- It was still a question of when, not if, ONDO prices would break past $1.

- On-chain metrics showed some profit-taking activity, but the uptrend is expected to sustain.

Ondo [ONDO] continued its uptrend but was still unable to breach the $1 resistance level. It reached an all-time high of $0.9934 on the 26th of March but has since fallen 8.8% to trade at $0.906.

The market structure was bullish and the $1 level was likely to be breached soon. A breakout past $1 could send ONDO into a price discovery frenzy.

However, as AMBCrypto reported earlier, investors need to be wary of Ondo Finance’s stagnant TVL.

Buying pressure remains steady

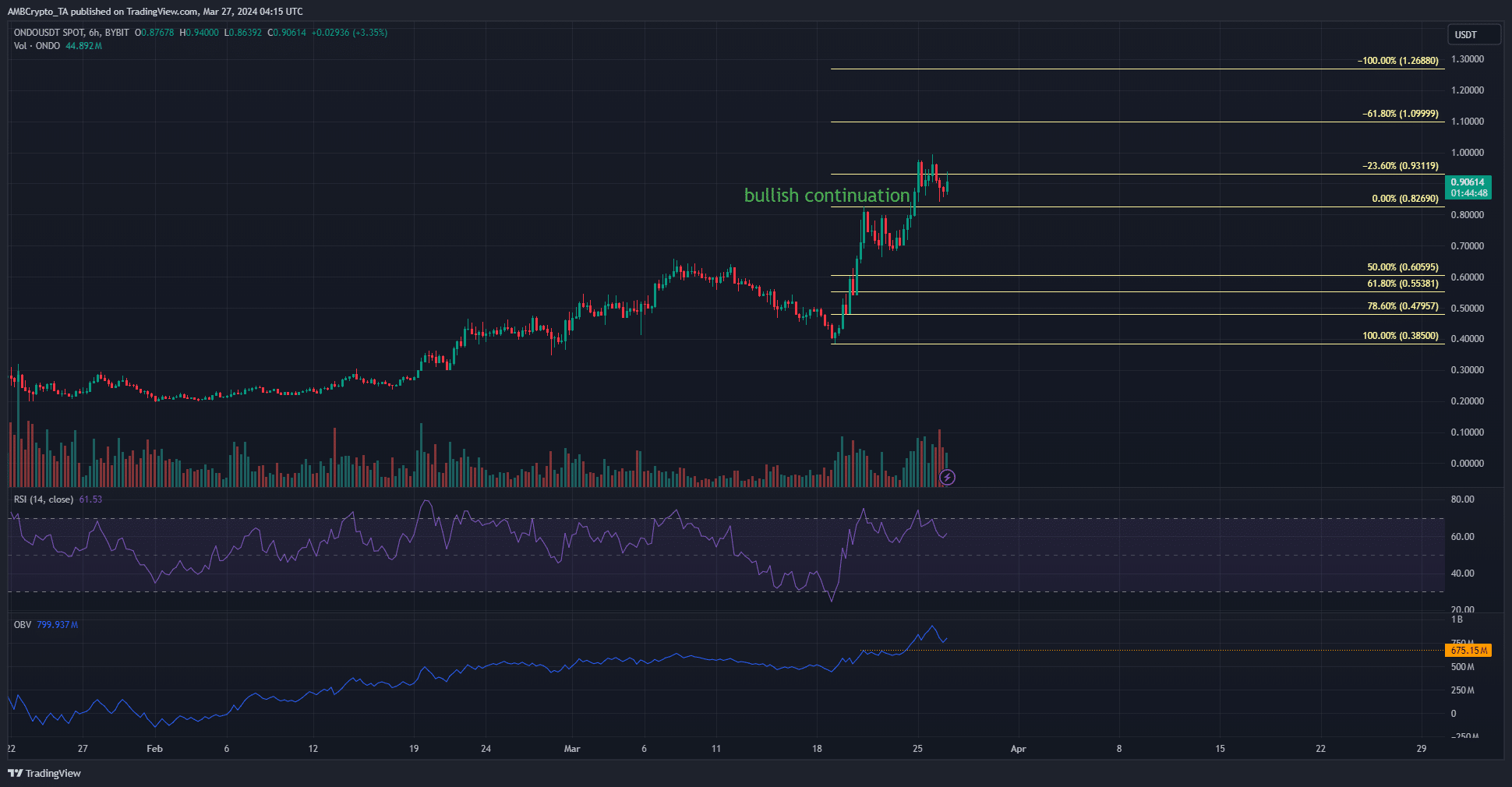

Source: ONDO/USDT on TradingView

Bullish conviction in ONDO remained firm. During the recent pullback from $0.994 to $0.84, the OBV did not reach the former resistance level.

