- Argentinians are turning to cryptocurrencies at an accelerated rate as inflation rates soared by 276%.

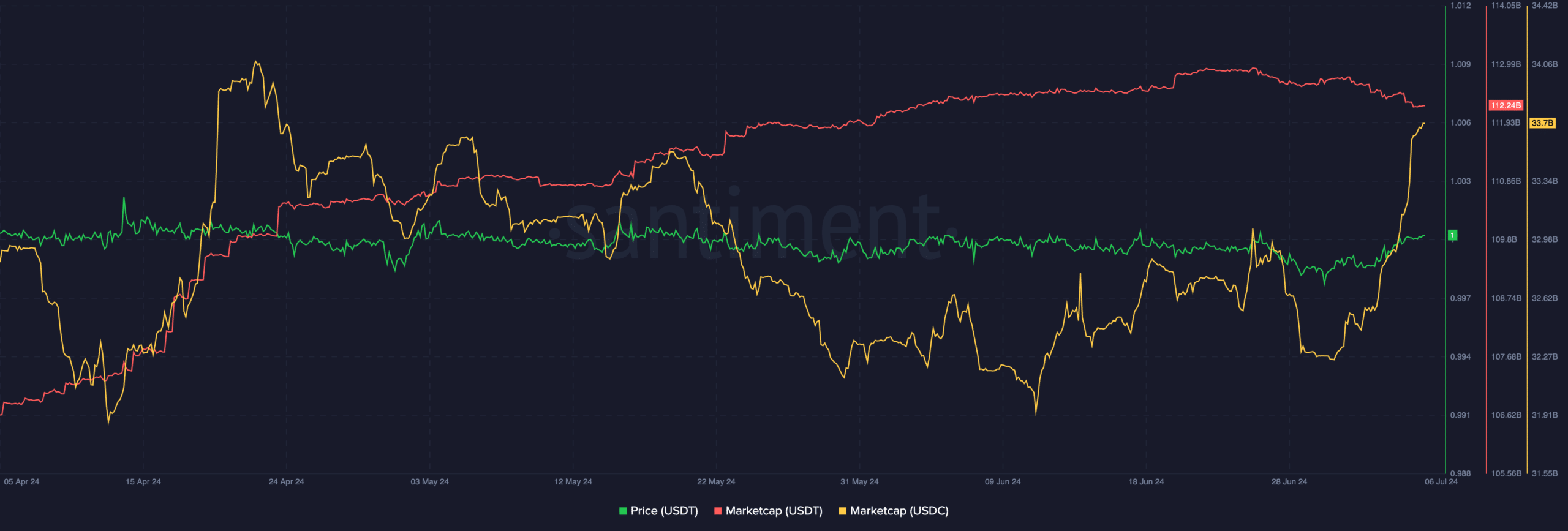

- USDT witnessed a massive surge in market cap, and USDC was close behind.

A recent Forbes report indicated that Argentina boasted the highest cryptocurrency adoption rate in the western hemisphere.

This surge in crypto adoption can be attributed to Argentina’s long-standing battle with high inflation, which has significantly eroded the value of its national currency, the peso.

No peso, no problem

This economic instability has fueled a surge in interest in alternative investments, and cryptocurrencies have emerged as a popular option for Argentinians seeking to preserve the value of their savings.

Data compiled by Forbes provides a glimpse into this trend. Their findings show that a staggering 2.5 million visitors from Argentina accessed 55 of the world’s largest cryptocurrency exchanges.

This translated to roughly 1.92% of total visitors on these platforms globally, highlighting Argentina’s significant role in the cryptocurrency space.

Furthermore, Argentina represented a remarkable 6.9% of all visits to Binance [BNB], the world’s leading cryptocurrency exchange by trading volume.

This concentrated activity on Binance underscored Argentina’s preference for established and reputable cryptocurrency platforms.

Normally, cryptocurrencies are seen as volatile investments with the potential for high gains – or losses.

People might buy Bitcoin [BTC], hoping its value will skyrocket, or use Ethereum [ETH] to pay for online goods and services. However, the situation in Argentina is quite different.

Many Argentines buy USDT and then simply hold onto it. They aren’t interested in trading or spending it – they just want a safe haven for their money.

This trend suggests a clear desire for stability. Argentina has been battling extremely high inflation, with annual rates reaching nearly 300% as of April 2024.

This means the prices of everyday goods are constantly rising, eroding the value of the Argentine peso.

While there have been some recent improvements, with inflation dipping to 276% in May (the lowest since early 2022), it remains stubbornly high at over 275%.

This weakens the peso’s buying power, making it a less attractive place to store wealth. As a result, Argentines are turning to USDT, a stablecoin pegged to the U.S. dollar, in an attempt to preserve the value of their savings.

USDT swoops in

The marketcap of USDT grew materially over the last few months and retained its dominance, partly due to factors such as Argentinian adoption.

However, USDC wasn’t too far behind, and also witnessed a surge and was seen to be slowly catching up to USDT.

Source: Santiment

Powered by WPeMatico