- AVAX’s daily chart turned green after a month-long price decline.

- A few metrics hinted at a successful breakout above the falling wedge pattern.

After a month of double-digit price decline, Avalanche [AVAX] finally managed to paint its daily chart green. The better news was that the token’s price was actually consolidating inside a pattern, which caused the price drop.

However, it was on the verge of a breakout, which could initiate a massive rally.

Avalanche’s bull pattern

CoinMarketCap’s data revealed that AVAX’s price dropped by more than 18% last month. But the last 24 hours were in investors’ favor as the token’s price increased by over 1%.

At the time of writing, AVAX was trading at $26.15 with a market capitalization of more than $10 billion, making it the 13th largest crypto.

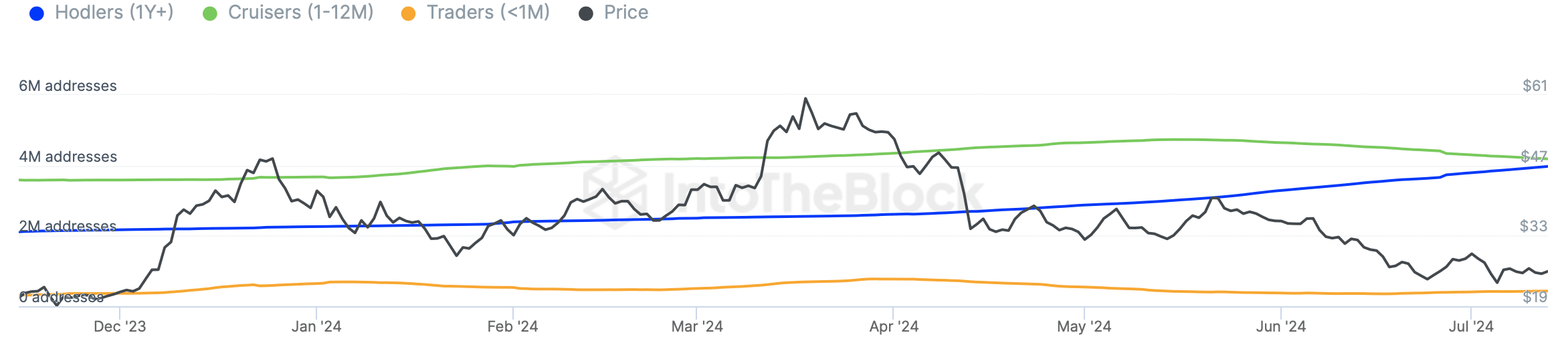

AMBCrypto’s analysis of IntoTheBlock’s data revealed that long-term holders’ confidence in AVX was rising. This was the case as the number 0f addresses holding AVAX for over an year were rising, suggesting that investors were expecting AVAX to pump.

Source: IntoTheBlock

That actually might be true, as a bullish pattern appeared on the token’s chart.

Captain Faibik, a popular crypto analyst, recently posted a tweet revealing a bullish falling wedge pattern. The token’s price entered the pattern at the beginning of this year and since then has consolidated inside it.

At press time, it seemed that Avalanche was finally getting ready for a breakout. If that happens, then investors might witness a 200% rise. In fact, the price hike could also earn AVAX a spot on the top 10 list of cryptos by market cap.

Source: X

Is a bull rally possible?

AMBCrypto then planned to have a closer look at Avalanche’s on-chain data to better understand. As per our analysis of Santiment’s data, AVAX’s weighted sentiment remained in the negative zone.

This meant that bearish sentiment around the token was dominant in the market. However, its funding rate registered a decline on the 14th of July.

Generally, prices tend to move in the opposite direction from the funding rate, hinting at a price increase that could result in a breakout above the bullish pattern.

Source: Santiment

The technical indicator MACD also displayed a bullish upper hand in the market. On top of that, AVAX’s Relative Strength Index (RSI) registered an uptick, further suggesting that it was likely for the token to begin a bull rally.

Nonetheless, the Chaikin Money Flow (CMF) suggested otherwise as it moved southwards.

