- Popcat has hit a new ATH.

- The price could decline if some key metrics do not pick up.

Popcat recently experienced a surge in attention within the cryptocurrency market, primarily driven by notable trends in its price. However, upon analyzing the trading volume associated with Popcat, it appears that this heightened interest may be short-lived.

Popcat’s social metrics spikes

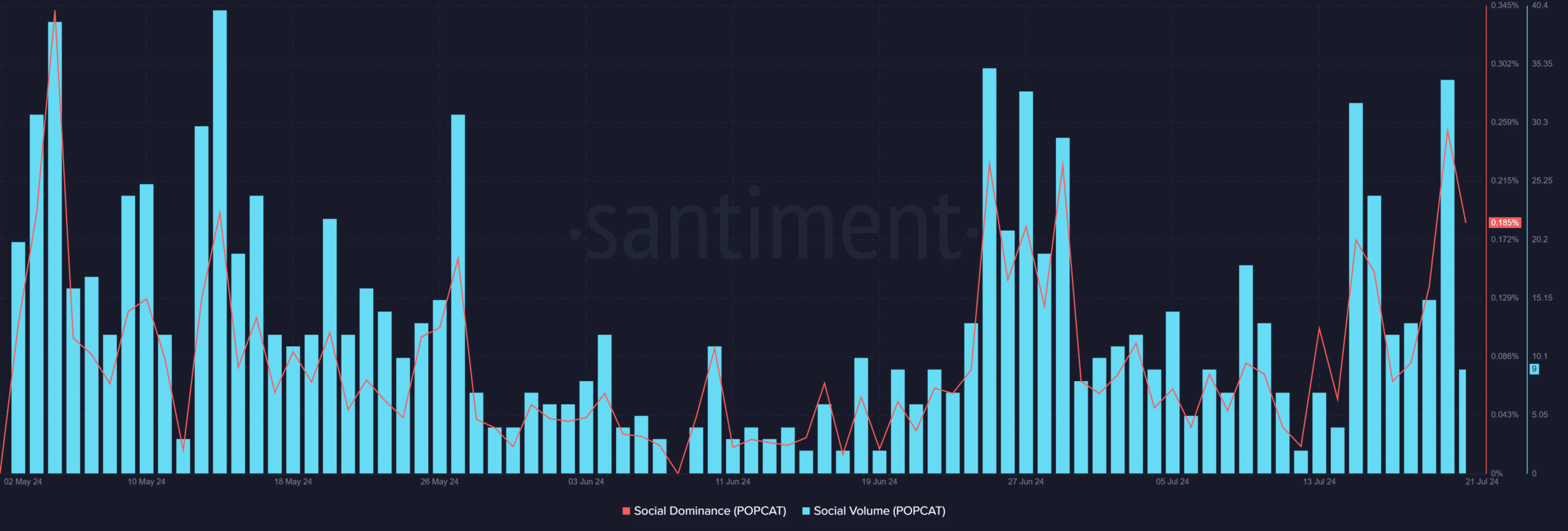

According to a recent update from Santiment, Popcat captured traders’ attention following an impressive price surge of over 100%. This spike in price coincided with a notable increase in social media attention.

Specifically, the social dominance metric, which measures the share of voice across various social platforms, jumped to over 0.25% on 20th July.

This level of social dominance was the highest recorded since May, highlighting a significant peak in market and public interest.

Source: Santiment

Additionally, Popcat’s social volume—a metric that tracks the number of mentions on social media—also saw a substantial increase, spiking to around 34 mentions on the same day.

This surge in social volume often correlates with increased speculative interest as more traders and investors discuss the asset.

However, it’s important to note that both social volume and social dominance have since declined.

