- The market cap to revenue ratio revealed that the token might attract only a few buyers.

- XRP’s price could increase but $1 might be a struggle.

Anyone who has held Ripple [XRP] since it hit its peak in 2018 would agree that being faithful to the project has been an extreme sport. While there are high hopes that the token might recover this cycle, tokenomics seems to disagree.

AMBCrypto discovered this after analyzing Ripple’s revenue from XRP transactions and its market cap. According to data from Messari, XRP’s revenue exceeded $560 million over the last 365 days.

While the token had fallen to 6th in terms of market cap, the value was $34.56 billion. When divided by each other, the ratio of market cap to revenue gives a reading of 61.18.

Too many stumbling blocks

This ratio is considered high and might be detrimental to XRP as investors might consider the cryptocurrency not worthy of buying.

But the cryptocurrency’s problem is not limited to that. Another factor that has hindered XRP’s growth is its supply.

The token fundamentally has a total supply of 100 billion. Out of this, 54.88 billion were in circulation. If there is a high supply, and demand for the cryptocurrency remains low, the price would find it difficult to appreciate. This was XRP’s story.

With this condition, and no headway in sight per Ripple’s lawsuit with the SEC, XRP might find it difficult to exhibit top performance this time.

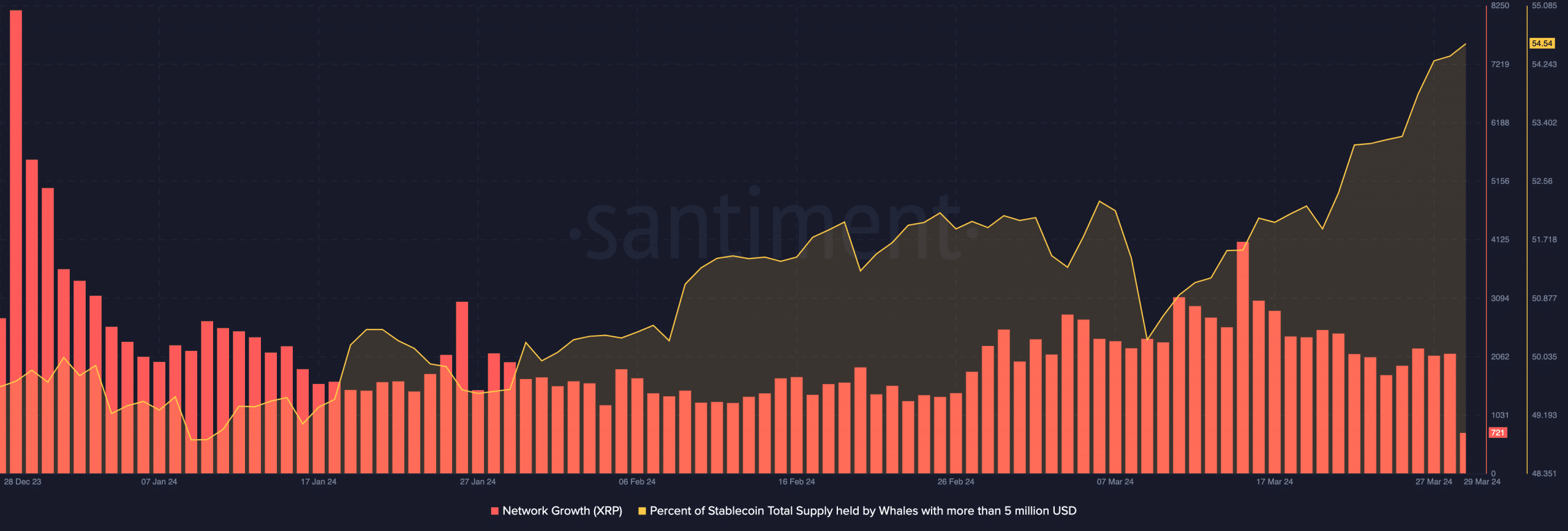

AMBCrypto’s analysis of the project’s on-chain status also reinforced this sentiment. For example, in December 2023, Ripple’s network growth was 8189, indicating an influx of new addresses interacting with the project.

Source: Santiment

However, that number had fallen below 800, meaning that the adoption of XRP was 10 times less. However, stablecoin supply by whales on the network has been increasing.

