- Solana continued its downtrend to reach its four-month-long support range.

- The altcoin’s Open Interest showed signs of a likely reversal.

After a promising Q1 performance this year, Solana [SOL] saw a rather sluggish trajectory over the past few months.

SOL lost nearly 30% of its value over the past month after reversing from the $186 resistance level. Technical indicators pointed to highly oversold conditions at press time and showed signs of a trend reversal.

The coin’s Open Interest trends increased over the past month while chalking out a bullish divergence with its price action. At the time of writing, SOL was trading at $134.3, down nearly 7% over the past week.

Can Solana bulls trigger an uptrend?

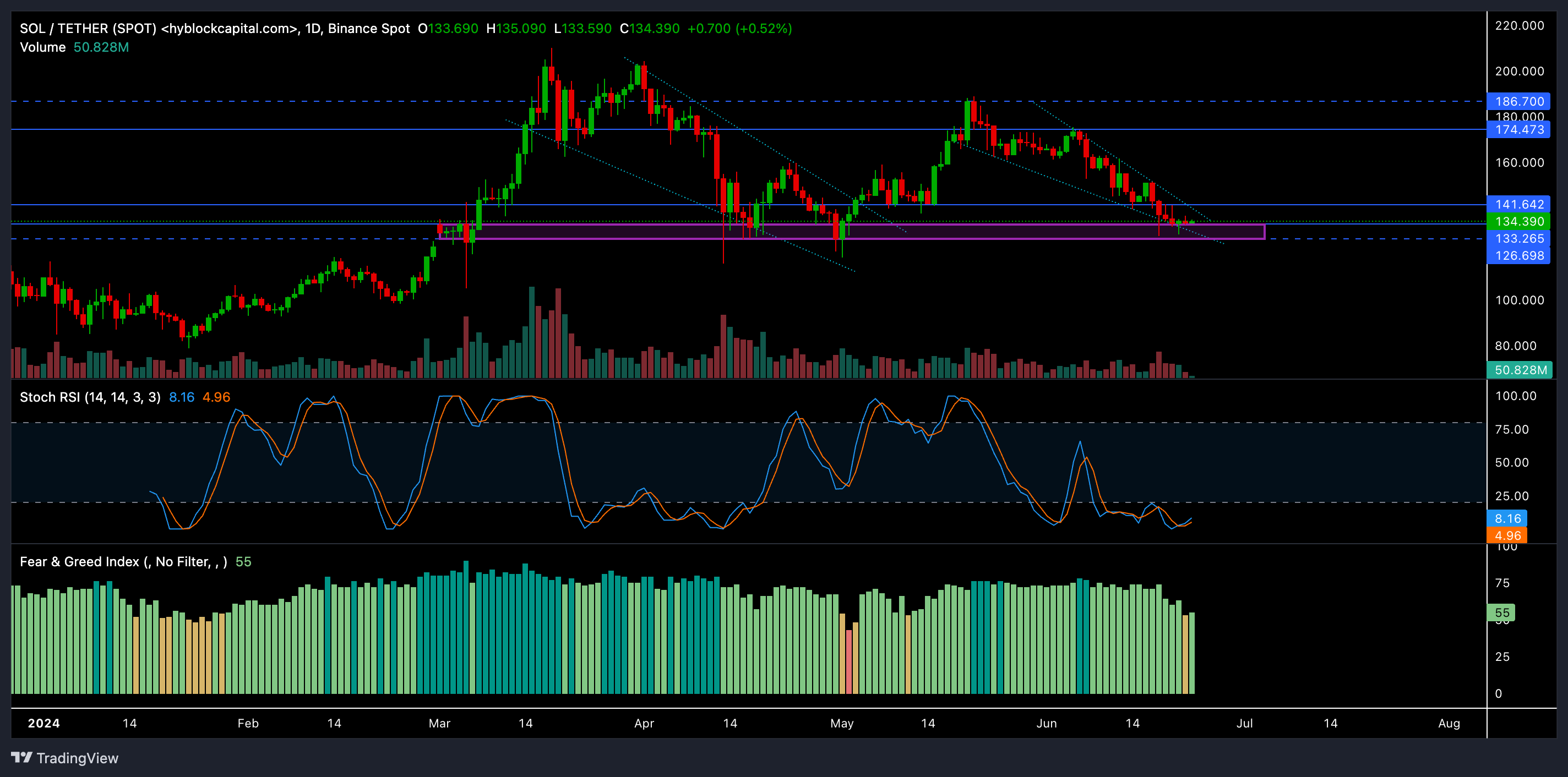

Source: SOL/USDT, Hyblockcapital

SOL’s reversal from the $186 resistance reaffirmed the bearish pressure last month as the coin continued its downtrend and tested the $133 support level at the time of writing.

Here, it’s worth noting that SOL held the $126-$133 support range for nearly four months. So, a likely reversal from this range again seems plausible.

In the meantime, the coin’s recent downtrend chalked out a classic falling wedge pattern on the daily chart.

While the bulls tried to break the streak of red candles, they should now hold the $126-$133 support range to prevent a major downward price breakout.

If the bulls can defend this support range, SOL could gather firepower to retest the $174 resistance in the coming days.

SOL saw a breakout after a similar falling wedge breakout that occurred last month and clocked in a 30% gain to test the $186 resistance. Any close above the $141 resistance can confirm the chances of a breakout rally.

The stochastic RSI showed a highly oversold position and confirmed a bearish edge at the time of writing. However, it also confirmed the chances of a likely reversal as it saw a bullish crossover at press time.

The Crypto Fear And Greed Index was still in the ‘greed’ zone, indicating that an uptrend could still be on the cards.

However, buyers must keep an eye on trading volumes as the coin aims to break out of its current pattern. The altcoin’s inability to back up green candles with enough volumes can cause a rather short-lived breakout.

Open Interest remains stable despite price drop

Is your portfolio green? Check out the SOL Profit Calculator

Open Interest (OI) levels on Binance [BNB] remained stable during a steep price decline. This indicated that despite falling prices, there still is high interest in maintaining positions as traders are possibly anticipating a turnaround.

Please note that OI levels remaining stable in isolation is not a bullish signal. But it can confirm the potential for a reversal when complemented with technical indicators and overall sentiment analysis.

Powered by WPeMatico