- Solana reclaimed the crucial $154 support level and jumped above its 20-day and 50-day EMA.

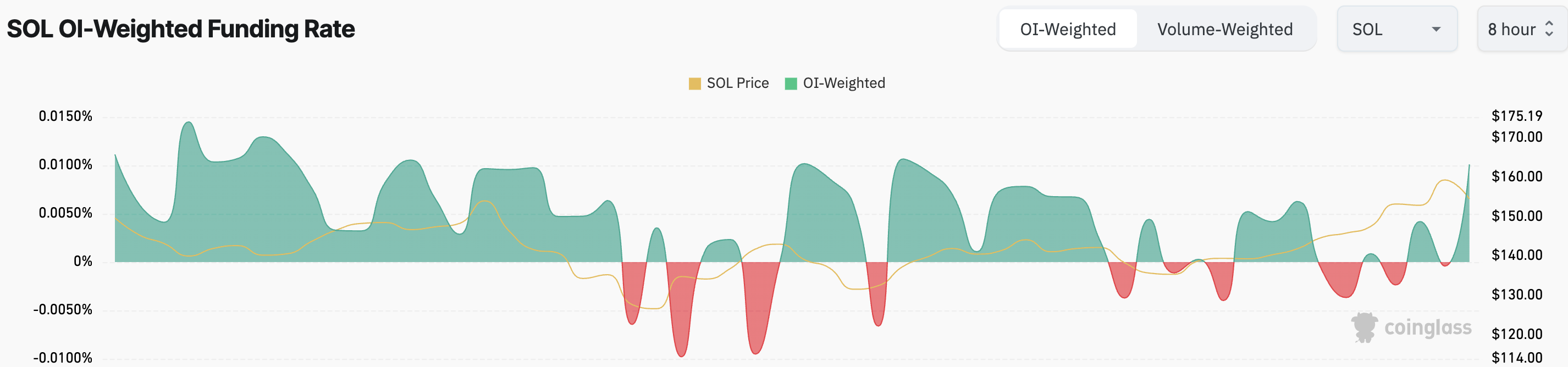

- SOL’s funding rate rose amid the recent market-wide bull run.

