- Shibarium’s rapid growth and 65,530% burn rate spike underscore SHIB’s increasing value potential.

- Balanced MVRV and bullish long/short ratio suggest cautious optimism for future price gains.

Shiba Inu’s [SHIB] Shibarium ecosystem has rapidly gained traction, boasting a whopping 430 million transactions and a user base of 2 million wallets.

These figures spark optimism around SHIB’s potential, especially with its recent burn rate spike of an extraordinary 65,530%. This deflationary surge aims to limit the token’s supply, potentially boosting its value over time.

At press time, SHIB trades at $0.00001702, marking a modest 0.96% increase on the day. With these elements in place, the key question arises: will Shibarium’s expansion fuel SHIB’s breakout?

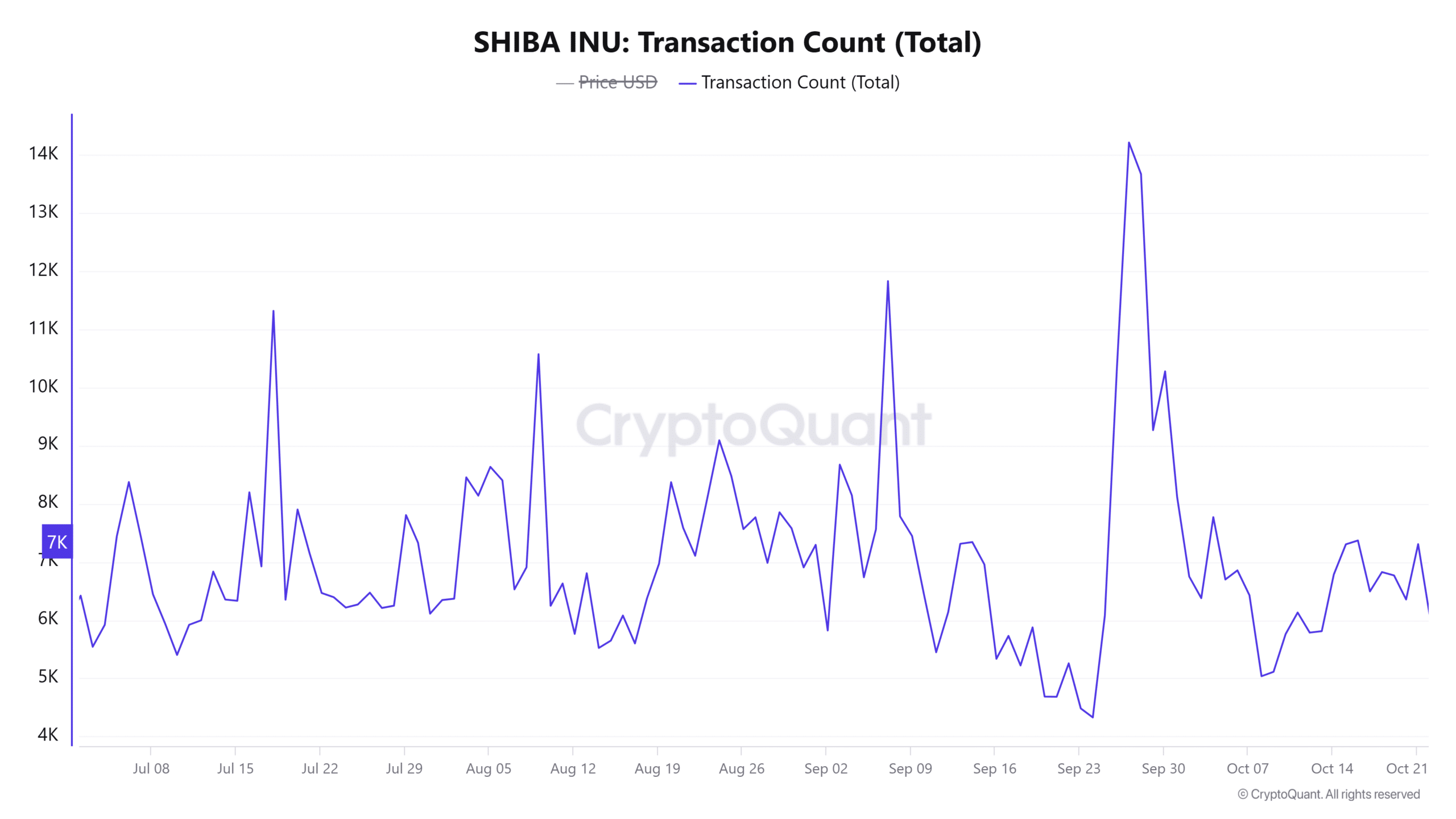

Are addresses and transaction count indicators of growth?