This indicated that the selling volume did not outweigh the buying volume of the past week.

Additionally, the price managed to bounce from the $0.84 region, marking it as a support zone. The RSI was above 60 to signal strong bullish momentum.

The $1.1 and $1.27 levels were the next bullish targets, based on the Fibonacci extension levels (pale yellow).

On the other hand, a move below $0.68 would be required to flip the market structure bearishly in the 6-hour timeframe.

Sentiment is firmly in favor of the buyers

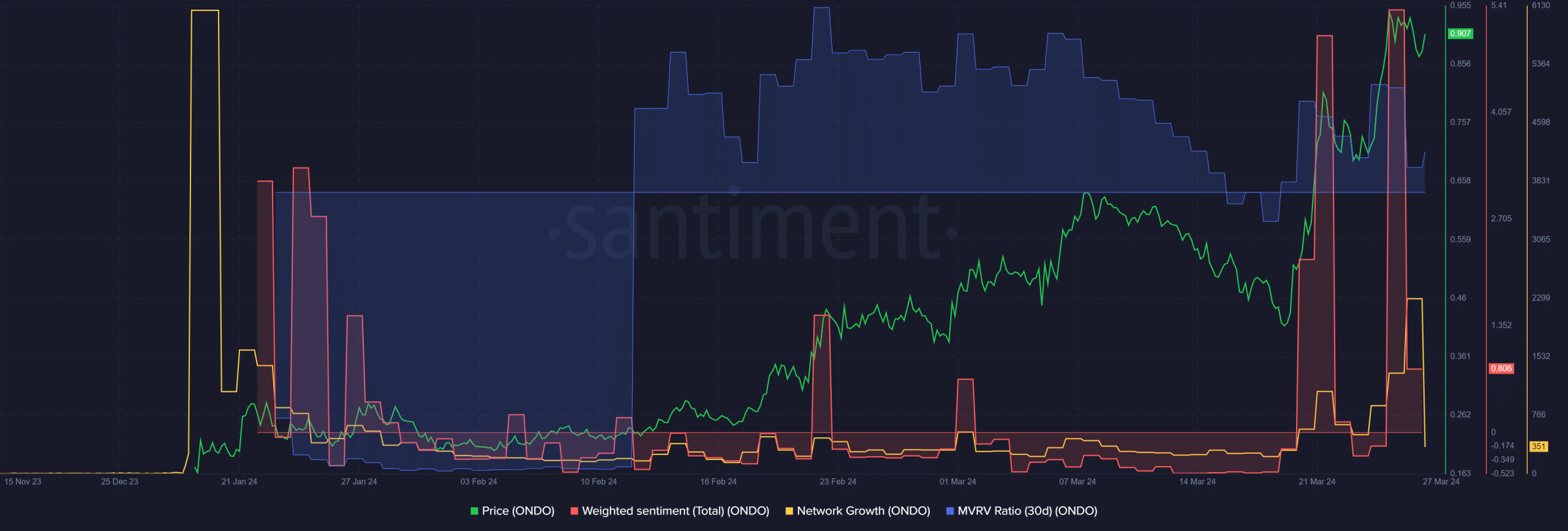

Source: Santiment

The 30-day MVRV ratio took a sharp dive ten days ago, before the start of the current impulse move. Since then the MVRV has been positive to reflect holders in profit.

Is your portfolio green? Check out the ONDO Profit Calculator

The Weighted Sentiment was also strongly bullish as prices approached ATH. Together, they highlighted the conviction of the bulls.

The past week saw an uptick in Network Growth, which was another positive development.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico