- MEW gained bullish momentum and trading volume suggested conviction.

- The spot CVD gave a negative signal, but sentiment was still bullish.

cats in a dogs world [MEW] noted gains of 34% since the 18th of September. The lower timeframe momentum was turning bullish for the memecoin, but it faced two key resistance levels at press time.

These two levels marked the borders of the $0.006-$0.00633 supply zone, a region that MEW coin bulls have struggled to breach since August.

A retest of the resistance zone is at hand

Source: MEW/USDT on TradingView

In the past six weeks, the $0.004-$0.00434 zone has acted as a stable support zone. From here, MEW bulls have been able to engineer two rallies.

One was rejected at the $0.006 resistance level, while the other is in progress.

The trading volume surged massively on the 19th of September, going much higher than it did during the rally on the 23rd of August. This suggested that bullish strength was much higher during this attempt.

Consequently, more success is anticipated, but this is not guaranteed. A session close above $0.00633 would be necessary to change the bias bullishly.

The RSI was at 78 to show intense upward momentum, and the OBV rocketed higher on the back of elevated buying pressure. Overall, the chances of a continued upward run were good.

The rapid drop in spot CVD was a surprise for MEW coin

Source: Coinalyze

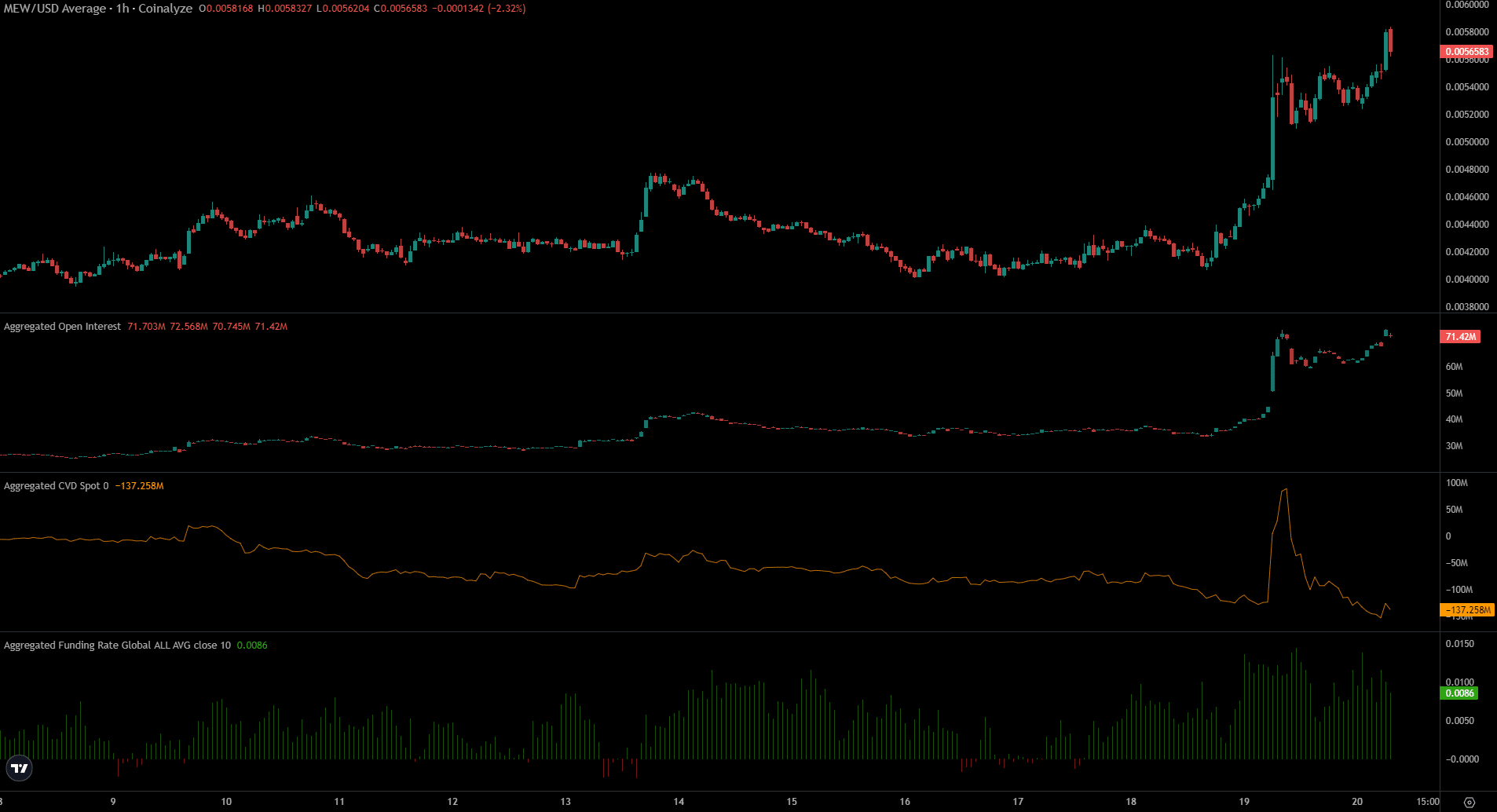

The Open Interest rose from $34 million to $73.9million within the past 48 hours, showing strong bullish conviction.

The positive Funding Rate showed that speculators were eager to go long and capture some profits, as MEW coin made quick gains.

Realistic or not, here’s MEW’s market cap in BTC’s terms

The spot CVD made large gains on the 19th of September, but these were erased a few hours later.

It was a sign of profit taking activity in the spot market and did not bode well for holders, since it hinted that sellers did not believe MEW could break the $0.006 resistance zone.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Powered by WPeMatico