Popcat sees significant pumps

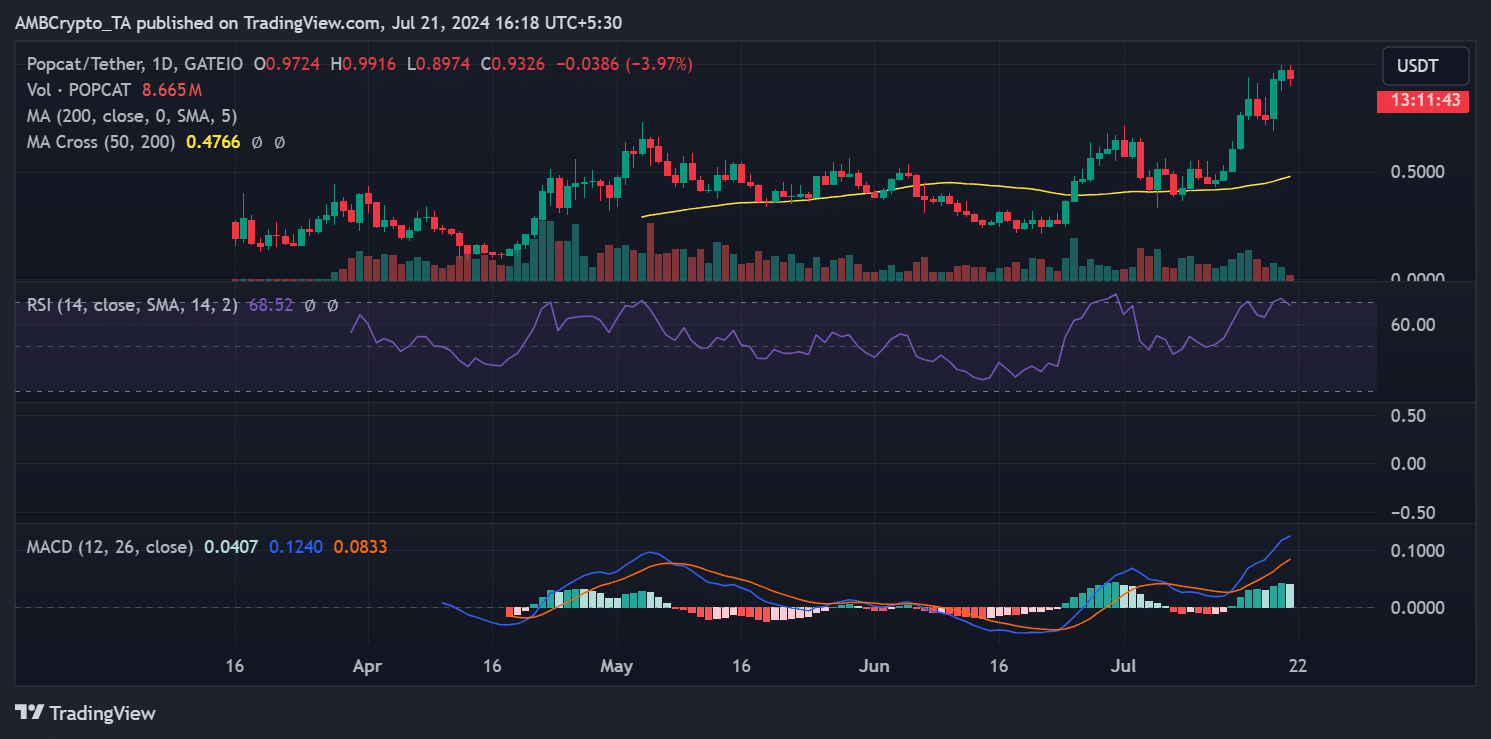

The price movement of Popcat, a Solana-based memecoin, has shown significant volatility over the past week.

It began with an impressive surge of over 20% and continued its upward trajectory with an additional 25% increase the following day. This increase pushed its price from around $0.5 to over $0.6.

Also, this momentum carried through the week, culminating in a peak of over $0.9. This not only represented a weekly increase of over 4% but also marked the all-time high for memecoin.

Source: TradingView

However, recent developments indicate a shift. As of the latest data, Popcat has experienced a decline of over 4%, yet it still hovers around the $0.9 price range.

