funds tied to Solana [SOL] SAW healthy demand last week, as investors’ appetite for the fifth-largest cryptocurrency took a healthy turn.

Solana sees a shift in sentiment

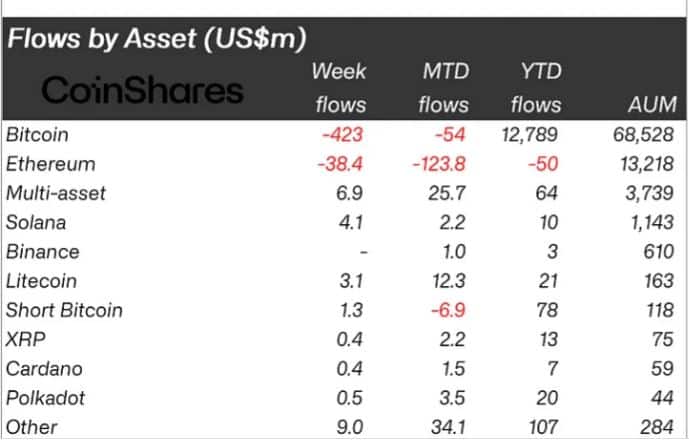

According to the latest report by crypto asset management firm CoinShares, Solana-based crypto products attracted more than $4 million in inflows last week.

This was a sharp turnaround from the $300,000 in net outflows recorded in the week prior.

Source: CoinShares

The recent inflow boost came even as blue-chip assets like Bitcoin [BTC] and Ethereum [ETH] witnessed heavy outflows, totaling $423 million and $38 million respectively.

