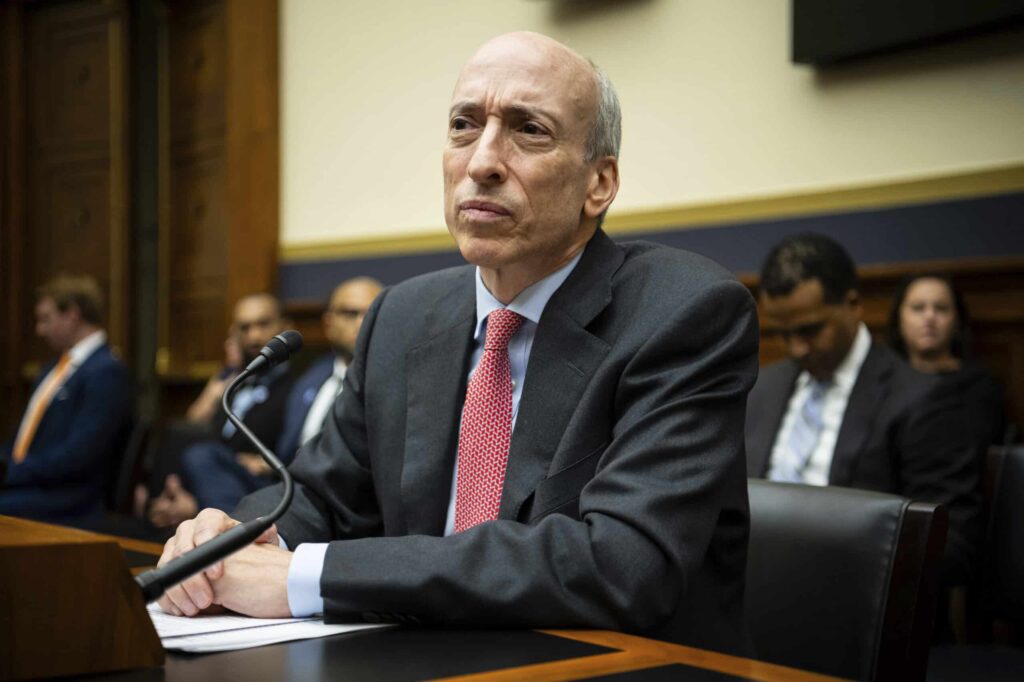

With the coming change in administration, Gary Gensler’s SEC doesn’t have much time to pursue enforcement against the crypto gaming company.

Current SEC chair Gary Gensler could well be replaced by the next administration.

(Shutterstock)

Posted November 1, 2024 at 5:38 pm EST.

Blockchain-based gaming company Immutable said on X on Thursday that the SEC had issued a Wells Notice against it, signaling that the agency had completed an investigation in which it had found the company to be in violation of securities laws. But if SEC Chair Gary Gensler is replaced under a new presidential administration, as seems likely, the investigation could be dropped altogether.

“Ongoing investigations at the SEC could be significantly impacted by a change in leadership,” said Austin Campbell, CEO of blockchain-based digital payments company Worldwide Stablecoin Payment Network (WSPN). “They could be modified, reprioritized, or even abandoned after such a change.”

The SEC currently has only two-and-a-half months before a new Presidential administration takes office on January 20, at which point Gary Gensler may no longer be the chair of the agency. Republican candidate Donald Trump has promised the crypto community that he would remove Gensler on his first day in office, although it’s unclear whether he actually has the legal authority to carry this out. Meanwhile, Unchained talked to sources close to Vice President Kamala Harris’ campaign who said that her transition team is also vetting replacements. Taken together, this means a new SEC chair with possibly different views on securities laws could take the SEC’s helm before the agency has time to issue an enforcement action and battle Immutable in court, a process that usually takes several months to complete.

Gensler’s leadership of the SEC has been heavily criticized by the crypto industry for carrying out “regulation by enforcement” by pursuing multiple punitive actions against blockchain companies rather than more pro-actively deciding upon and clarifying its rules.

In a statement on Friday, Immutable said that it believed it had operated within the bounds of the law. The company works on putting in-game assets, which it estimated to be worth over $110 billion in total across the industry, on-chain. If the SEC chooses to issue an enforcement action, Immutable promised to “fight for [its] rights, and those of our industry, vigorously.”

Immutable said in its statement that it received its Wells Notice from the SEC just hours after initially being contacted by the SEC, giving Immutable little opportunity to respond or cooperate. Typically, companies are contacted by the commission months before a Wells Notice is issued. Immutable also said that the SEC’s notice included only 20 words of material information describing areas where the company had violated securities laws, leaving it to question which assets were targeted.

According to the statement, Immutable speculated the SEC was focused on its IMX token since the agency had also sent a Wells Notice to Digital Worlds Foundation, the parent company of the issuer of the IMX token. The IMX token is an ERC-20 utility and governance token that is used by Immutable developers to pay transaction fees.

“We welcome regulatory clarity—but it appears that some elements of SEC do not want to engage in a constructive dialogue,” Immutable said in its statement.

Powered by WPeMatico