- Dogecoin’s market sentiment remained positive, with analysts predicting a bullish run.

- Amidst increased crypto volatility, DOGE has endured massive liquidation.

For the last two weeks, since Bitcoin [BTC] hit $71k and plummeted to $64k, the crypto market has experienced high volatility. Altcoins have suffered extensively.

Dogecoin [DOGE], the leading meme-coin, has equally suffered from the current market conditions.

In the last seven days, DOGE has declined by 8.61%, with a 0.15% decline in 24 hrs. Per CoinMarketCap, trading volume declined by 31.99% to $323M as well, with a 0.20% increase in market cap in the last 24 hrs.

The prevailing market conditions have brought about various speculations from leading crypto analysts. Although the market has experienced sustained momentum, analysts remain optimistic about DOGE’s future.

On the 18th and the 19th of June, DOGE experienced massive liquidation, with 44M and 18M long positions liquidated, according to Coinglass.

This whale activity did not go unnoticed, with @sinceredoge sharing about it on X. He noted,

“DOGE experienced a significant liquidation event, with long positions totaling $60 million being liquidated.”

Despite the massive liquidation news, @sinceredoge shared optimism, arguing,

“There are still reasons to be bullish on Dogecoin. Some analysts predict that Dogecoin could reach a high of $0.52 in 2024.”

Another notable analyst, @Trader Tardigrade, shared on X that,

“The last time when its Ris=30 in Oct 2023, Doge was under $0.06, and then it grew up to $0.22, in which there was over 300% growth.”

The analysts applied Doge’s historical price movements to make the case, positing that, after hitting the oversold zone, Doge tends to experience a sustained reversal to an uptrend.

What DOGE’s fundamentals tell us

The above predictions indicated that Doge could experience a massive rally in the near future; thus, the current condition presents a buying opportunity.

Importantly, various metrics and indicators showed a potential change in pattern.

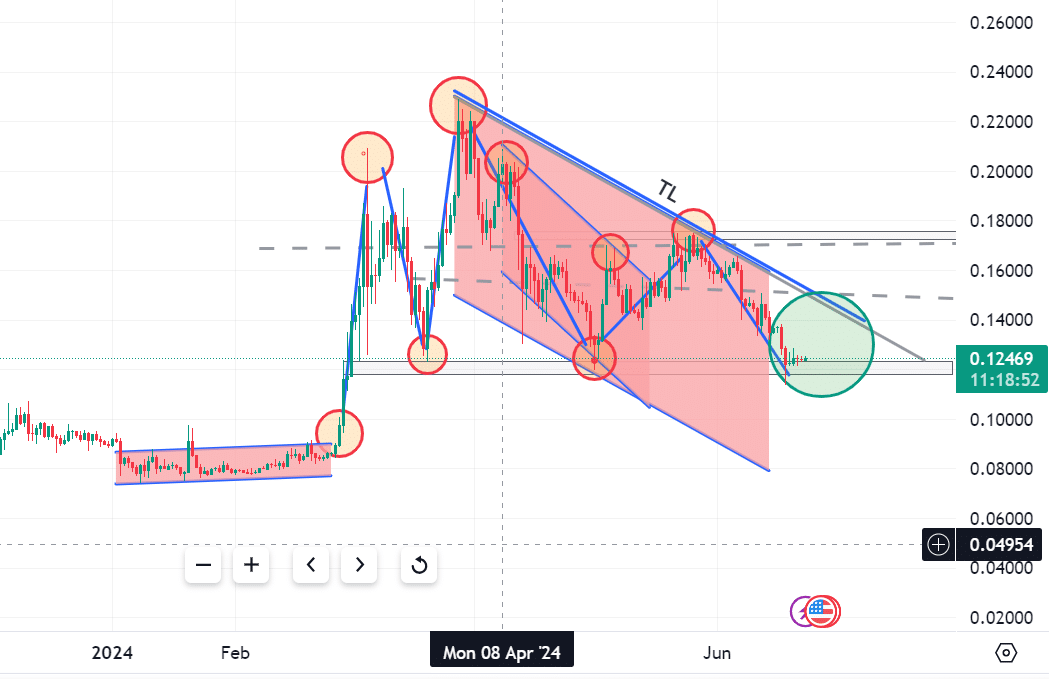

Source: TradingView

Dogecoin has experienced a strong bearish trend, but the indicators showed a potential reverse pattern. For instance, the RSI at 33 with an RSI-based MA of 35.