Respite for the road

But this does not guarantee that whales are arming themselves with buying power to accumulate XRP. If this is the case, then good for the token. However, there is no guarantee that the price would climb toward $3.40 as it did in 2018.

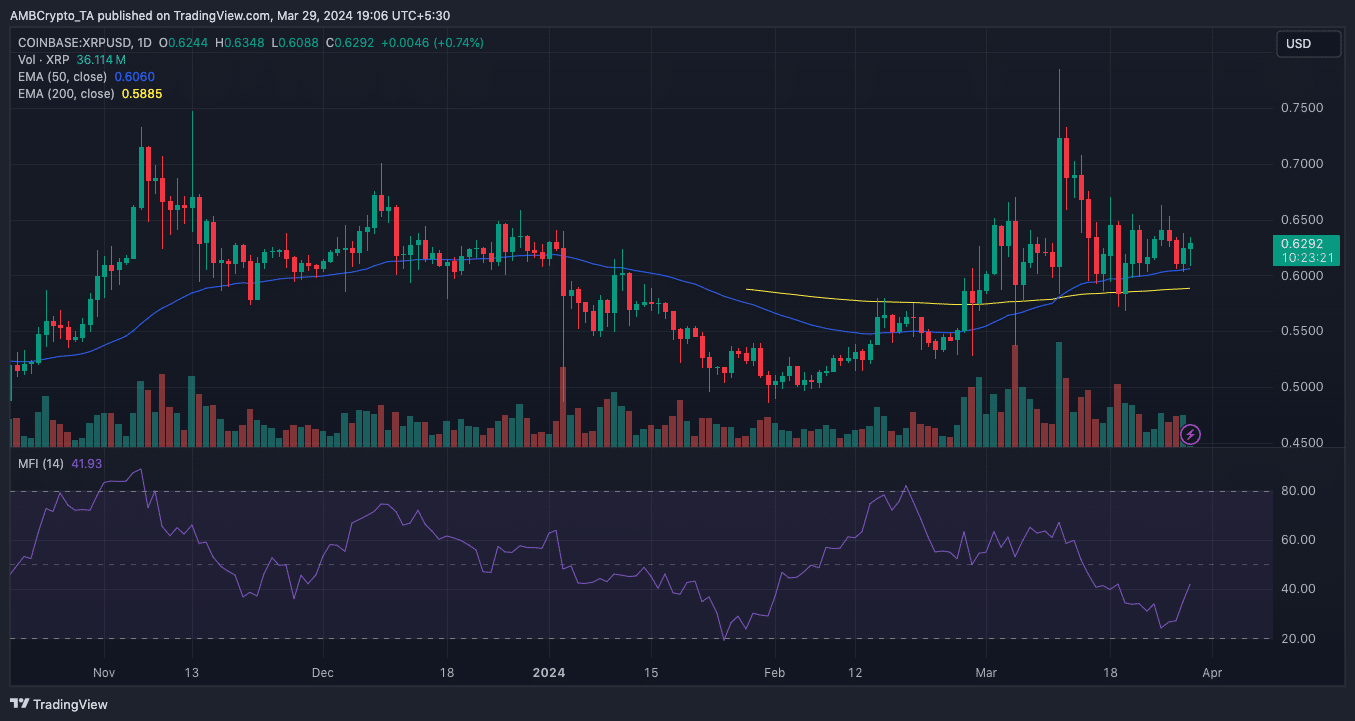

Moreover, we dissected the token’s price potential. On the daily timeframe, the 50 EMA (blue) had crossed over the 200 EMA (yellow), suggesting that XRP had a long-term bullish potential.

However, both EMAs were too close to the price which stood at $0.62. This position signaled that while the price might extend, making an out-of-this-world rally seems unlikely.

Source: TradingView

Read Ripple’s [XRP] Price Prediction 2024-2025

We also looked at the Money Flow Index (MFI). Though the MFI reading was lower, it had started to recover, suggesting that capital was flowing into the cryptocurrency.

For the short term, the price of XRP might climb toward $0.68. However, the long-term prediction might be a bit conservative. In a highly bullish case, the token might trade less than $1.

Powered by WPeMatico