- Dogecoin rallied by 22% amid the Musk-Trump buzz, with 86% of holders in profit and active large transactions

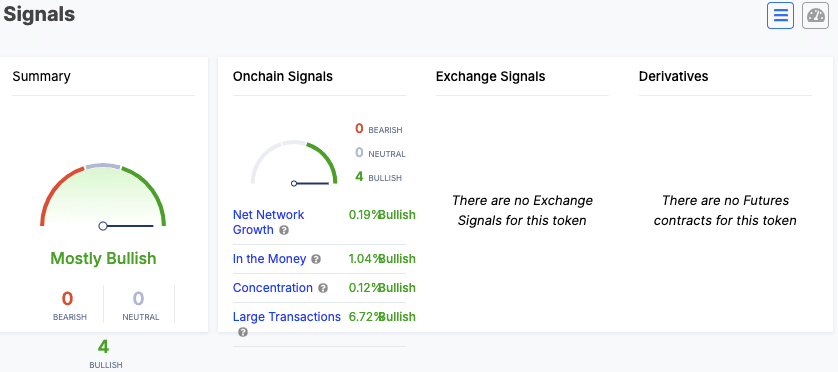

- On-chain metrics flashed generally bullish signals too

Dogecoin’s (DOGE) price has recorded a strong rally over the last few days, climbing by over 22% within the past week to hit $0.1704. In fact, this level now marks DOGE’s highest point since May 2024.

Meanwhile, the connection between Elon Musk and former President Donald Trump has generated interest among Dogecoin holders and observers. Musk’s announcement that he’ll collaborate with Trump’s administration on efficiency projects has sparked speculation, especially with the shared “D.O.G.E.” acronym.

Musk’s historical association with Dogecoin, including self-labeling as the “Dogefather” and tweets that drove past price gains, has added to this anticipation.

This, on the back of Trump’s current odds of winning the 2024 presidential elections standing at 65.1%, according to Polymarket.

Positive on-chain data for Dogecoin

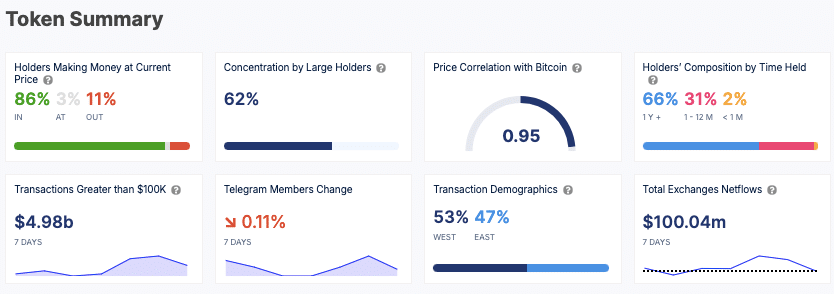

Dogecoin’s on-chain data from IntoTheBlock supported the recent price trend, reflecting robust holder confidence. About 86% of holders are currently profitable – A sign that many investors entered at lower price points.

Additionally, 66% of the holders have kept their investments for over a year, which is a sign of a solid base of long-term holders.

The past week has seen a transaction volume of approximately $4.98 billion for large transactions over $100,000 – A sign of sustained participation from large investors or institutions.

Source: IntoTheBlock

However, the concentration of supply, with 62% held by large entities, suggested the potential for price shifts if these holders move their assets.

Dogecoin’s high price correlation of 0.95 with Bitcoin also underlined that its value continues to be influenced by Bitcoin’s price trends.

Global interest and market signals

A demographic breakdown of transactions revealed that global interest in Dogecoin remains strong, with 53% of activity coming from Western regions and 47% from Eastern markets. This spread also suggested that interest in Dogecoin is balanced across different parts of the world.

Over the past week, net exchange flows of $100.04 million pointed to changes in trading behavior though. These findings can also be seen to reflect increased liquidity or potential selling.

However, it’s worth noting that the on-chain signal analysis for Dogecoin presented a mostly bullish outlook. Metrics such as net network growth, the number of profitable holders, concentration of supply, and large transaction volumes all showed positive trends.