In the last two days, the RSI has been on an uptrend with a possibility of crossing RSI-based MA. The RSI near the oversold zone shows a buying opportunity, as the pattern may reverse because of buying pressure.

The RSI was closing into its MA at press time, which was a bullish trend.

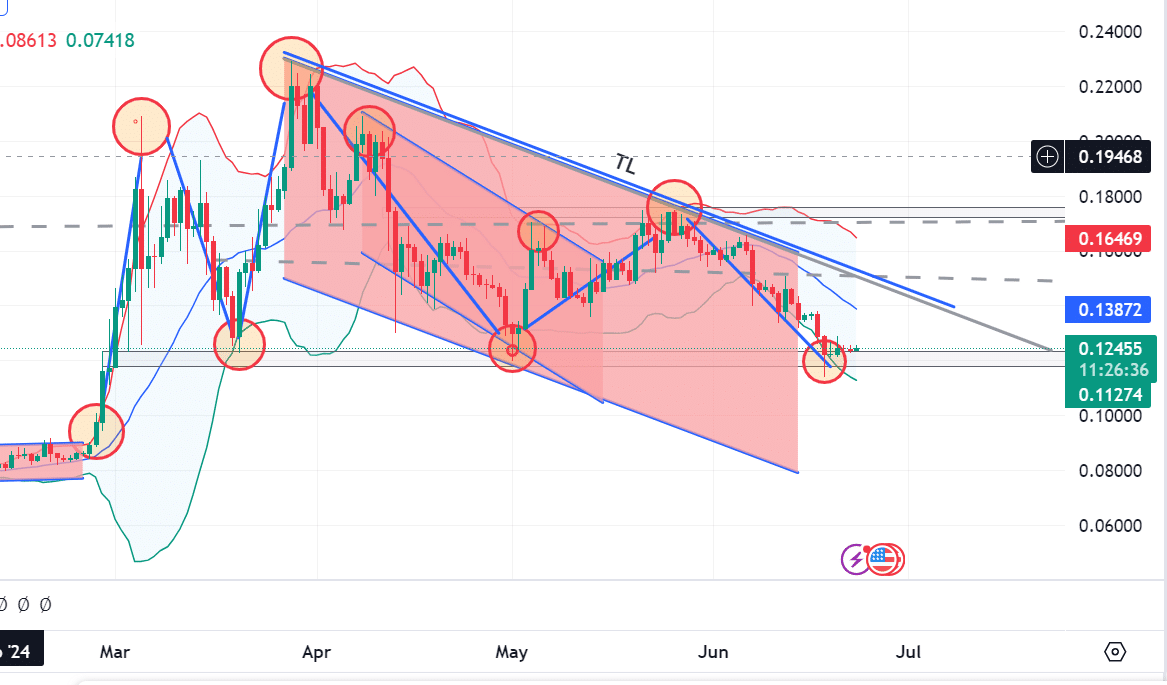

Source: TradingView

Also, the lower Bollinger band showed that the prices were above it, which signified the end of a downtrend and the start of a possible reversal to the uptrend.

In fact, the prices at the lower band presented a buying opportunity, anticipating a price increase.