Daily active addresses for Shiba Inu have shown a steady increase, with a recent 0.89% rise in just 24 hours as per CryptoQuant. This consistent engagement within Shibarium indicates that interest remains strong among users.

Additionally, the transaction count has increased by 1.63%, signaling heightened activity across the network.

However, while this steady growth is encouraging, it has yet to reach explosive levels. Therefore, to attract a broader spectrum of investors, Shibarium’s ecosystem may need a sharper rise in both activity and utility to drive SHIB toward significant price gains.

Higher engagement could reflect broader adoption, possibly setting the stage for future price rallies.

Source: CryptoQuant

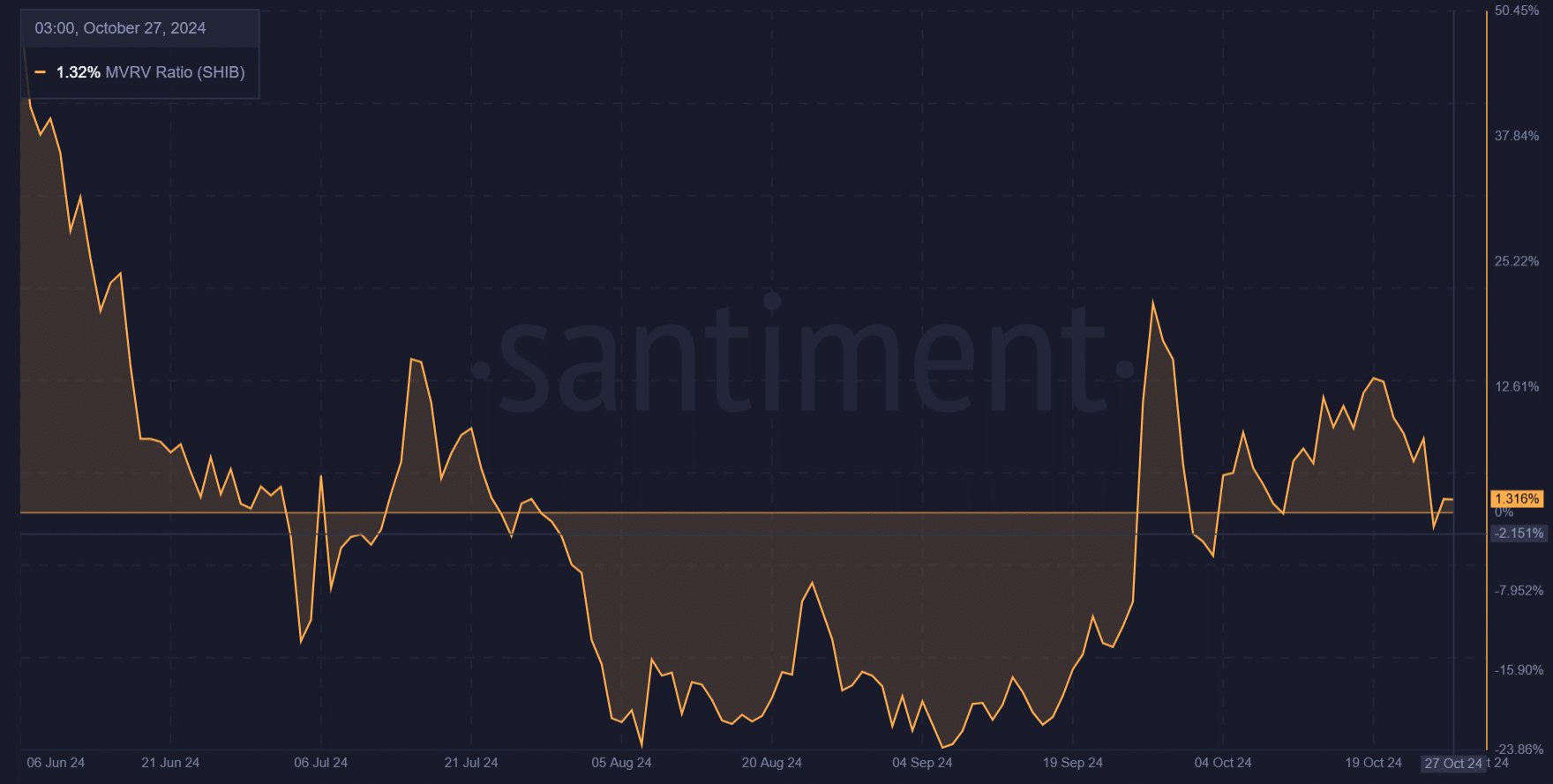

What the MVRV ratio tell us about SHIB’s value

Shiba Inu’s Market Value to Realized Value (MVRV) ratio, currently at 1.32%, indicates slight profitability for recent investors.

This modest level suggests that SHIB is not yet at a point of overvaluation, which could support ongoing accumulation without triggering a wave of profit-taking.

If the MVRV ratio rises substantially, it might signal potential overvaluation, consequently leading to increased selling pressure. Therefore, the current balanced MVRV ratio points to cautious optimism, allowing new investors to enter the market without immediate risk of a sell-off.

