- BTC hit a two-week high above $65K after Trump attack.

- The macro and US political scenes look great for BTC, despite Mt. Gox’s supply.

Bitcoin [BTC] was up 7% on a weekly basis and traded above $65K, boosted in part by the crypto market and updates from the US political scene.

Last week, the German government cleared its $50K BTC supply pressure, which was a set-up for BTC’s recovery. After bottoming out below $55K, BTC recovered and reclaimed $60K, rallying 8.8% last week.

Trump boosts Bitcoin recovery?

The recovery extended into the current week, pushing the largest digital asset above $65K. This week’s bullish momentum coincided with the failed assassination attempt on Donald Trump on 13th July.

Additionally, the crypto market has viewed Trump’s Vice President (VP) pick, Ohio Senator James David Vance, favorably as pro-crypto. JD Vance reportedly supported several crypto legislations, including the SAB 121 repeal, and owns BTC.

Reacting to Trump’s VP pick, Ryan Adams of Bankless stated,

‘JD Vance is Trump’s VP pick and the likely next Vice President. He strongly supports crypto. He voted for SAB121 repeal. He’s a holder – owned $250k Bitcoin in 2022 – likely more now. He’s slammed Gensler in open letters. Further evidence that Trump white house is pro-crypto.’

Interestingly, Trump’s VP pick on 15th July also coincided with a 6% rally for BTC, accounting for the largest daily gains this week.

