- Whales started profit-taking over concerns of steeper drops ahead.

- UNI’s technical indicators flashed strong bearish signals.

A whale was spotted sending a massive stash of Uniswap [UNI] holdings to crypto exchanges, presumably to make profits.

Whales offload UNI bags for gains

According to on-chain data, the investor transferred 1.36 million UNI tokens, worth more than $15 million at prevailing market prices, to Binance in the last 48 hours.

Notably, the whale purchased 1.53 million when UNI’s price was $6.45. As of this writing, the wallet has been drained off all UNI holdings, suggesting potential profits worth $6.5 million on the total investments.

UNI’s fortunes shift sharply

The sell-off followed a disappointing month for the governance token of the world’s largest decentralized crypto exchange (DEX). UNI plummeted 11.56% in the last seven days, and more than 10% over the month, according to CoinMarketCap.

The slump erased roughly half of the gains recorded in late February and early March.

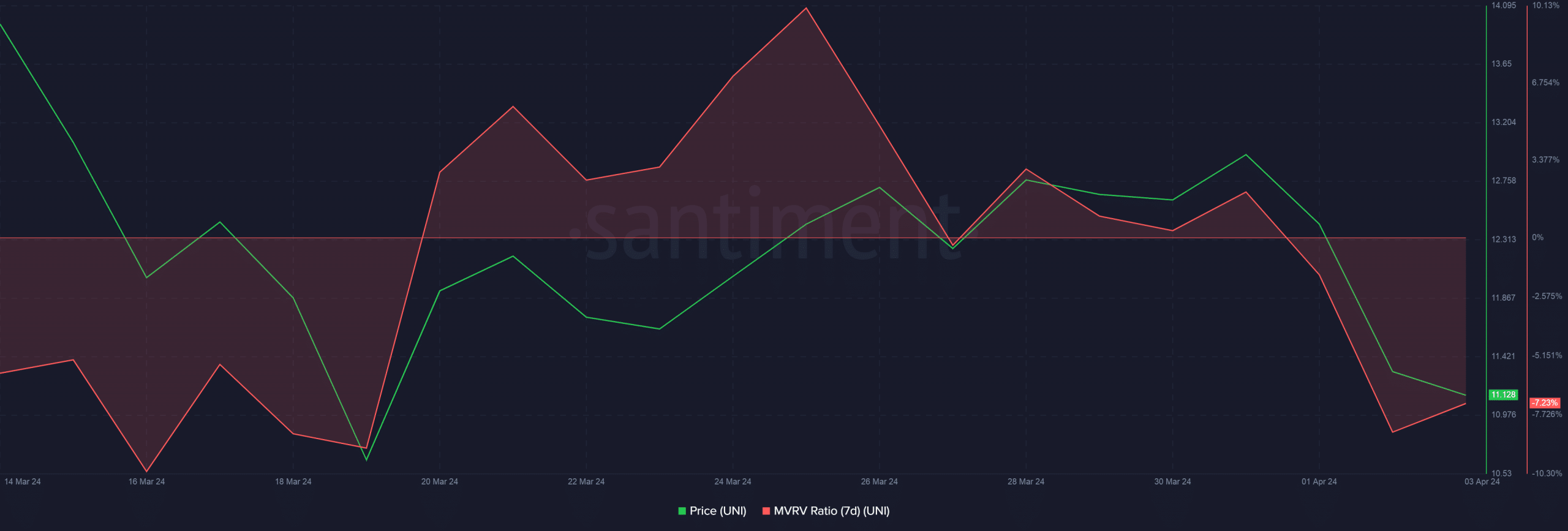

As per AMBCrypto’s analysis of Santiment data, the unrealized losses of UNI holders increased sharply in the past week. If all coins were sold, traders would be realizing losses of 7.63% on average.

Source: Santiment

The pessimism was also reflected in the way whales were positioned in the futures market. As per AMBCrypto’s analysis of Hyblock Capital’s data, the total number of long positions taken by whales on Binance dropped from 75% in mid-March to 69% as of this writing.

This implied that either whales were reducing their long exposure or increasing their short exposure.

Source: Hyblock Capital

UNI in for more trouble?

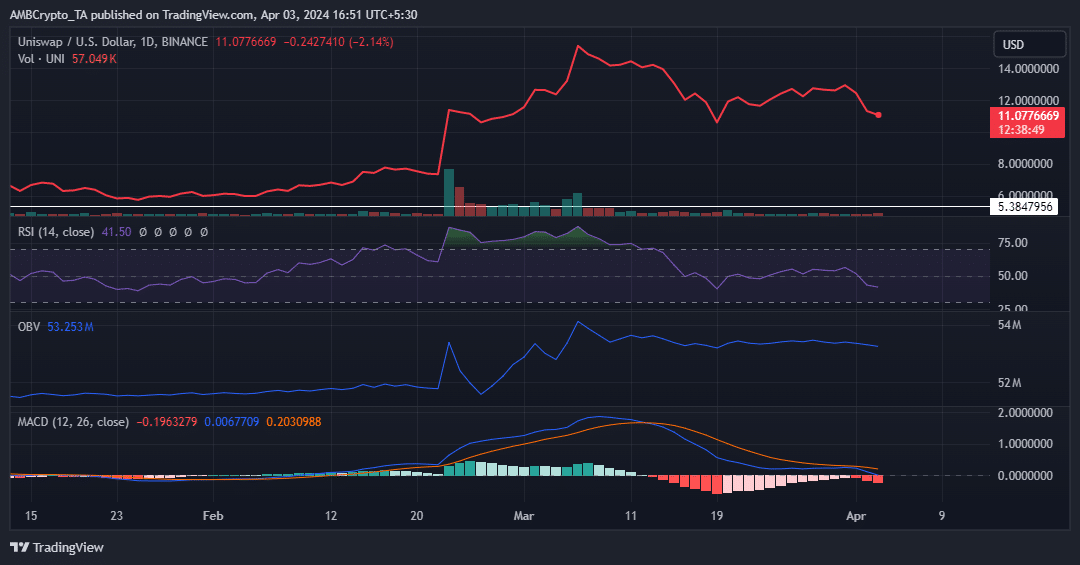

AMBCrypto examined some of UNI’s key technical indicators to better understand its next potential moves on the charts.The Relative Strength Index (RSI) was hovering around 40. A dip below this level could pave way for further downsides in the days to come.

Realistic or not, here’s UNI’s market cap in BTC’s terms

The On Balance Volume (OBV) largely mirrored the price trend, implying that downtrend could likely continue.

The Moving Average Convergence Divergence (MACD) crossed below the signal line, and seemed likely to dip below zero, a strong bearish signal.

Source: Trading View

Powered by WPeMatico