Source: Santiment

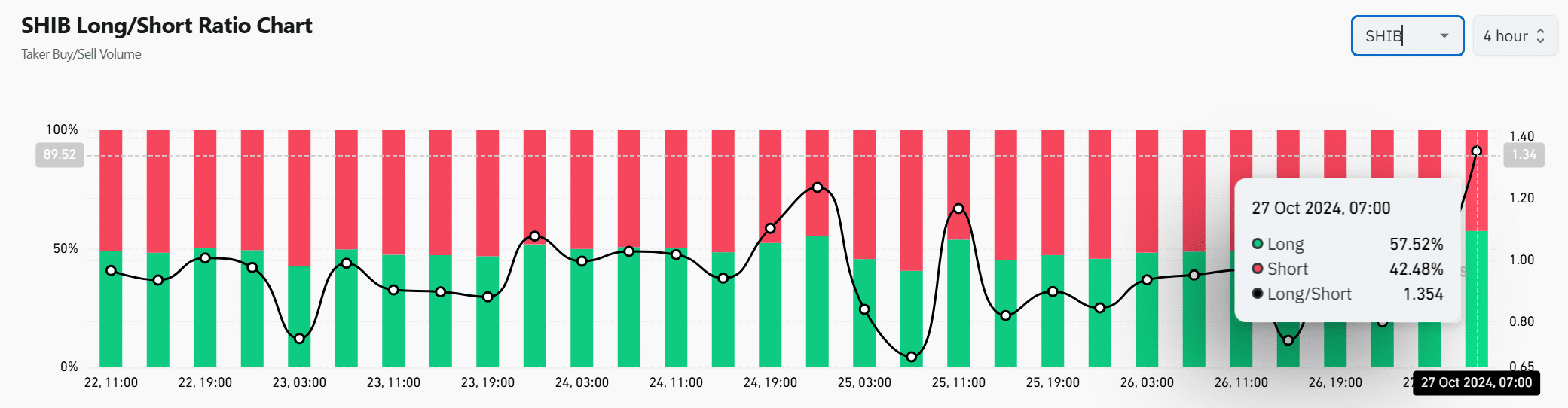

Does the long/short ratio reveal bullish sentiment?

We then examinined SHIB’s long/short ratio and found that 57.52% of positions are long, while 42.48% are short. This distribution leans bullish, with most traders expecting a rise in SHIB’s price.

Nonetheless, the substantial percentage of shorts suggests some caution, as a shift in sentiment could trigger selling.

This long/short ratio reflects an overall optimistic yet cautious outlook, with traders betting on SHIB’s potential while remaining vigilant for potential volatility.

Source: Coinglass

Read Shiba Inu [SHIB] Price Prediction 2024-2025

Odds of a SHIB rally

Shibarium’s growth, coupled with SHIB’s soaring burn rate, creates a foundation for potential price appreciation. While daily active addresses and transactions show steady engagement, these levels may need to accelerate to ignite a substantial rally.

The balanced MVRV ratio and slightly bullish long/short sentiment provide encouraging signals. Therefore, Shiba Inu’s ecosystem seems well-positioned for growth, but the next wave of activity could be crucial for a definitive breakout.

Powered by WPeMatico