Can BTC push above $67K

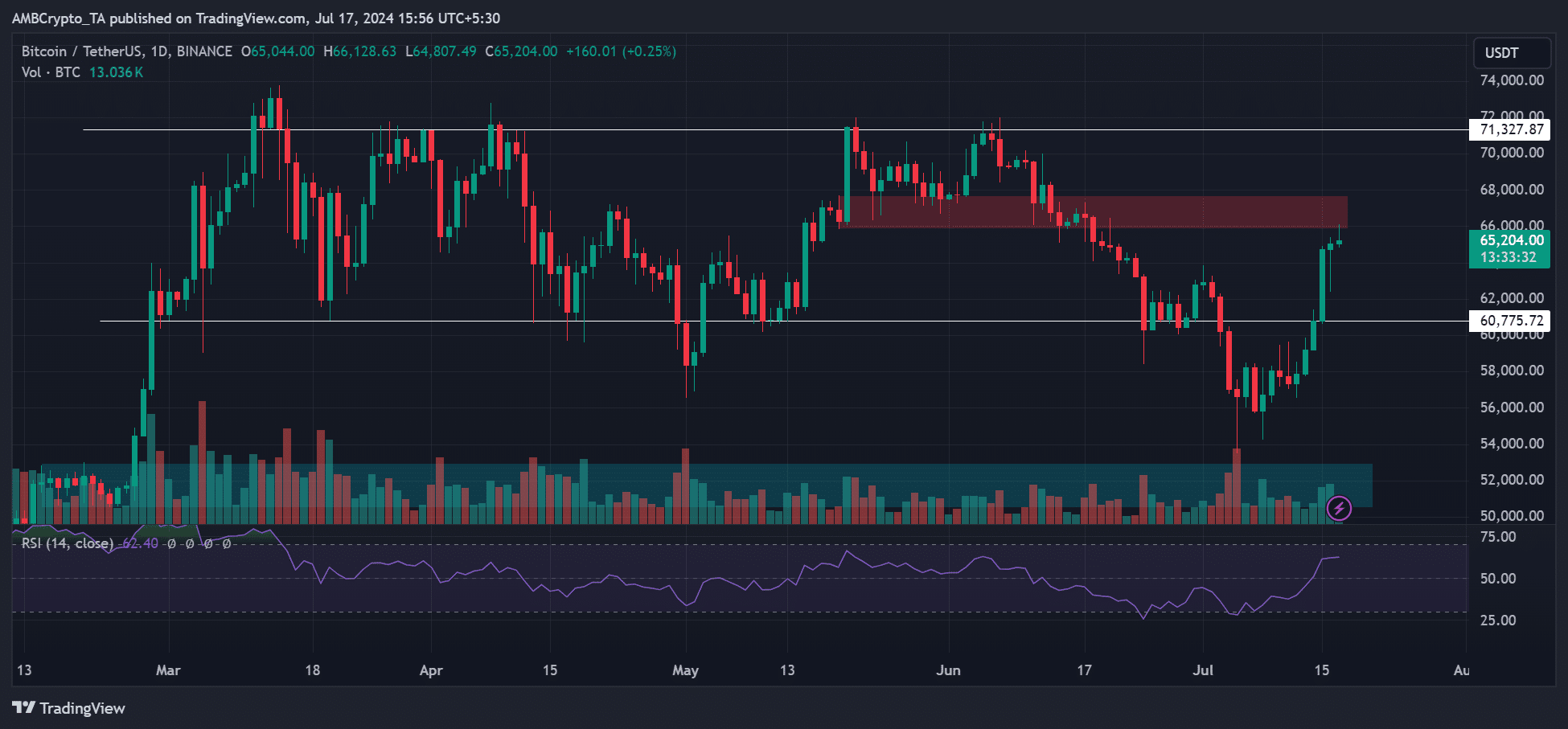

Source: BTC/USDT

However, the recovery has hit an obstacle and breaker block, marked red, near $67K. The asset could see the $70K level despite this short-term hurdle, per BTC price chart analyst Cryp Nuevo. The analyst projected that BTC could eye range-highs above $70K.

According to some market analysts, even the ongoing Mt. Gox repayment, with over 30% of BTC on the move, might not affect the recovery. As of press time, BTC held above $65K despite the massive move by Mt. Gox.

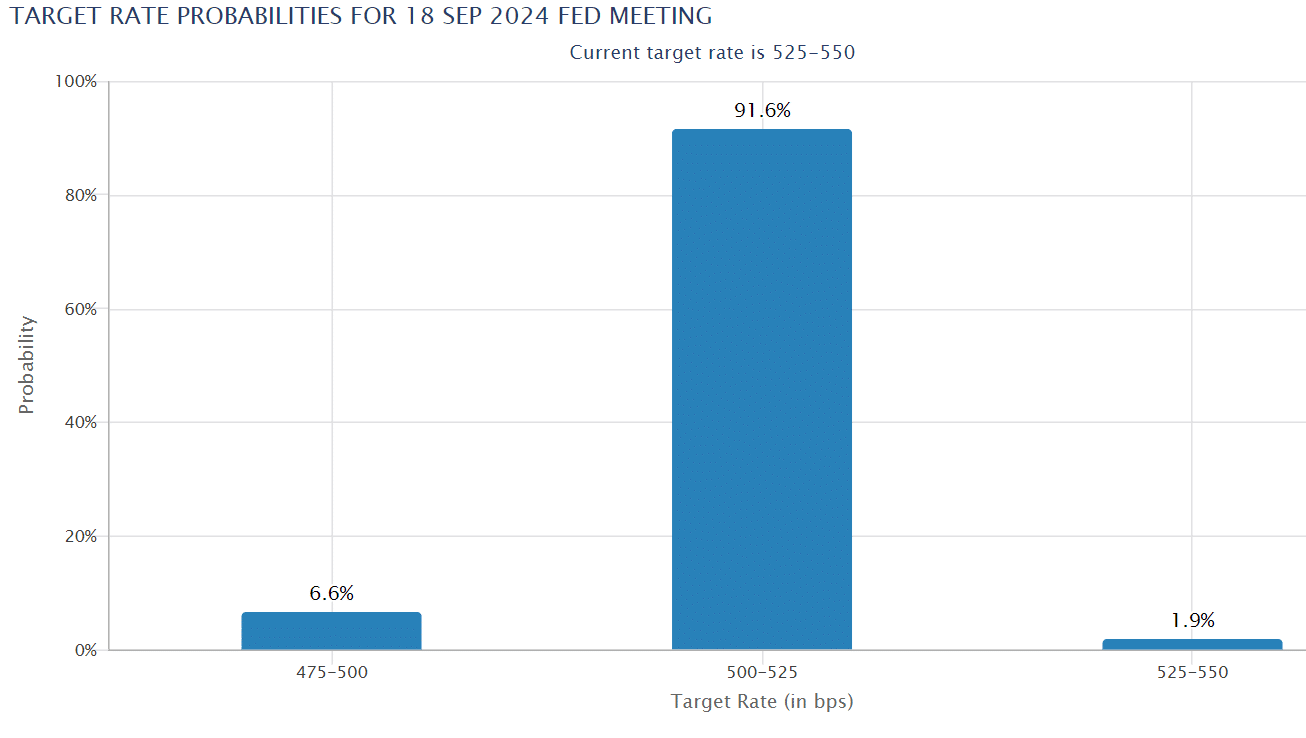

Meanwhile, the long-term outlook remains bullish, especially from a macro perspective. Over 90% of interest rate traders expect Fed rate cuts in September, which could fuel risk assets, including BTC and crypto markets.

Source: CME Fed Watch Tool

Powered by WPeMatico