Source: TradingView

Realistic or not, here’s AVAX market cap in BTC’s terms

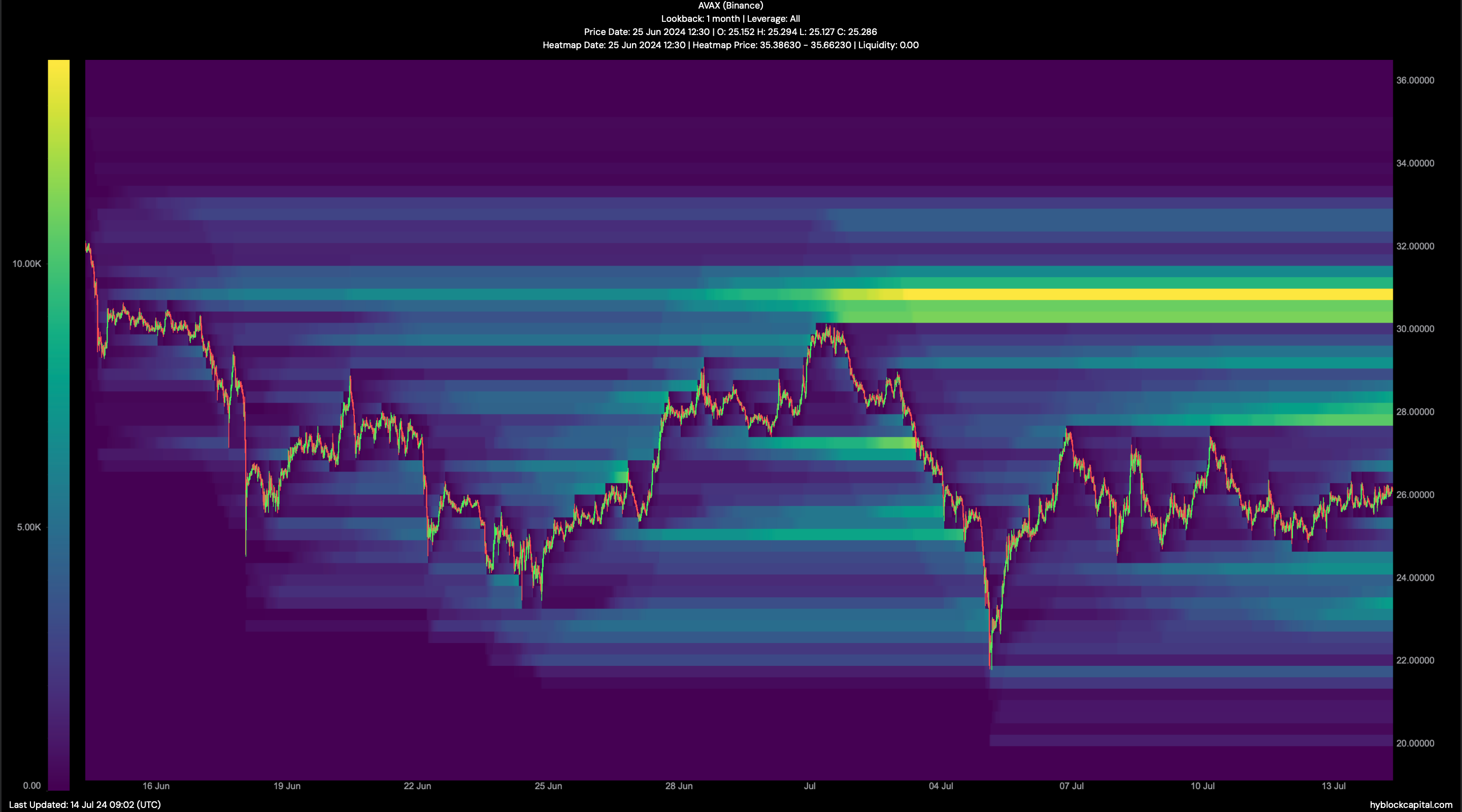

If bulls begin a rally, then AVAX might first reach $27.9, as liquidation would rise at that mark. A breakout above that could push Avalanche to $30 this week.

However, if the bears dominate, then the token’s price might plummet to $24.

Source: Hyblock Capital

Powered by WPeMatico