Reinforcing his role as a top pioneer in the blockchain gaming industry – hence snagging the #1 position among our most influential people in the space roundup – Pixels CEO Luke Barwikowski has released a detailed 2024 financial report of the Ronin-based social RPG.

Crunching those numbers, to get a better overview we’ve worked up the data into the following set of graphs.

At a high level, the game has seen two contrary trends during 2024.

- Its daily unique active wallet count (players) peaked in May, dropping steadily — ending 2024 at 283,000 DAUWs — as the team optimized their play-to-earn rewards strategy.

- However, the number of accounts spending PIXEL tokens in-game (paying wallets) grew steadily through 2024 — up 75% comparing February to December’s total of 109,000 DAUWs.

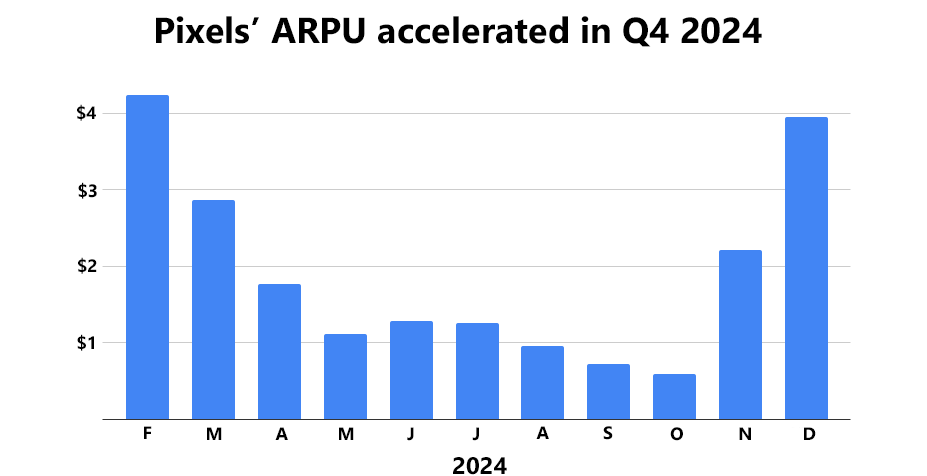

It’s also significant to see that the average spend per wallet also experienced a sharp increase in November and December thanks to new in-game features.

Meanwhile, February’s ARPU was so high because players were then spending to maximize their initial airdrop total. The PIXEL token went live in mid-February.

Another critical KPI is Pixels’ ‘return on rewards’ ratio. This is the proportion of PIXEL given out as rewards during a month compared to the amount of PIXEL spent in-game.

Pixels ended 2024 with a reward ratio of 0.5, meaning that for every 100 PIXEL given out as rewards, 50 PIXEL were spent in-game.

Again, this ratio rose steadily during the year as the team got better at optimizing rewards towards players who spent their rewards in-game, rather than extracting value from the ecosystem by selling their tokens off.

Barwikowski is hopeful he and his team can figure out what he calls “web3 fundamentals”, explaining that “The North Star is a new metric we’re pioneering: RORS – Return on Reward Spend. We believe that we can build out a play-to-earn model where rewards generate a positive return on revenue for an ecosystem.”

This is good news, as is the steady growth of monthly revenue in terms of the amount of PIXEL spent in-game. In December, it hit an all-time-high of 10 million tokens. Yet net revenue per month remains substantially negative, with December’s total being -10 million tokens, although this was an improvement from July’s nadir.

Effectively, until the game’s return on rewards ratio goes higher than 1 — i.e. until net revenue becomes positive — the Pixels Foundation is being drained of resources.

A sub-1 ratio also adds constant sell pressure to the PIXEL token, which is one of the reasons for the 76% decline in the PIXEL’s token price during 2024.

“Once RORS crosses 1 – we’ll feel as if we have made very positive progress on RORS & we’ll have opened up an entirely new model of User Acquisition to the world”, says Barwikowski.

He continues with two hopeful points. The first concerns the strong early performance of Pixel Dungeons, the first game Pixels has published which also uses the PIXEL token. Its opening playtest had a return on rewards ratio that was greater than 1, i.e. more PIXEL tokens were spent in-game than given out in rewards.

The other is the potential for big data and AI to enable the better and earlier targeting of players who spend their rewards in-game rather than selling them.

For further updates, follow Pixels on X.

Powered by WPeMatico