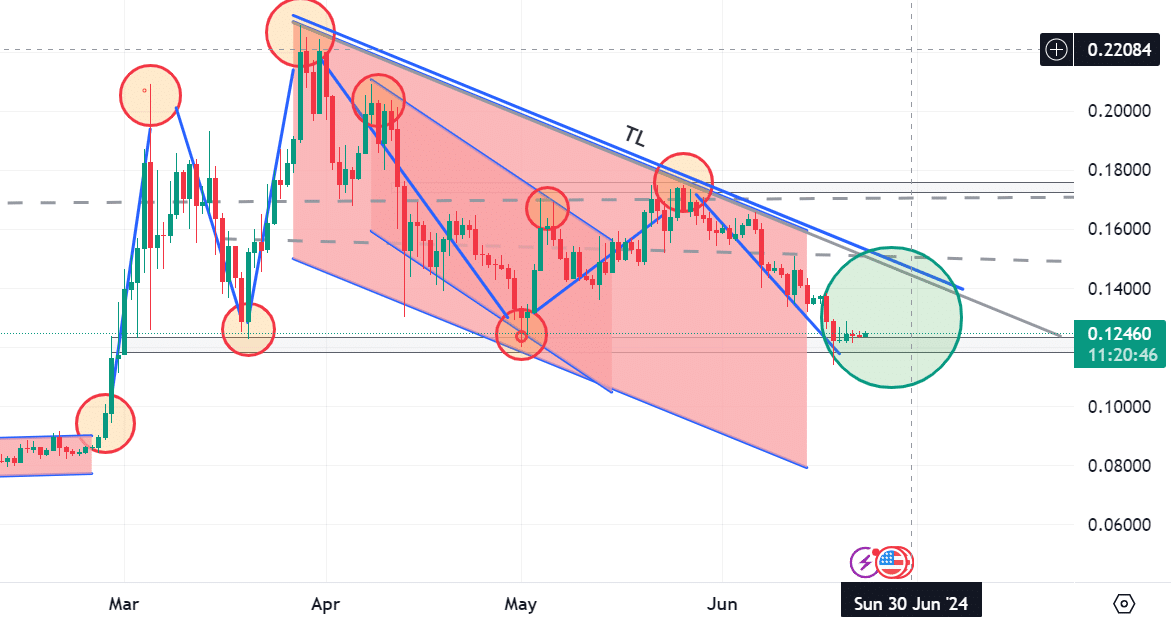

Source: TradingView

Notably, since the 19th of June, DOGE has been in a consolidation phase. In the last five days, prices have been consolidating around $0.124.

At this point, when prices are close to the daily MA, it shows that a positive market event would result in higher buying pressure, thus driving prices upward.

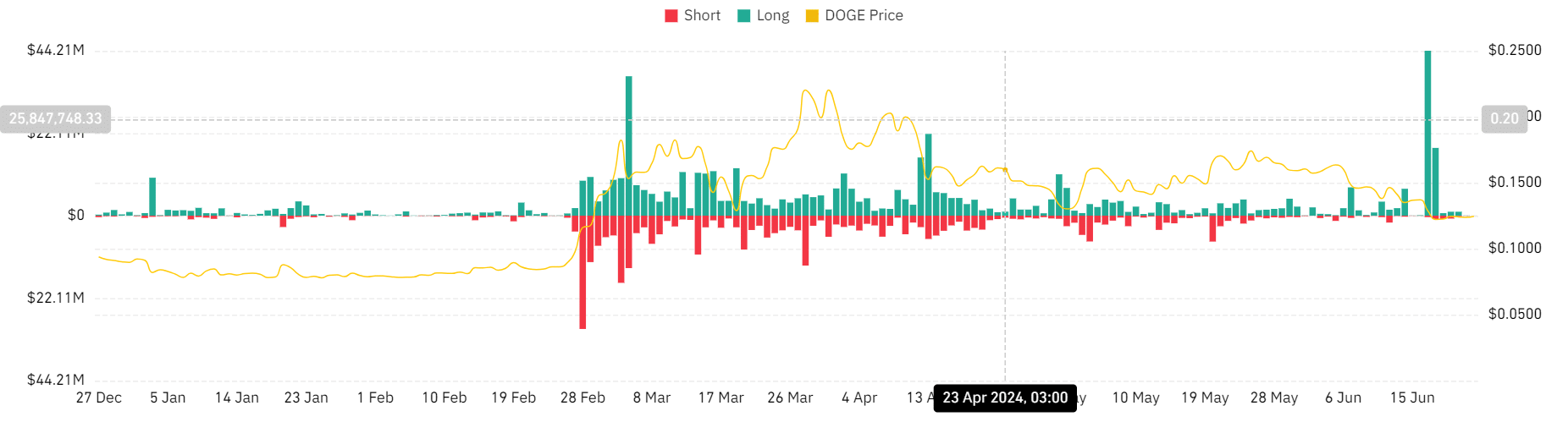

Source: Coinglass

Looking further, AMBcrypto’s analysis of Coinglass data shows that long positions liquidations have declined for the last three days.

