- Notcoin has dropped over 70% since its peak in January, trading at $0.008488 at press time.

- Technical indicators showed that the asset was oversold, pointing to a possible rebound to key levels before continuing its downtrend.

Notcoin [NOT] has been on a downward trajectory since it peaked in January, when it reached a high of $0.02836. Since then, the cryptocurrency has seen a steep decline, losing more than 70% of its value.

At the time of writing, NOT was trading at $0.008488, marking a 4.8% decrease in the past 24 hours alone. Despite this persistent decline, technical analysis suggested that a potential rebound may be on the horizon.

Possible rebound ahead?

While Notcoin remains in a bearish phase, certain technical indicators suggest that the asset may be due for a short-term rebound.

The NOT price chart revealed that the asset has been consistently creating a series of downtrends, leading to an oversold condition.

In financial markets, when an asset becomes oversold, it often indicates the possibility of a price rebound.

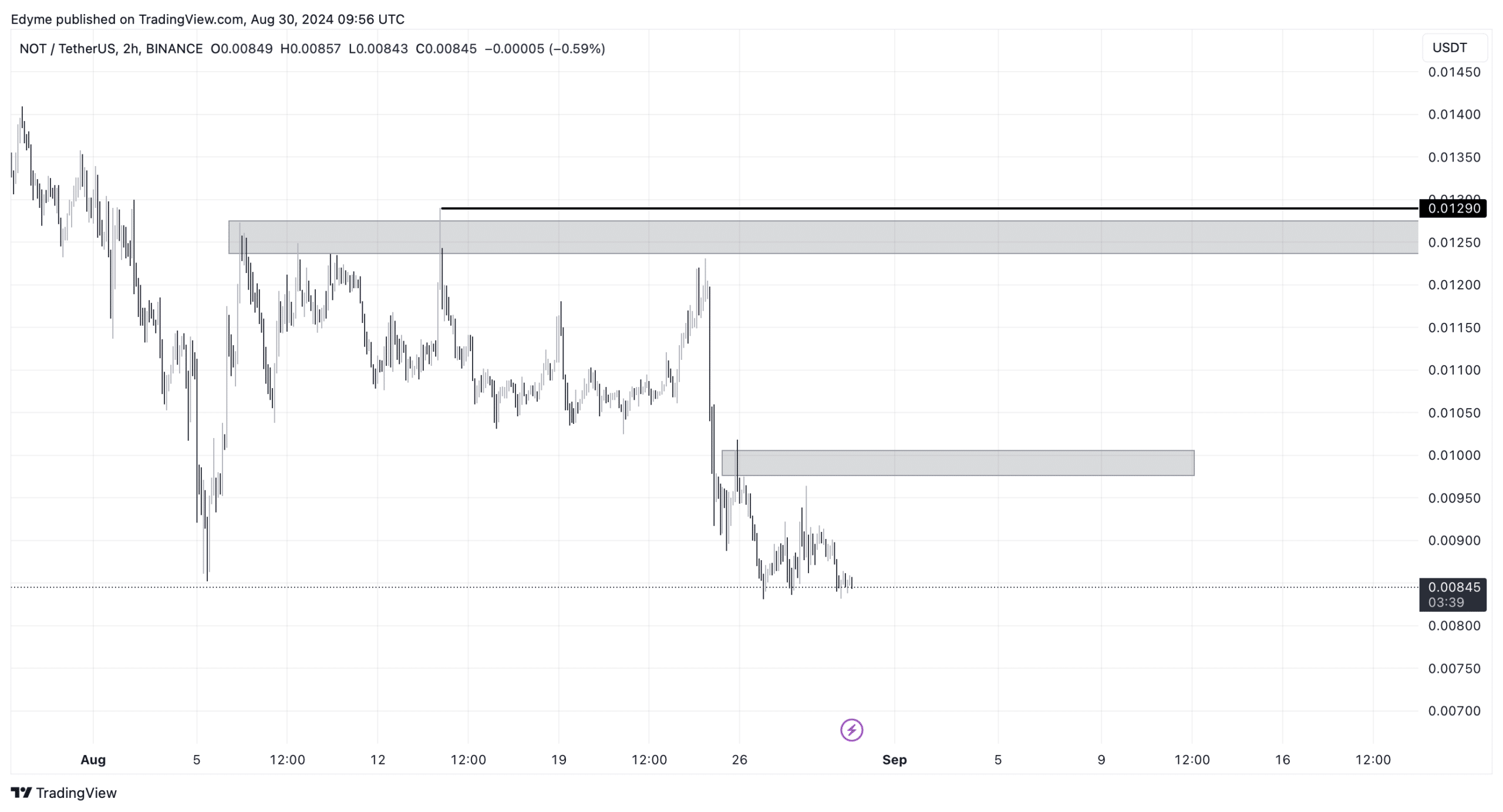

Source: NOTUSDT on TradingView

Examining the 2-hour time frame chart for NOT, we can identify potential levels where the price could rebound. These levels are areas of liquidity and are positioned in the premium of a specific swing structure.

Recently, Notcoin has traded below a major swing low, a scenario that often precedes a rebound. The first significant level to watch for a potential rebound is at $0.0975 to $0.01018.

If this level is breached, the next target is higher at $0.0123 to $0.0129.

Should Notcoin manage to break above these two levels including the $0.0129 region, it could indicate a change in the market structure, potentially signaling the beginning of an upward trend.

Notcoin provides mixed signals

Beyond technical analysis, examining the fundamentals is crucial in determining whether NOT is poised for a rebound.

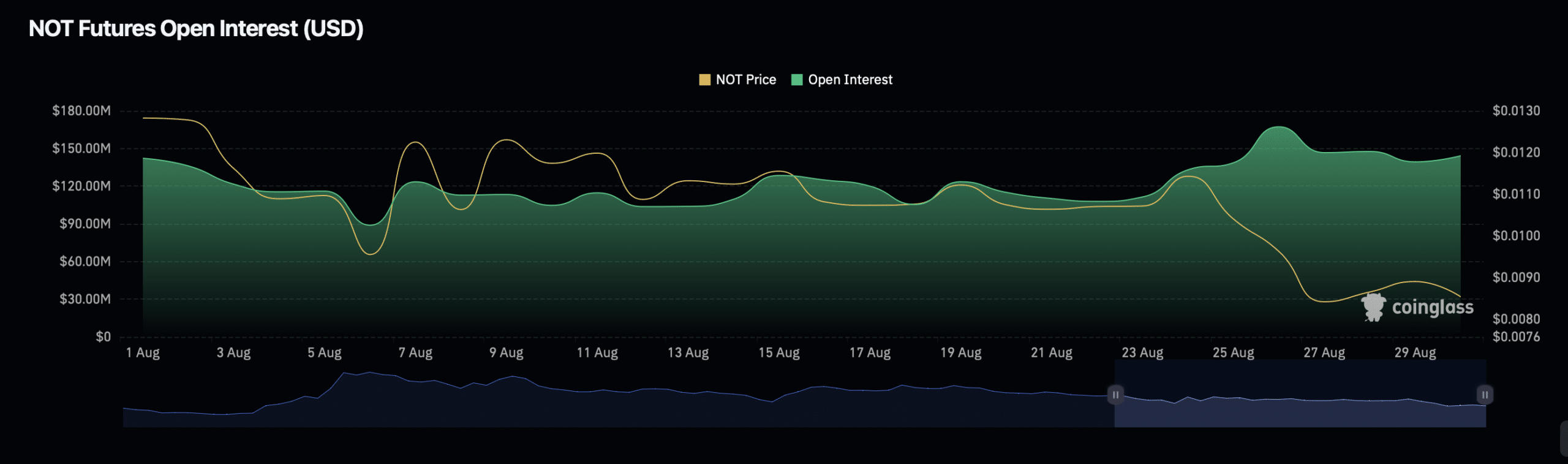

Data from Coinglass showed a slight increase of 0.53% in NOT’s Open Interest over the past day, bringing the press time valuation to $145.80 million.

