- ETH’s fall has caused holders to rethink their belief in the coin’s potential.

- The MVRV ratio showed that altcoin was undervalued.

Long-term holders of Ethereum [ETH] have signaled that they are also concerned about the cryptocurrency’s potential, AMBCrypto discovered.

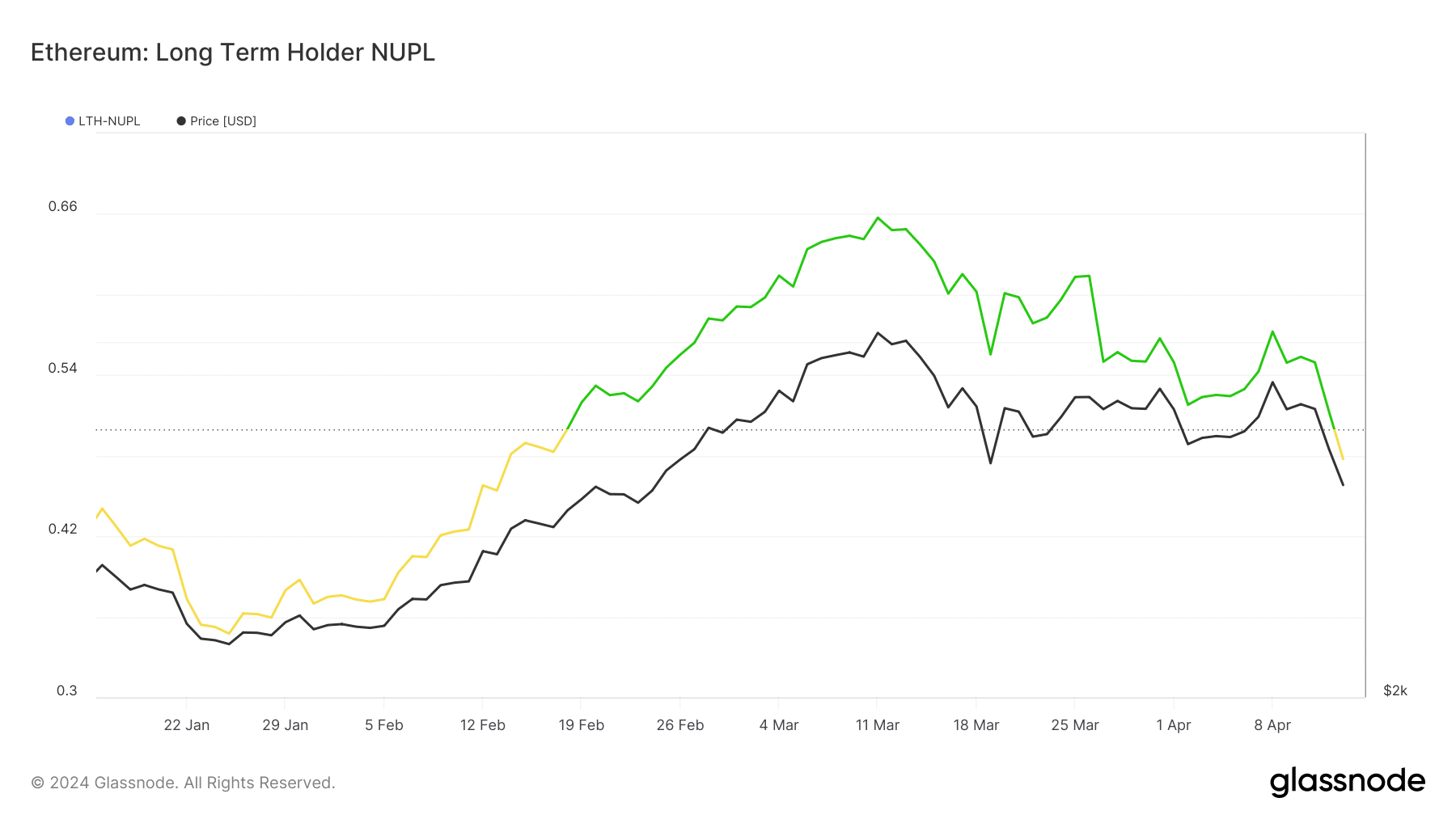

We found out after examining the Long-Term Holders Net Unrealized Profit/Loss (LTH-NUPL). The metric considers the behavior of investors with a UTXO of at least 155 days.