Since the 19th of June, when Doge experienced $18M liquidation long positions, whale activities have been reduced to $9.26k (at press time).

Reduced liquidations are a positive thing, which means long positions are not closing, and there are new openings for short positions.

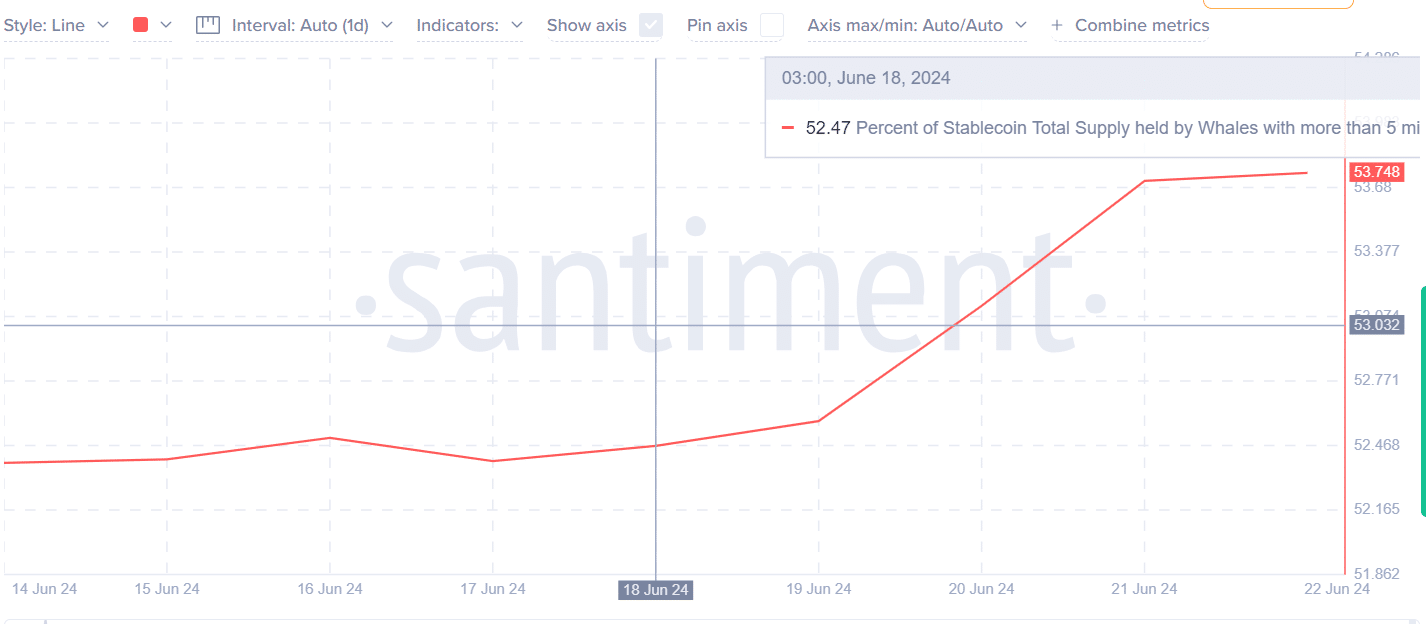

Source: Santiment

Similarly, AMBCrypto’s analysis of Santiment showed that whales with more than $5M have increased. From the 19th of June after liquidation, whales’ total supply has increased from $52.5M to $53.7M.

Increased accumulation showed trust in future market shifts, with anticipation to sell at higher prices.

Is your portfolio green? Check out the DOGE Profit Calculator

DOGE: Bulls vs. bears

If prevailing positive market sentiments continue, and DOGE holds the support level around $0.123, it will test the resistance level around $0.152.

A breakout at this level will drive DOGE to reach $0.172. However, if the support level doesn’t hold, it will decline to $0.1135.

Powered by WPeMatico