This slight retraction in price could be attributed to normal market corrections following rapid gains.

Additionally, the current analysis of its Relative Strength Index (RSI), which stands around 70, suggests that Popcat is in the oversold territory.

Not enough volume to back up the trend

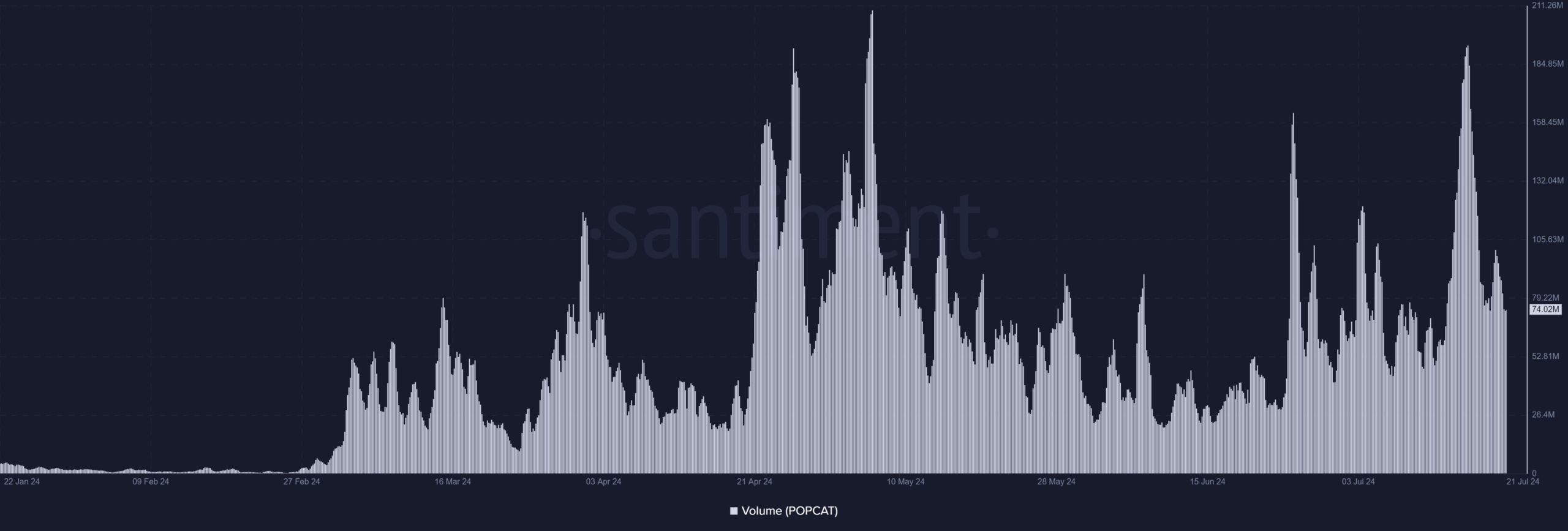

The analysis of Popcat’s trading volume on Santiment reveals some concerning trends for its recent price performance.

Despite the price of Popcat reaching an all-time high, the trading volume did not mirror this growth, indicating potential weaknesses in the price rally.

On 20th July, as trading closed, the volume was recorded at around $98 million. Earlier in the week, the volume had surged past $193 million, but this figure tapered off notably as the price peaked.

Source: Santiment

Currently, the trading volume has further decreased to approximately $74 million. This reduction in volume while the price is at its peak could be a warning signal.

Typically, a healthy price increase is supported by high or increasing trading volumes, signifying strong buyer interest and momentum.

Is your portfolio green? Check out the Popcat Profit Calculator

Conversely, if the price increases but the volume decreases, it may indicate that the upward price movement lacks enough buying pressure to sustain it, making it more susceptible to a reversal.

Given this scenario, the price of Popcat might face further declines if the trading volume does not pick up.

Powered by WPeMatico