Holders are not calm

If the metric displays red, then investors are scared that the cryptocurrency might capitulate. Color blue suggests euphoria or greed.

At press time, the LTH-NUPL had moved from green to yellow. Green signifies the viewpoint that the price might continue to appreciate. But with Ethereum at yellow, it means that holders of the altcoins are now anxious and unsure about its potential.

Source: Glassnode

The change in sentiment could be linked to ETH’s price action. On the 12th of April, the cryptocurrency crashed below $3,200. When market participants thought that the collapse was over, another one occurred.

This time, it was the unsettling state in the Middle East that sent ETH to $2,850. However, press time data showed that the price has reclaimed $3,000 again.

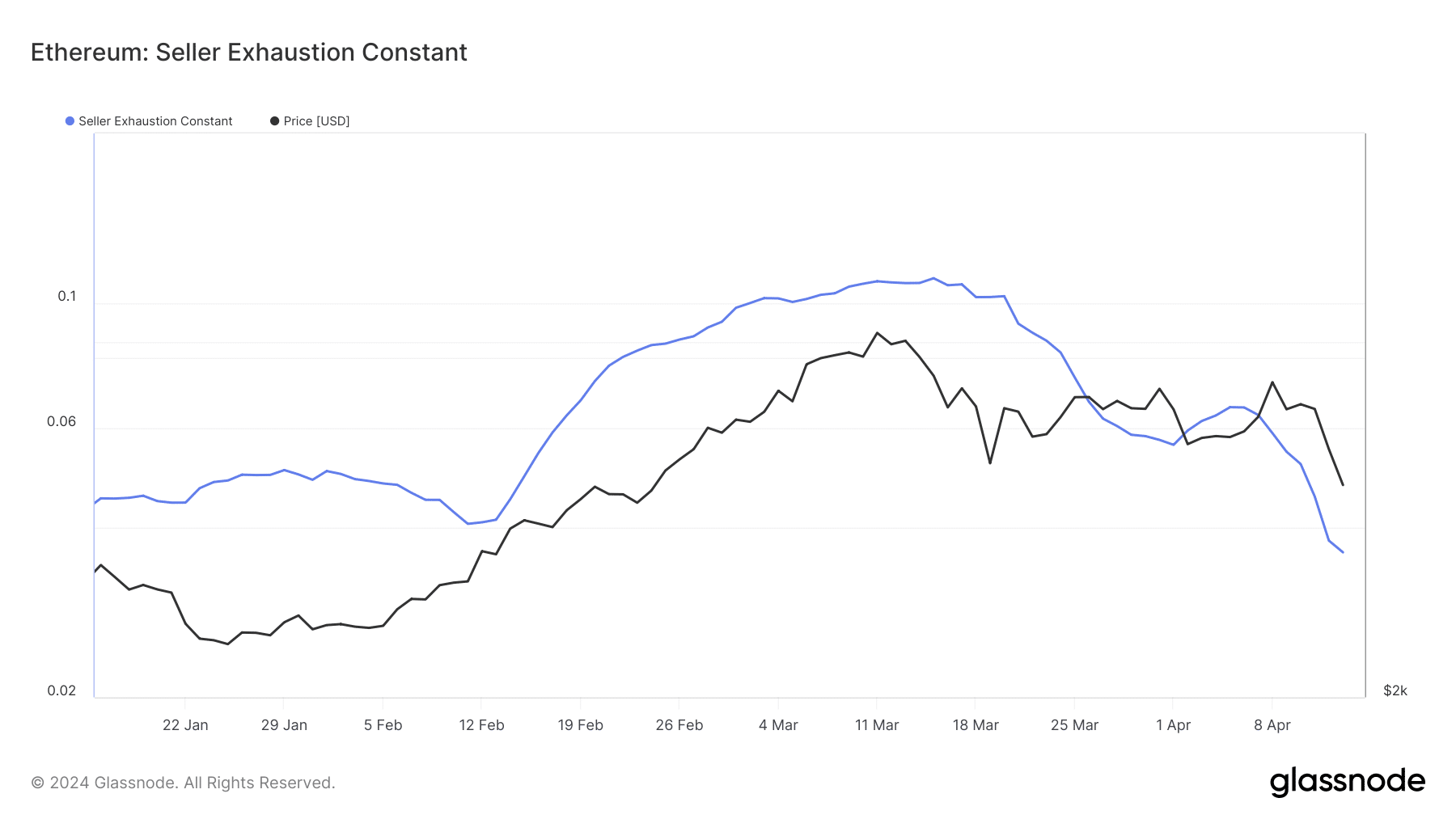

But will the price be higher than this in the short term? AMBCrypto evaluated the possibility by assessing the Seller Exhaustion Constant.