Source: IntoTheBlock

Taken together, these observations implied active network use, profitability, and a strong presence of larger transactions.

Recent activity in large transactions

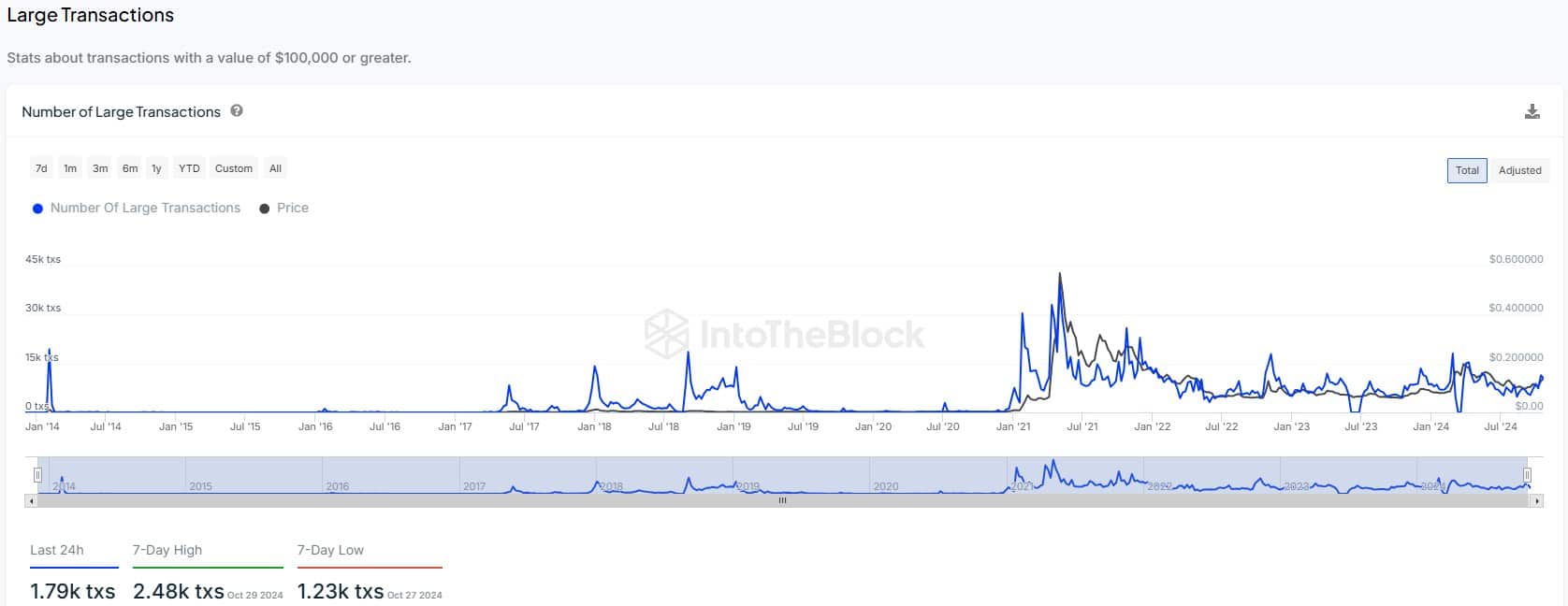

According to recent data, Dogecoin has maintained a steady flow of large transactions. In the last 24 hours alone, 1.79k large transactions were recorded, indicating active trading by larger market participants.

The 7-day peak was on 29 October 2024, with 2.48k large transactions, while the low was 1.23k on 27 October. Together, these alluded to variations in trading volumes throughout the week.

Source: IntoTheBlock

A look at historical data also revealed periods where spikes in large transactions aligned with notable price movements. This trend was evident in early and mid-2021 when DOGE’s price rallied significantly on the charts.

Options market data

Finally, Options market data from Coinglass provided us additional context on Dogecoin’s trading landscape. Consider this – The recent Options volume registered a decline of 88.62% – Totaling $89.91k.

On the other hand, Options Open Interest rose by 14.60%, reaching $503.51k. Such a hike in Open Interest may suggest that traders are positioning themselves for future movements in Dogecoin’s price.

Powered by WPeMatico