Blob usage recently hit an all-time high, helping Ethereum’s tokenomics and adding credence to the notion that L2 networks are not parasitic to their parent chain.

Blobs stand for “binary large objects.”

(Shutterstock)

Posted November 1, 2024 at 4:25 pm EST.

The demand to transact on Ethereum layer 2 networks is on an upswing, as shown by a number of onchain metrics.

In the last three days, the average number of blobs posted to Ethereum was 21,497, a record figure surpassing the previous sustained high in March, according to a Dune Analytics dashboard curated by pseudonymous data analyst Hildobby.

When L2s batch and compress transactions to Ethereum’s base layer, rollups had initially put the information inside calldata, an expensive process, but the advent of Ethereum’s Dencun upgrade earlier this year introduced blobs, a new space to store data that substantially lowered the cost of transacting for L2s.

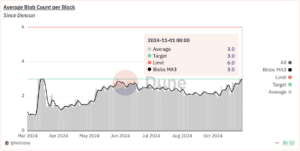

“Ethereum blocks are consistently full with three or more blobs suggest[ing] that demand for rollup transactions is growing,” according to Eigen Labs product manager Teddy Knox, referring to the target number of blobs per block, not the max limit, which is six. As a result, “we’re essentially entering into a phase where blobs take on some price.” Eigen Labs is the software firm behind restaking protocol EigenLayer.

The increased usage of blobs impacts ETH’s tokenomics, lending weight to those who contend that Ethereum L2s are not parasitic to their parent chain, a recent ongoing debate.

Blobs Entering Price Discovery

Since Dencun, the average number of blobs posted in each Ethereum block has been steadily increasing. At presstime, the average count of blobs per block has jumped nearly 43% in the past month to three blobs (a little over 2,000 transactions per block), the target number for Ethereum developers. This shows growth in user demand for rollup transactions, Knox told Unchained.

The last time there was a sustained period of comparable demand for blobspace with over 21,000 blobs posted daily was in March, when a project called Ethscriptions created a mechanism for inscribing data on blobs.

Since then, the cost for rollups to post blobs has been basically zero, but within the last four days, the blob base submission fee climbed as high as roughly 15 gwei worth about $5, before settling at 65 cents at presstime, per Hildobby’s dashboard. Gwei is a small unit of ETH.

Read More: Are L2s ‘Parasitic’? Analysis Shows Ethereum Only Gets a Tiny Percentage of Fees

Why This Is Positive for ETH Tokenomics

Similar to how base fees for transacting on Ethereum are burned, blob fees are burned as well and removed from circulation, thus decreasing the supply.

As a result of the recent increased blob count per block, the majority of ETH burned from blob fees in the last 30 days occurred in the past seven days. 21.17 ETH was burned from blob fees over the past week compared to the 26.88 ETH in the last 30 days, data from analytics platform Ultra Sound Money shows.

Per Paul Vaden, a core contributor at the Lyra Foundation, which aids in the development of trading platform Derive Protocol on Ethereum, the conversation about increased blob count and rise in blob costs has two sides.

“You have Ethereum bag holders who want the blob fees to go up so the burn looks good and then you have L2s users and developers who want the blob fees to stay low, because otherwise they’re incurring a lot of costs. So there’s some contention there,” Vaden said to Unchained.

Why This Shows L2s May Not Be Parasitic to Ethereum

In regards to the increased cost for rollups in posting blobs, “this is where it’s clear that they’re not really parasitic, because they are paying this rent to post their data to Ethereum,” Vaden argued.

The popularity of blobs and rollup transactions can be seen through capital flows from Ethereum and to its L2 networks. While Ethereum has a netflow, or inflows minus outflows via bridges, of -$6.4 billion year-to-date, L2 networks Arbitrum, OP Mainnet, and Base have a total netflow of +$6.1 billion. These three Ethereum L2s each had a greater netflow than other layer one blockchains such as Solana and Avalanche, per blockchain analytics firm Artemis.

Solana has seen +$1.4 billion in bridged netflows, while Avalanche’s figure stands at -$469 million.

Read More: Should You Skip Trading the Election? Arthur Hayes Explains What Could Drive Bitcoin Prices Up

The use of blobs and the activity shift from the Ethereum base layer to its L2s was always part of the rollup-centric roadmap, said Eigen Labs’ Knox, adding that “it’s been very intentional.”

“The only way to onboard, as we like to say, the next billion users, is to make sure there’s space for them. There’s not going to be any kind of massive adoption of crypto if it costs anywhere from $5 to $50 to submit a transaction. And so I think the role of the scaling roadmap is working. That’s what we’re seeing.”

The price of ETH has remained stable in the last seven days and grown 2.5% in the last 30 days to $2,510, per CoinGecko.

Powered by WPeMatico