However, the Open Interest volume has seen a significant dip, decreasing by 42% to $783.92 million.

Source: Coinglass

This decline in Open Interest volume could suggest waning interest or confidence among traders, which may put downward pressure on NOT’s price despite the OI’s slight increase.

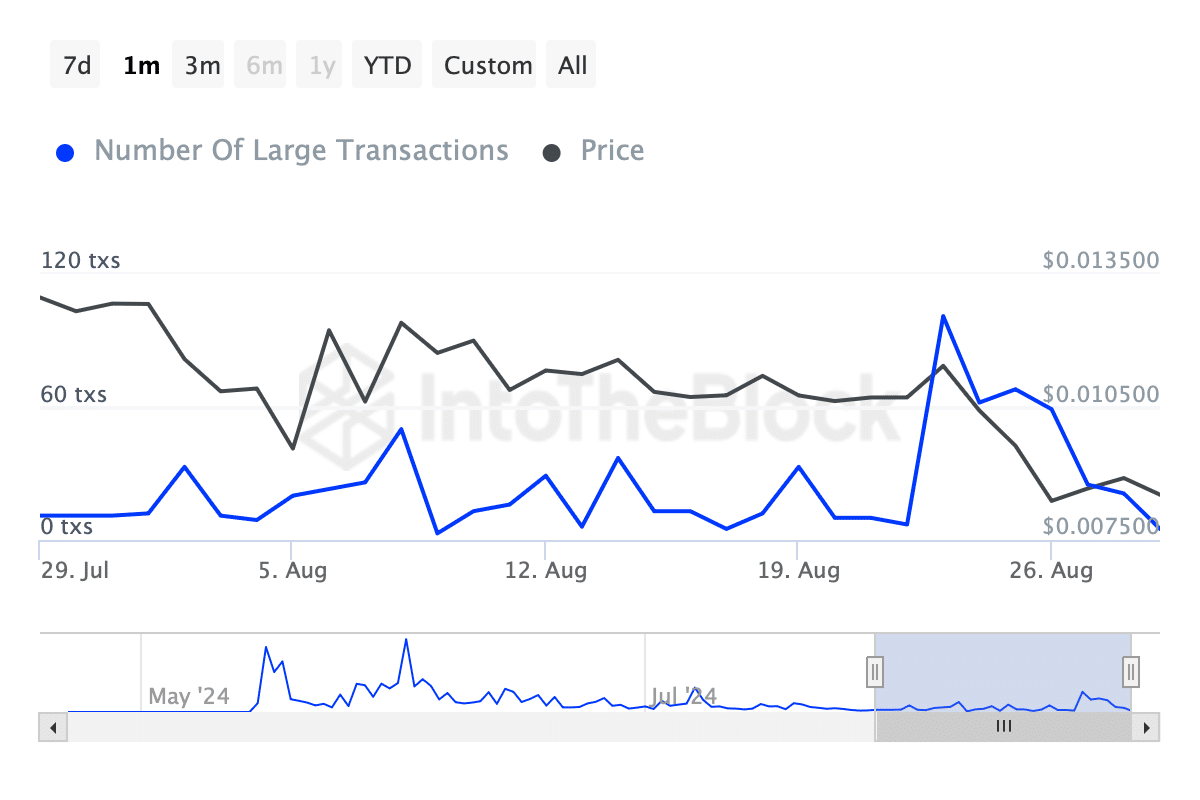

Additionally, whale activity in Notcoin had decreased significantly. According to data from IntoTheBlock, the number of whale transactions (those exceeding $100,000) dropped drastically.

Source: IntoTheBlock

Read Notcoin’s [NOT] Price Prediction 2024–2025

After peaking at 101 transactions last week, the number has now plummeted to just five transactions as of press time.

This sharp decline in large transactions could be an indication of reduced confidence among major investors, which might limit the potential for a strong rebound in the near term.

Powered by WPeMatico