- Over 90% of stablecoin volumes are linked to bots and large traders.

- The findings suggest that stablecoin payments haven’t hit mainstream adoption yet.

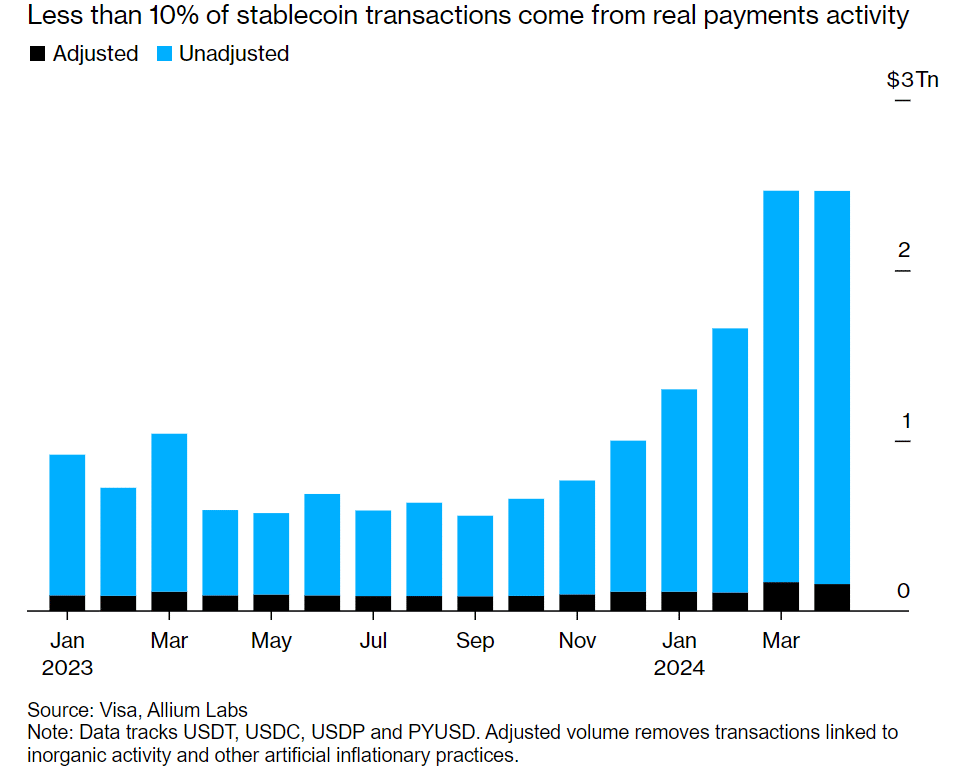

Only less than 10% of the April stablecoin transaction volume was linked to genuine users.

According to a Bloomberg report, which cited Visa Inc.’s latest findings, over 90% of volume was linked to bots and large-scale traders.

Part of the report highlighted that,

“Out of about $2.2 trillion in total transactions in April, just $149 billion originated from organic payments activity”

Source: Bloomberg

Compared to the $150 trillion payments industry, the report suggested that stablecoins were far from hitting mainstream adoption as a payment option.

Stablecoin have a long way to hit mainstream adoption

Paypal and Stripe are some traditional payment ecosystem players that have entered into the stablecoins space.

Visa, a major traditional player, handled $12 trillion in transactions last year alone. Most market watchers view the global mainstream adoption of stablecoin payments as a direct threat to Visa’s business.

However, some market watchers believe that the market is in its early stages and mainstream adoption could occur in the long run, but in the short or midterm, attention should be on the payment rails.

One analyst, Pranav Sood, general manager at the payment platform Airwallex, commented,

“The short-term and the mid-term focus needs to be on making sure that existing rails work much better.”

In the meantime, the stablecoin market surged further amidst market improvement from massive drawdowns in March and April.

Its market cap hit $160B, with DAI dominating notable growth from blue-chip stablecoins.

On the monthly front, Ethena’s USDe and First Digital’s FDUSD registered double-digit growth, DeFiLlama data showed. DAI, USDT, and USDC followed closely with single-digit growth in that order.

A surge in stablecoin holdings, especially by whales, could mean large players positioning for discounted offers, inducing the markets.

At press time, Bitcoin [BTC] was back in its $60K—$71K range, and a further uptick in stablecoins could drive extra market upside.

Powered by WPeMatico