- PEPE’s futures open interest has declined by over 30% this month

- Memecoin is currently seeing very low demand

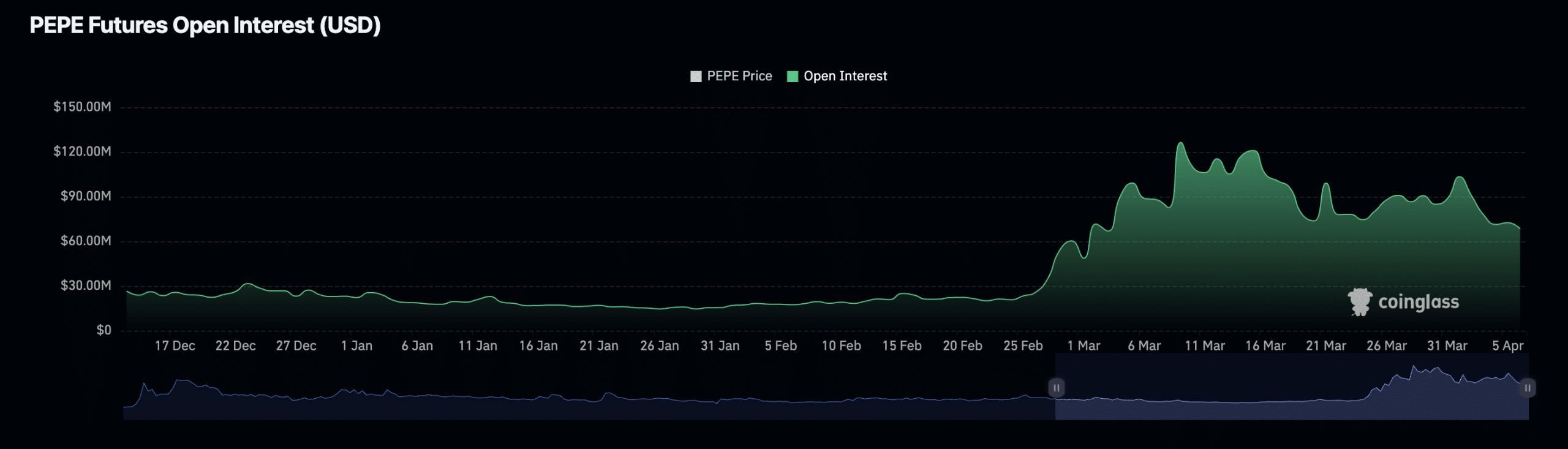

Pepe’s [PEPE] futures open interest has cratered to a 30-day low, according to Coinglass. With a reading of $68.43 million at press time, figures for the same have declined by 34% since the beginning of April.

Source: CoinGecko

An asset’s futures open interest is the total number of outstanding futures contracts or positions that have not been closed or settled. When it falls, it often signals a drop in market activity or changing sentiment among traders.

The fall in PEPE’s open interest since the beginning of the month is due to the general market’s decline. This has, in turn, affected PEPE’s price trajectory. In fact, CoinGecko’s data revealed that the global cryptocurrency market’s capitalization fell by 4% in the last seven days alone. Over this period, the values of leading assets such as Bitcoin [BTC] and Ethereum [ETH] have also plummeted by 3% and 5%, respectively.

Trading at $0.000006735 at press time, PEPE’s price has lost 16% of its value in the last week.

Is the frog losing its croak?