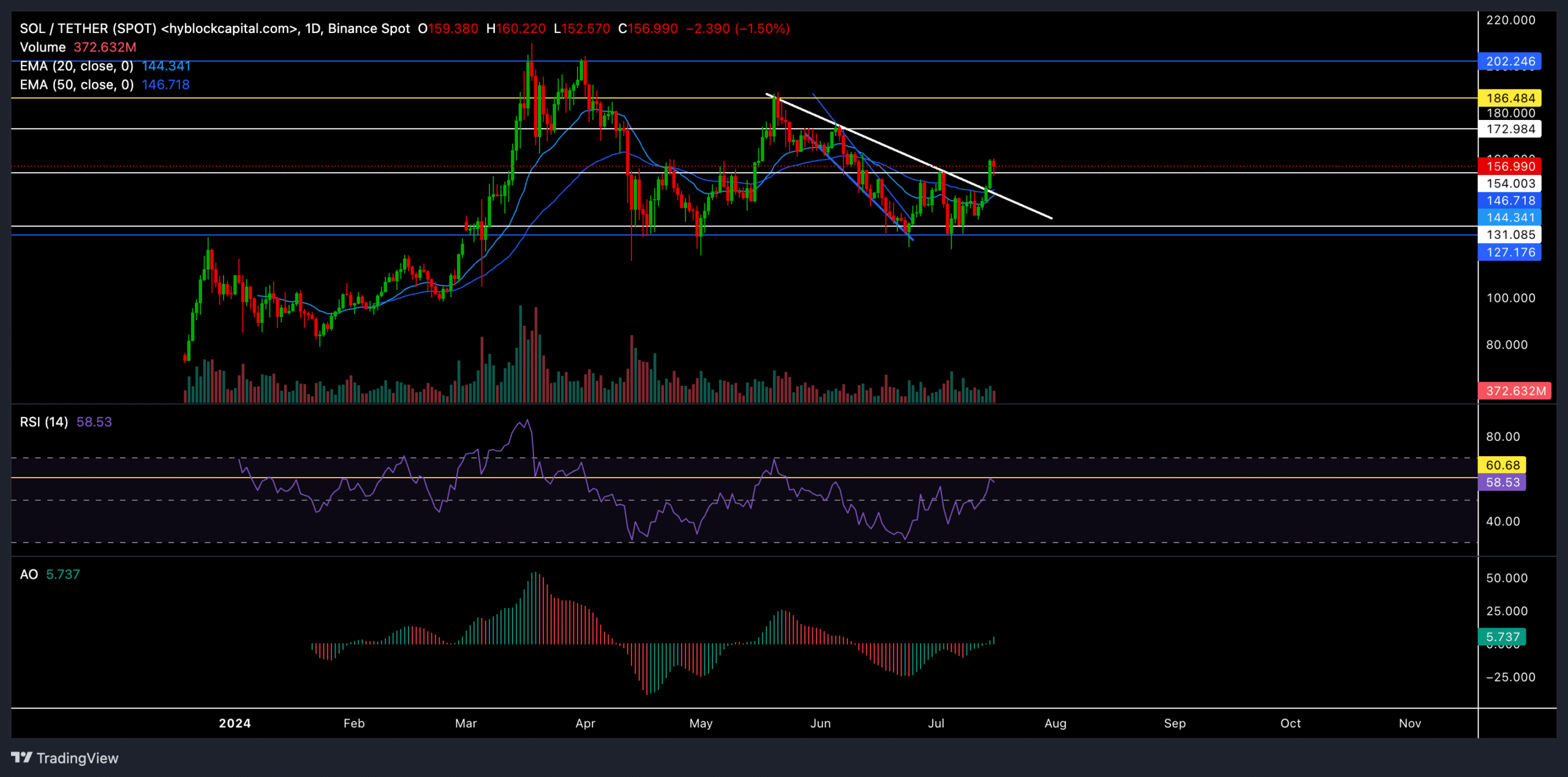

A recent recovery above the crucial $154 level set the stage for Solana [SOL] bulls to exude more pressure. The altcoin saw a solid bullish edge as it jumped above the 20-day and 50-day EMA at press time.

The previous oversold conditions provoked a well-needed reversal from the $131 support level. The coin entered into a relatively high volatility zone amid this recovery. At the time of writing, SOL was trading at around $156.5.

Can SOL bulls continue to exert pressure?

Source: TradingView, SOL/USDT

After a highly bullish Q1 this year, SOL reversed from the $202 resistance and was under bearish chains for the past three months. It lost around 37% of its value during this downturn and tested the $127 support level multiple times in these three months.

The altcoin recently formed a falling wedge pattern on its daily chart. After an expected bullish breakout, it tested the $154 level. Buyers found it challenging to cross this level, which saw a confluence of horizontal and trendline resistance levels.

However, the recent rebound from the $127-$131 support range formed a classic double-bottom setup on the charts. The recent close above the $154 level confirmed this pattern as SOL reclaimed a crucial support level.

Going forward, SOL would likely rebound from the $154 support level and look to test the $172-$175 range in the coming days.

Buyers should wait for the 20-day EMA to cross above the 50-day EMA to confirm their bullish bias. It’s worth mentioning that any decline below the $154 support level can delay SOL’s immediate recovery prospects.

The RSI finally found a convincing close above 50 at press time. However, it struggled to jump above its 60 resistance.

Moreover, the Awesome Oscillator finally closed above the zero level over the past day. This close above the zero level also confirmed bullish twin peaks on the oscillator.

These peaks also occurred a few months ago when SOL saw a bullish rally toward the $186 resistance.

Is your portfolio green? Check out the SOL Profit Calculator

Funding rates improved

Source: Coinglass

Coinglass data highlighted how SOL’s funding rates saw a sharp uptrend over the last few days as bulls re-entered the market. It’s worth keeping an eye on this trend as a declining trend could suggest an ease in buying sentiment.

It’s also crucial to consider Bitcoin’s sentiment and trajectory before making buying decisions.

Powered by WPeMatico