- A leverage flush down to $60,000 might trigger an elongated bearish phase.

- The NVT Ratio indicated that Bitcoin was overvalued, but could rally much later.

On-chain analyst Will Woo has commented on Bitcoin’s [BTC] price action, noting that a move back to the bear market is possible.

On X (formerly Twitter), Woo noted that Bitcoin had a Short-Term Holder (STH) support at $58,900. He also opined that a decline in this price could invalidate almost every thesis about a potential bull market.

The risk has not left

Apart from the STH support, the analyst also highlighted that the Cumulative Volume Delta (CVD) had peaked.

The CVD measures the net difference between the buying and selling pressure of an asset within a mid to long-term timeframe.

If the CVD had peaked as Woo mentioned, then a decrease in BTC’s price could be next. The analyst agreed with the forecast and noted that,

“Longer term: still weeks away from a proper bullish environment.”

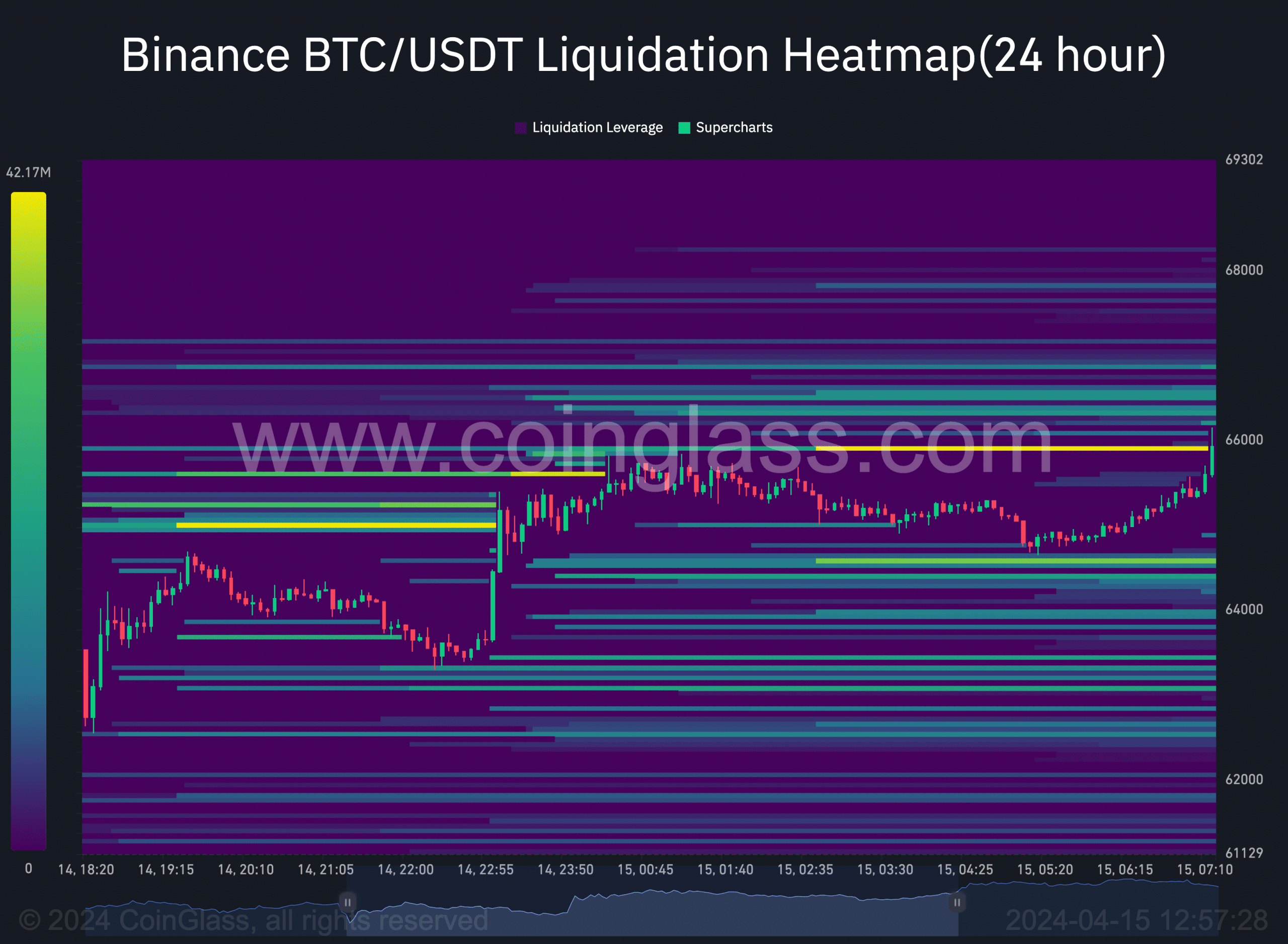

AMBCrypto evaluated the analyst’s prediction by looking at the liquidation heatmap. This heatmap predicts where large-scale liquidations can occur.

