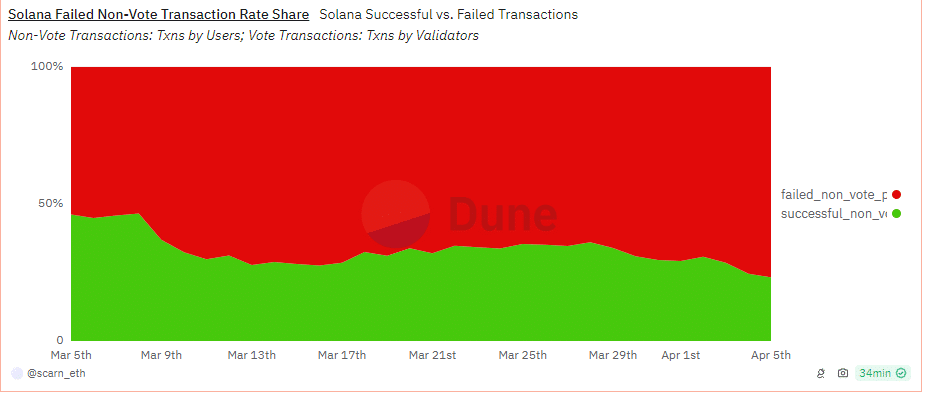

- The failure rate increased sharply over the last week.

- Solana proponents blamed bot spamming for the high transaction failure rate.

The ongoing upsurge in network traffic might have started to cause problems for Solana [SOL].

Solana sees rise in unsuccessful transactions

According to AMBCrypto’s analysis of a Dune dashboard, more than 75% of all non-vote transactions on the chain failed on the 4th of April, the highest ever. The failure rate increased sharply in the last week.

For the curious, non-vote transactions refer to the transfer of SOL between different Solana accounts or smart contracts, and is an indicator of the network’s demand and usage.

Source: Dune

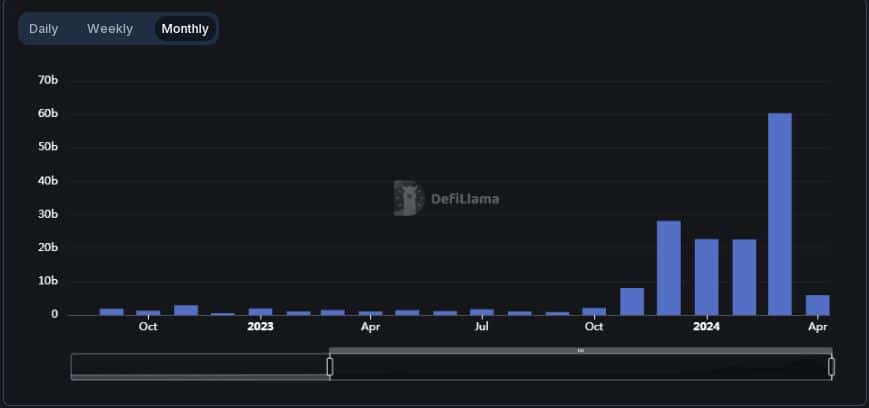

Solana has been experiencing high network utilization lately, primarily driven by the mad rush for memecoins. The frenzy has attracted crypto degens in hordes, causing a steep spike in trading volumes on the network’s decentralized exchanges (DEXes).

Solana-based DEXes did handle trades worth more than $60 billion in March, its all-time high (ATH) by a significant margin, as per AMBCrypto’s scrutiny of DeFiLlama’s.

Source: DeFiLlama

These high volumes were initially assumed to be the primary catalyst causing transaction failures on the network. But were they?

A case of bot spams?

Mert Mumtaz, CEO of Solana-based developer platform Helius, dismissed the issue at hand, saying most of the failed transactions was due to bots spamming the network.

“About 95% of that entire chart is just bots failing arbitrage attempts,” Mumtaz argued. He added that the chart was not a reliable indicator of network activity because most users would be made aware of the likelihood of the transaction failing and would drop out.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Mumtaz said that the upcoming 1.18 release, intending to improve Solana network’s performance, might not be able to fix the spamming issue. Network patches might be the solution, he claimed.

Meanwhile the FUD generated on this development caused a 4% slide in SOL’s price in the 24-hour period, data from CoinMarketCap showed. The fifth-largest cryptocurrency was down 5.46% on a weekly timeframe as of this writing.

Powered by WPeMatico