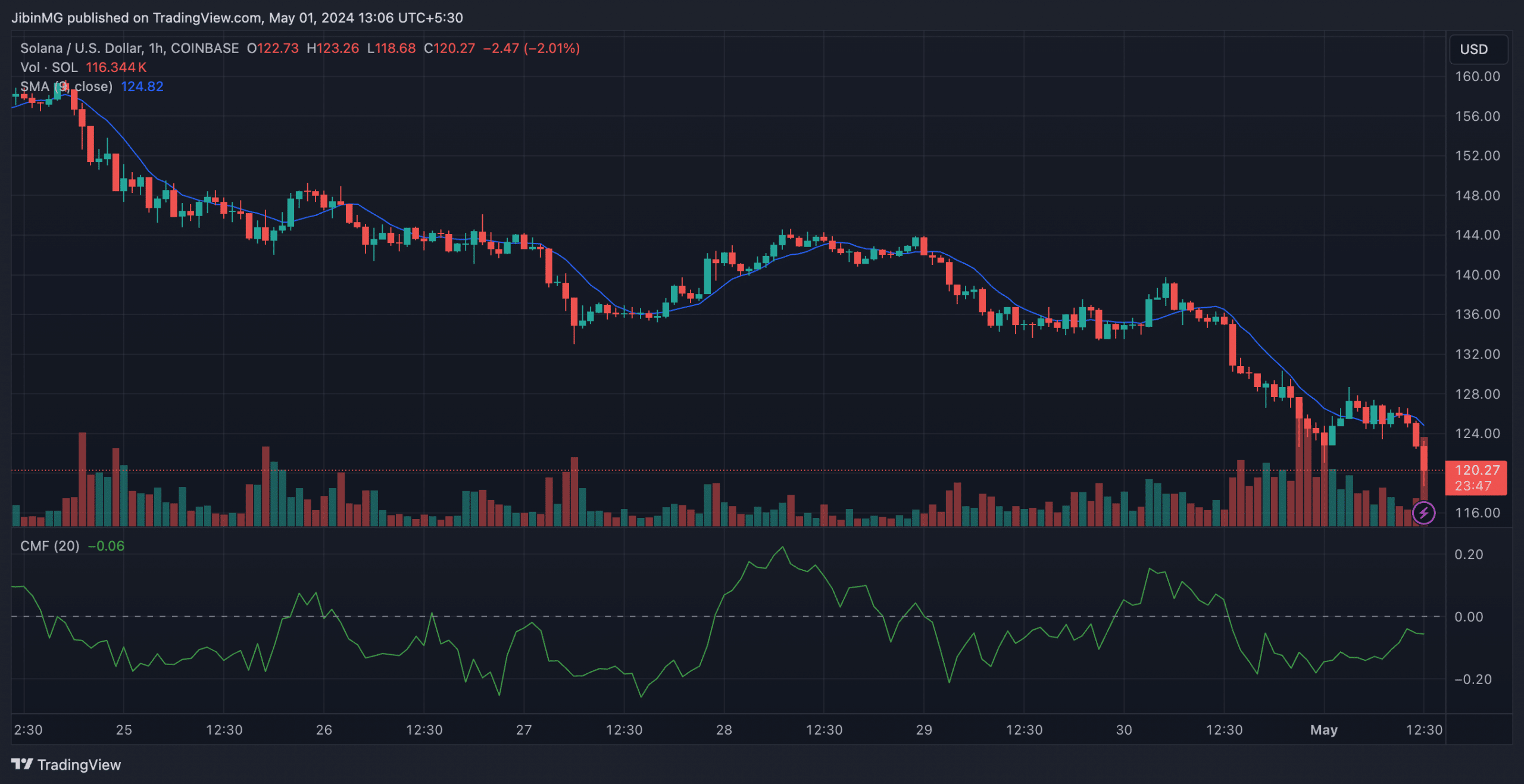

Interestingly, demand for SOL-linked funds surged despite a bearish price action, which saw the crypto tumble 16% over the week, AMBCrypto noted using CoinMarketCap data. At press time, in just 24 hours, SOL’s price was down by over 10% on the charts.

Source: SOL/USD, TradingView

In fact, the price decline resulted in a slight drop in total assets under management (AUM) from last week, from $1.15 billion to $1.14 billion.

Was this the reason?

While it is difficult to pinpoint the bullish catalyst propelling investors toward Solana goods, the possibility of reduced network congestion could be a credible cause.

Solana developers have been shipping release after release to alleviate transaction failures and congestion on the network, issues that have contributed significantly to the FUD around the coin.

The latest one to go out was the v1.18.12, which was currently being validated in the test environment.

The Solana community hoped that these improvements would finally resolve the ongoing troubles with the blockchain, which has been strained to its limits due to an explosion in meme coin trading.

Read Solana’s [SOL] Price Prediction 2024-25

The latest blow

With Bitcoin crashing below $60,000, the downtrend has persisted on SOL’s charts, with the altcoin down 10% in 24 hours.

The latest drop appeared to be part of the broader market bloodbath, fueled by lackluster performance of newly-listed spot crypto ETFs in Hong Kong.

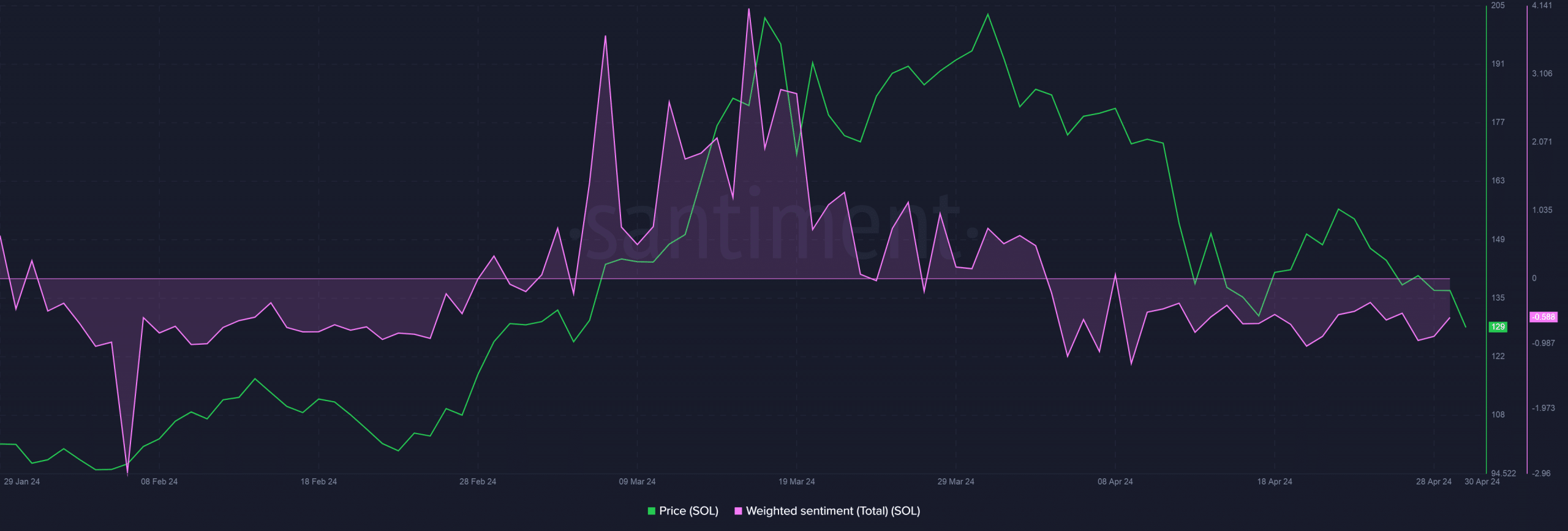

Source: Santiment

Powered by WPeMatico