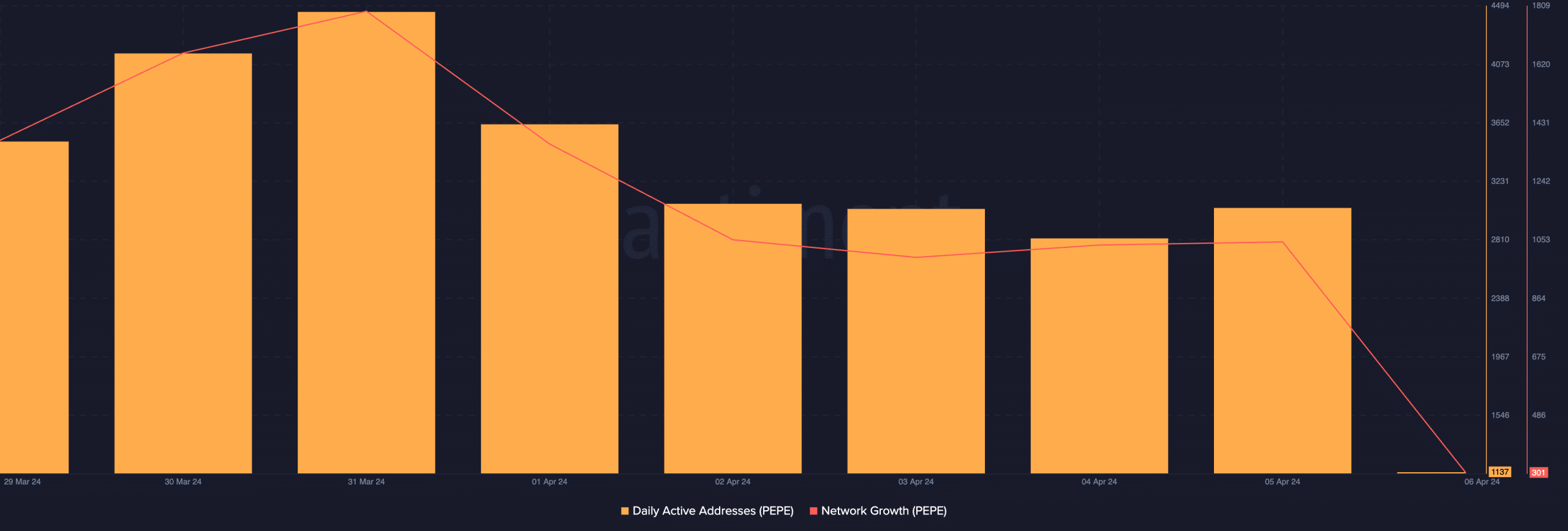

The gradual drop in the memecoin’s hype has decimated the daily decline for PEPE since April began. On-chain data revealed that the daily count of addresses involved in PEPE trades has fallen by 17% since 1 April.

Likewise, new demand for the memecoin has dwindled over the same period. Data obtained from Santiment revealed that on 5 April, the number of new addresses that were involved in PEPE transactions totaled 1047. This represented a 42% decline from the 1792 new addresses that demanded the memecoin on 31 March.

Source: Santiment

Read Pepe’s [PEPE] Price Prediction 2024-2025

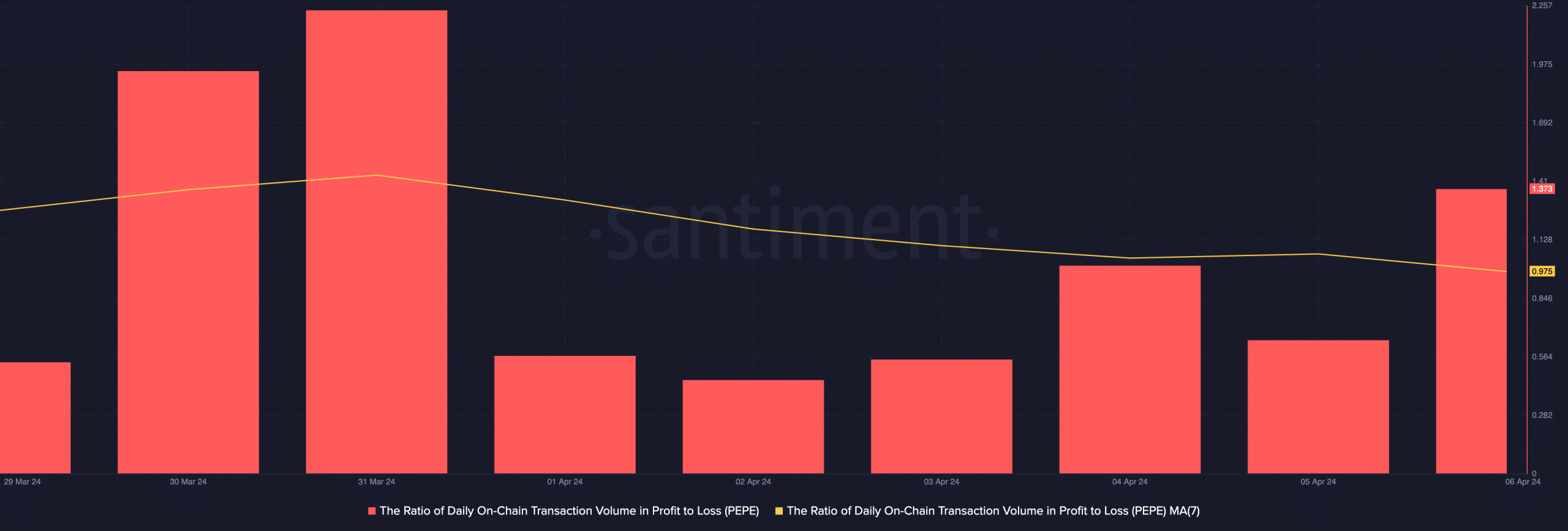

As bearish momentum climbs, the profitability of daily PEPE transactions has also fallen. AMBCrypto, using a seven-day moving average, observed the ratio of PEPE’s daily transaction volume in profit to loss and found that this has dropped consistently since 31 March.

Source: Santiment

With a ratio of 0.975 at press time, this metric suggested that for every PEPE transaction that ended in a loss, only 0.975 transactions returned a profit. This means that the volume of transactions that end in loss is higher than those that investors realized profit on.

Powered by WPeMatico