- Ethereum formed similar structures on the price charts at similar times

- ETH set to close the gap created after falling below the critical support band

Ethereum’s [ETH] recent price recovery from the $2,100-level has sparked speculation that it may replicate its 2016 and 2019 successes in 2024.

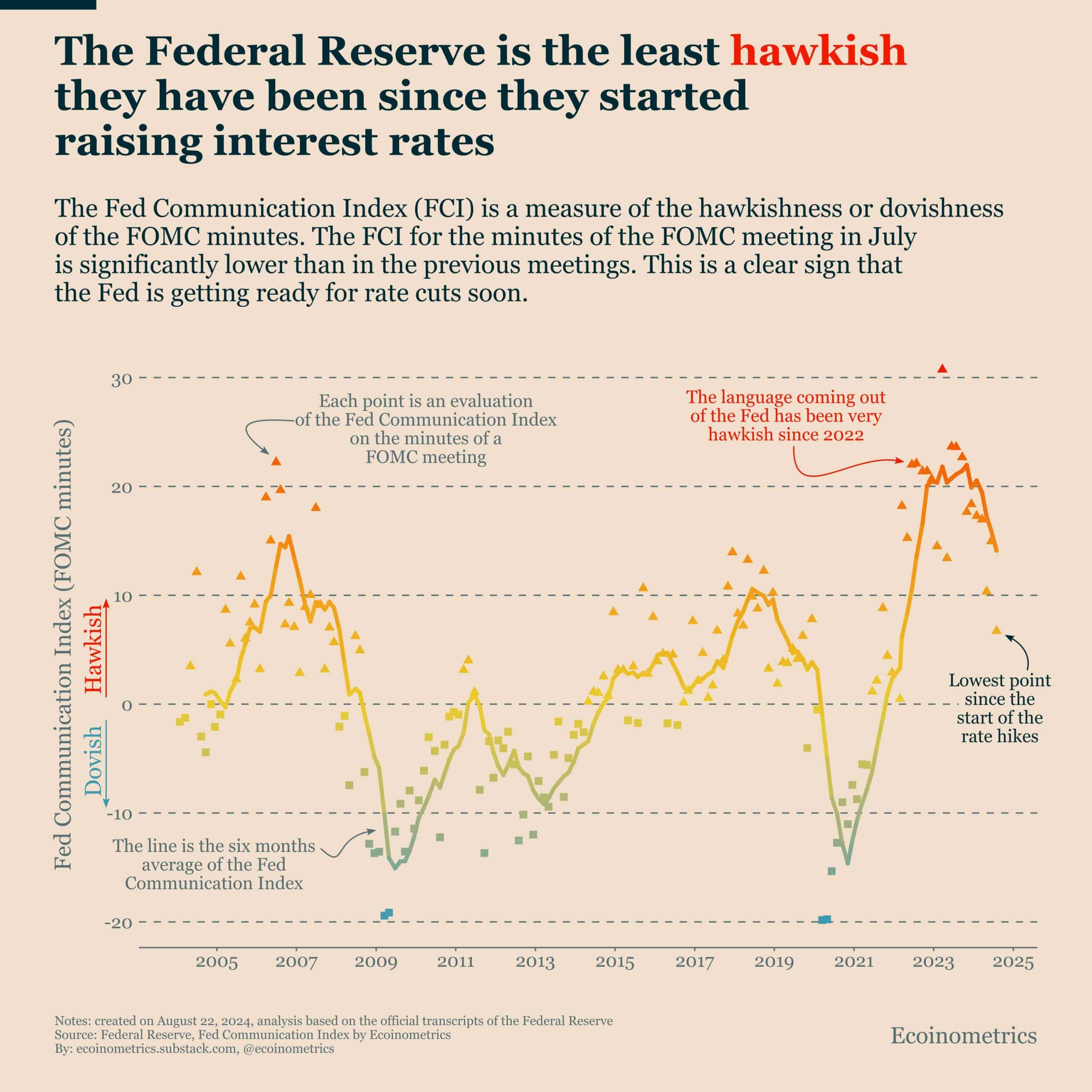

With Ethereum (ETH) poised to close a weekly candle above the $2,800-$2,900 range, many believe a bull run is on the horizon. This, especially as the Federal Reserve prepares for interest rate cuts in September.

In fact, historical patterns reveal that ETH/BTC broke down in 2016, 2019, and now in 2024, with previous breakdowns leading to rallies in September.

Source: TradingView

Notably, in both 2016 and 2019, ETH peaked on 19-20 September. These dates are close to the date when the Fed is scheduled to cut rates next month (18 September). This could be more than just a coincidence though, signaling potential gains for the world’s largest altcoin.

ETH/USD weekly outlook

At the time of writing, ETH/USD remained below its 20-week Simple Moving Average (SMA). On the contrary, Bitcoin (BTC) and several other altcoins have already reached their bull market support bands.

Source: TradingView

As the rate cut approaches, ETH might close the gap created after it fell below this support, echoing the bullish patterns seen in 2016 and 2019. This similarity could reinforce the possibility of ETH repeating its previous successes.

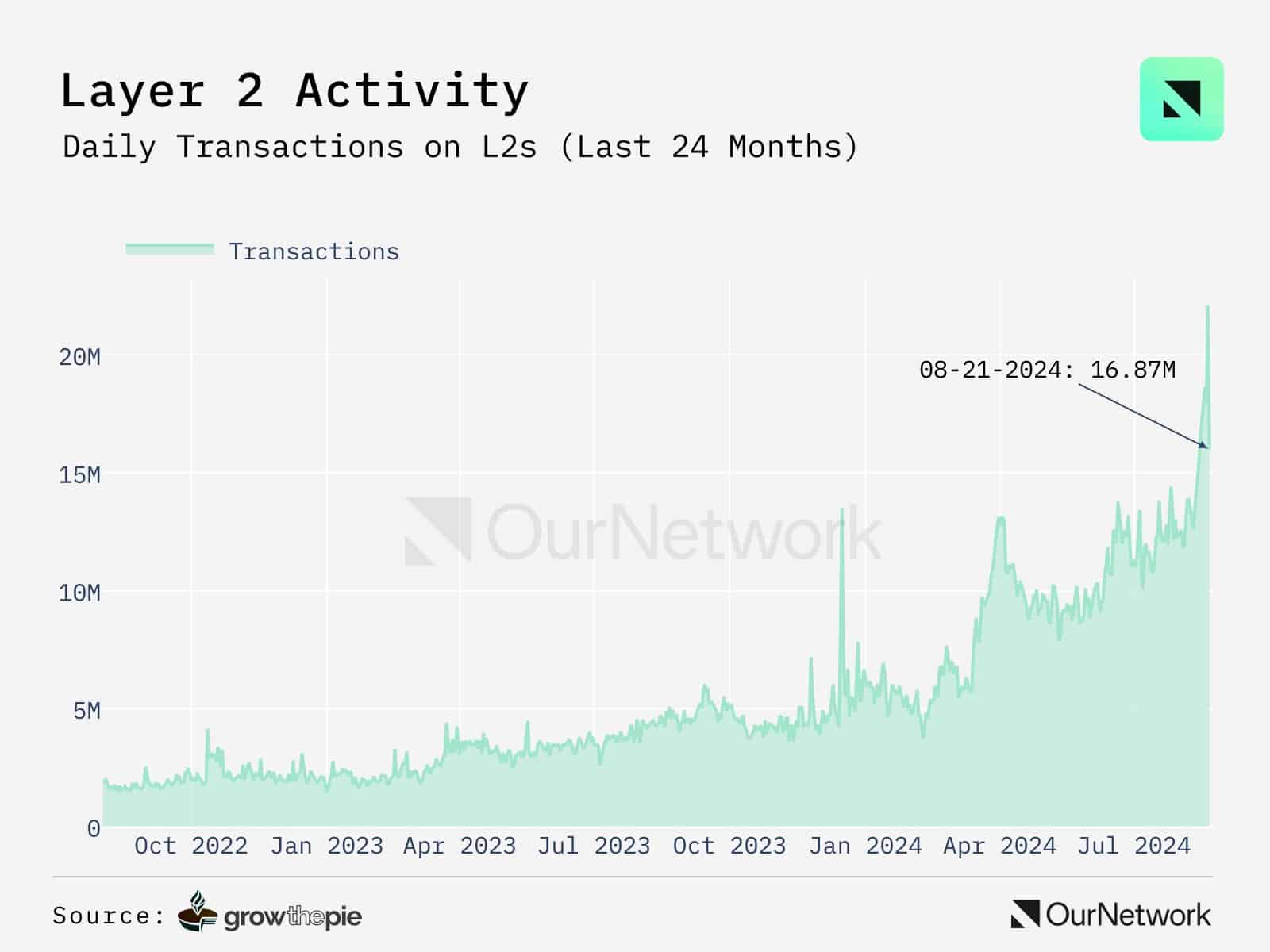

Ethereum Layer 2 daily transactions surge

Ethereum’s Layer 2 solutions are seeing unprecedented growth, with daily transactions hitting a record 16.87 million on 21 August, according to OurNetwork.

The Ethereum ecosystem is scaling rapidly, with major developments including Sony’s entry into Web3 through its new division – Soneium.

Source: OurNetwork

This platform, powered by Optimism’s OP Stack and integrated with Astar, Chainlink, and USDC, aims to make blockchain gaming mainstream.

Increased activity on the ETH blockchain due to such innovations could drive prices higher, reminiscent of the 2016 and 2019 rallies.

Impact of the broader crypto market and USD

The broader crypto market turned green recently after Federal Reserve Chair Jerome Powell hinted at a September rate cut. This momentum is likely to continue with ETH, a major player in the crypto industry since it may be poised for a price surge on the charts.

Moreover, any weakening of the USD, expected as the Fed adopts a more dovish stance, could further boost ETH’s price.

The Federal Reserve, less hawkish now than at any point since it began raising rates, is set to cut rates. This has historically led to the dollar’s weakness. This will be a significant driver pushing ETH prices higher, just like during its previous bull runs.

Source: Ecoinometrics

Powered by WPeMatico