As such, traders can identify areas of high liquidity, resistance, and support zones. A high concentration of liquidity is called a magnetic zone.

At this point, the liquidity heatmap highlights a color change, suggesting that the price might move toward the point.

At press time, the metric showed that Bitcoin might move toward $66,638. Here, $7.18 million worth of contracts might be liquidated.

However, if BTC drops, the next area of interest would be $64,580. At this point, open positions worth $29.17 million could be wiped out on Binance alone.

Source: Coinglass

In a nutshell, Bitcoin needs to flush out long leverage positions down to $60,000 to confirm this bear phase. If this does not happen, the price of the coin might rise between $72,000 and $75,000.

Stay calm, BTC’s decline is not end

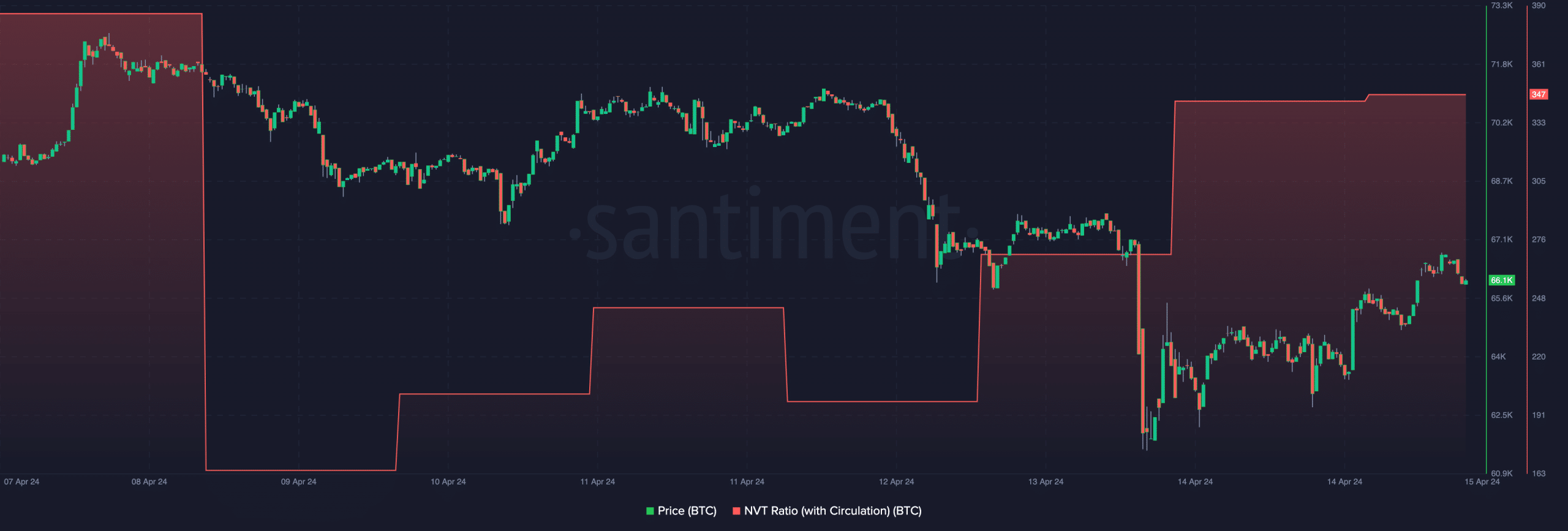

Though BTC flashed bullish tendencies, the Network Value to Transactions (NVT) ratio showed that the analyst might have a point.

For context, the NVT ratio indicates whether a cryptocurrency is overvalued or not. If the metric spikes, it means that the cryptocurrency might be overvalued relative to the transactions.

However, a low NVT ratio means the network is undervalued, and prices can move higher in the short term.

As of this writing, Bitcoin’s NVT ratio moved higher, suggesting that the price could be overvalued for the current market condition.

Source: Santiment

Should the reading remain high over the coming days, Bitcoin’s price might undergo another correction. However, Woo shared his long-term Bitcoin forecast hours after his initial post.

Is your portfolio green? Check out the BTC Profit Calculator

According to him, the coin might hit $91k this cycle and $650k in the years to come. He concluded,

“The new Bitcoin ETFs bring price targets of $91k at the bear market bottom and $650k at the bull market top once ETF investors have fully deployed according to asset manager recommendations. These are very conservative numbers. Bitcoin will beat gold cap when ETFs have completed their role.”

Powered by WPeMatico