Selling pressure may take ETH to another level

An increase in the Seller Exhaustion Constant indicated that sellers are running out of steam. If this was the case, the price of ETH might be gearing up for a significant upside.

However, data from Glassnode showed that the metric dropped to 0.036, meaning that bears were not out of the way yet. Should the reading continue to go lower, ETH’s price might also fall.

In this instance, Ethereum holders might move from being optimistic to displaying their fears. The price of the cryptocurrency could also be affected, and another decline toward $2,800 could be next.

Source: Glassnode

Conversely, a spike in the metric could change the state of things for the better. If this happens, ETH could try revisiting $3,200 to $3,500 within a short period.

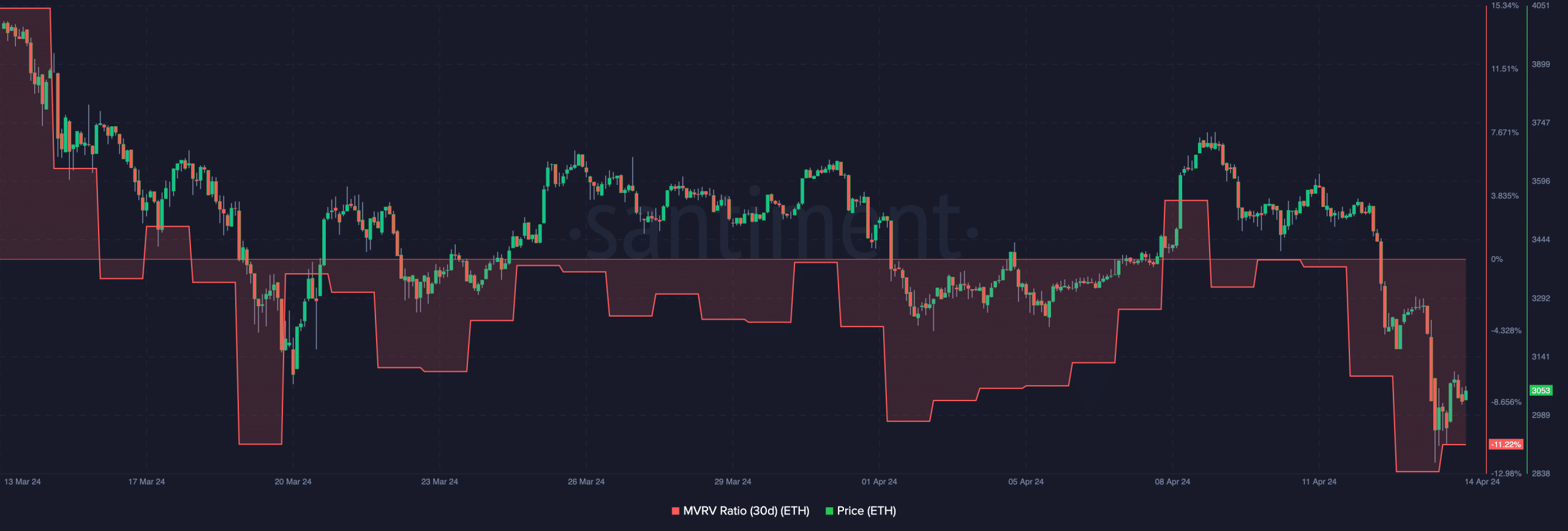

Furthermore, the Market Value to Realized Value (MVRV) ratio suggested a possible bounce for ETH. At press time, the 30-day MVRV ratio was -11.22%.

This reading was proof that most ETH holders who accumulated recently were at a loss. However, the MVRV ratio also shows if an asset is undervalued, at fair value, or overvalued.

Source: Santiment

Since the metric was negative, it suggested that Ethereum was in an undervalued state. Take for instance— the 20th of March when the metric was around the same spot, and the price was $3,100.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Days later, the value of the cryptocurrency rallied to $3,669. There were other instances where a similar thing happened.

Therefore, the long-term potential of ETH might remain bullish and holders might eventually put two feet forward.

Powered by WPeMatico