- Dogecoin’s bullish momentum continues with prices above the 9-day SMA, signaling potential further gains.

- Despite bullish trends, decreasing whale transactions and active addresses showed a need for higher user engagement.

Dogecoin [DOGE] was trading at $0.125656 at the time of writing, reflecting a 2.73% increase in the last 24 hours. DOGE’s 24-hour trading volume was $812,310,432, indicating strong market activity.

Meanwhile, Dogecoin holds the #9 rank on CoinMarketCap, with a press time market cap of $18,239,143,710, per CoinMarketcap.

Despite these positive figures, Dogecoin has struggled to breach the $0.2 mark this year. The market remains volatile, with the potential for both substantial profits and losses.

Is DOGE following historical patterns?

Dogecoin’s current price patterns are closely aligned with its halving cycles. Per historical data, after each halving event, DOGE has experienced significant upward price movements.

For instance, in early 2017 and late 2020, the price surged following periods of consolidation and breakouts from descending trendlines.

Analyst MikybullCrypto suggested that a similar pattern could be forming, with a potential breakout projected around the next halving cycle.

Source: X

MikybullCrypto tweeted,

“A post-halving wave of rally brewing. Get ready!”

Technical analysis

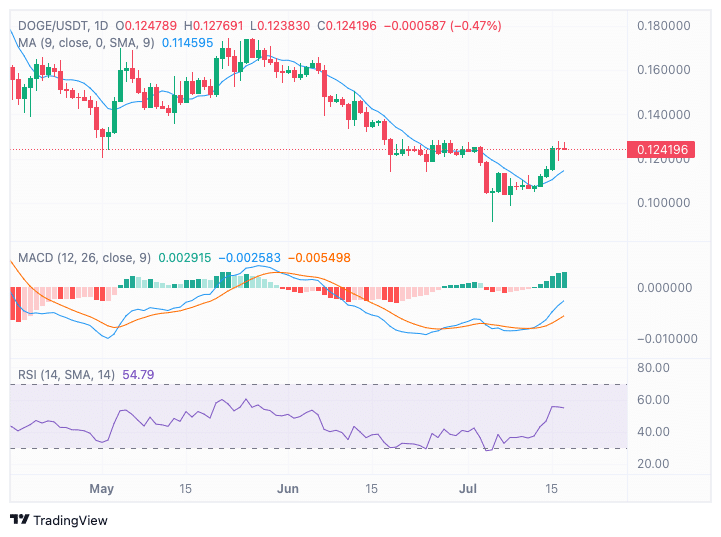

DOGE moved above the 9-day Simple Moving Average (SMA) at press time, indicating short-term upward momentum. This followed a period of consolidation around the $0.100000 mark in late June.

The Moving Average Convergence Divergence (MACD) indicator supported this outlook. The MACD line has crossed above the signal line, forming a bullish crossover.

The histogram was in positive territory at the time of writing, suggesting that buying pressure was building.

Source: TradingView

At press time, the Relative Strength Index (RSI) was at 55.52 — above the neutral 50 mark but still below the overbought threshold of 70.

This indicated moderate bullish momentum without the risk of immediate pullback due to overbought conditions.

The RSI trend suggested increasing buying interest, which could lead to further price gains if sustained.

Decline in whale activity

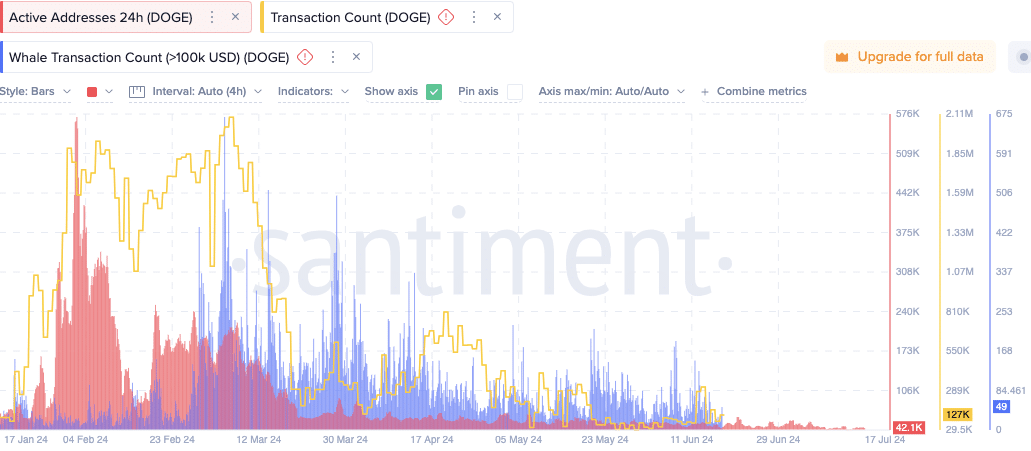

Despite the recent bullish sentiment, there has been a decline in DOGE’s whale activity and user engagement.

Whale transactions, defined as transactions over $100K, have decreased to 49 significant transactions (at press time). This reduction aligns with the overall decrease in network activity.

Active addresses have also decreased to 42.1K at press time, and the transaction count dropped to 127K, showing a decline in user engagement and network activity.

Source: Santiment

Is your portfolio green? Check out the DOGE Profit Calculator

Dogecoin’s recent performance and technical indicators suggested a potential for further upward movement.

However, the decline in active addresses and whale activity highlighted the need for increased user engagement to sustain the bullish trend.

Powered by WPeMatico