- Bitcoin’s price recovery is linked to reduced sell-side pressure from major stakeholders.

- Increased ETF inflows and institutional demand are supporting Bitcoin’s current price stability.

Following a period of significant downturn, Bitcoin [BTC] now appears to have seen a noticeable rebound in price after reclaiming the $65,000 price mark earlier today.

Currently BTC trades at $65,448, up 4.4% in the past 24 hours. It is worth noting that the asset had earlier today traded as high as $66,059.

According to insights from the on-chain data provider Glassnode, this surge might be the result of a “near-term sell-side relief,” suggesting a temporary easing in selling pressures that have heavily influenced Bitcoin’s price trajectory in recent weeks.

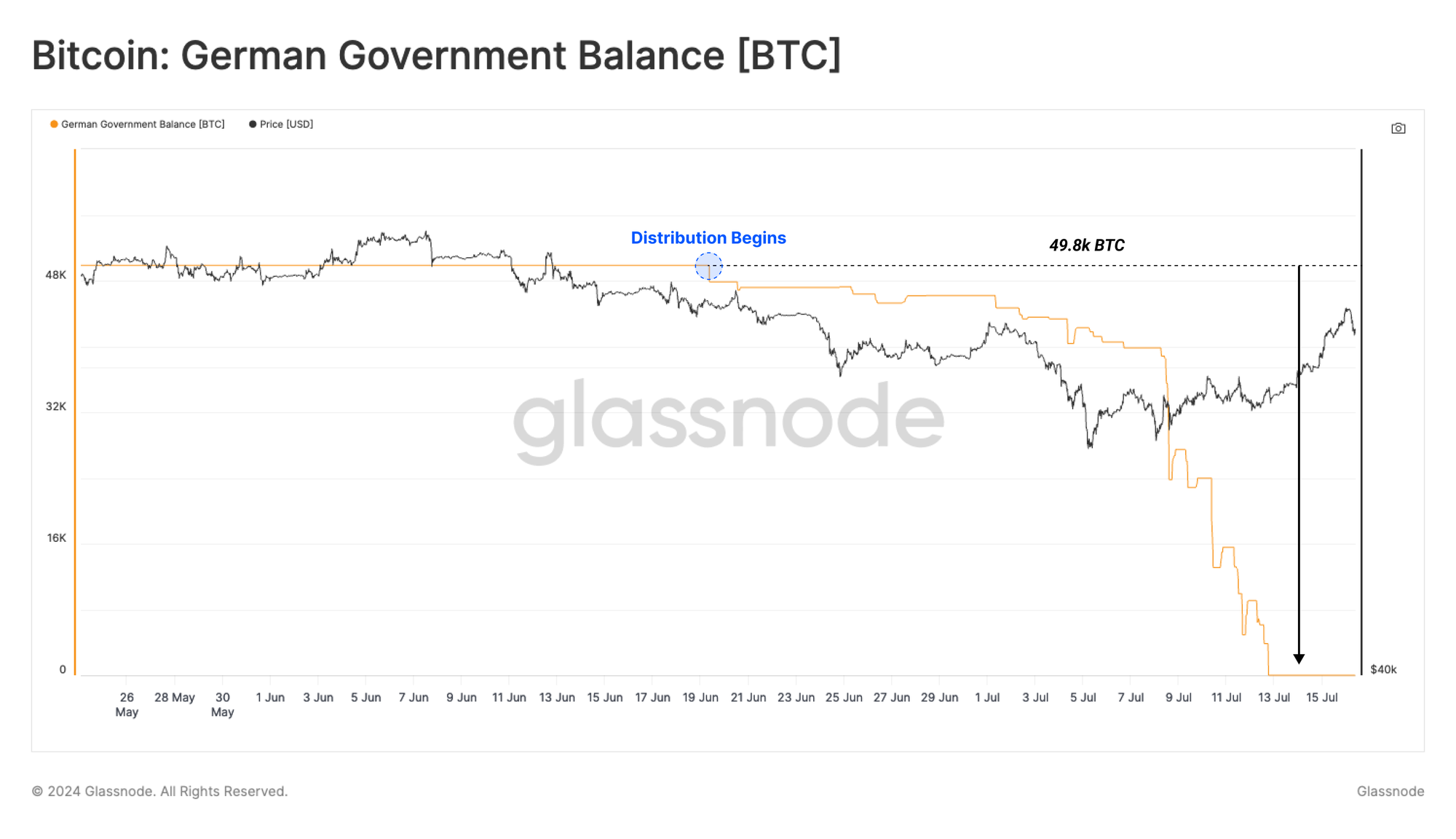

The relief in sell-side pressure appears linked primarily to the cessation of large-scale sell-offs by significant holders, including the German government, which had been exerting downward pressure on Bitcoin’s market value.

This development suggests a pivotal shift in the market, potentially paving the way for more stable or increasing prices moving forward.

Source: Glassnode

Bitcoin: Analysis of recent market movements

Glassnode’s report highlights that the recent decline in Bitcoin’s price to around $53,000 was influenced by anticipated repayments from the defunct Japan-based crypto exchange Mt. Gox and substantial Bitcoin sales by the German government.

These factors contributed to an increased volume of Bitcoin hitting the market, intensifying sell-side pressure.

However, the bulk of the German government’s sell-off occurred in a condensed period from 7th July to 10th July, during which 39.8k BTC flowed out from official wallets, stabilizing shortly thereafter.

This stabilization coincided with Bitcoin prices not falling further, suggesting that the market had already absorbed the shock of these sales.

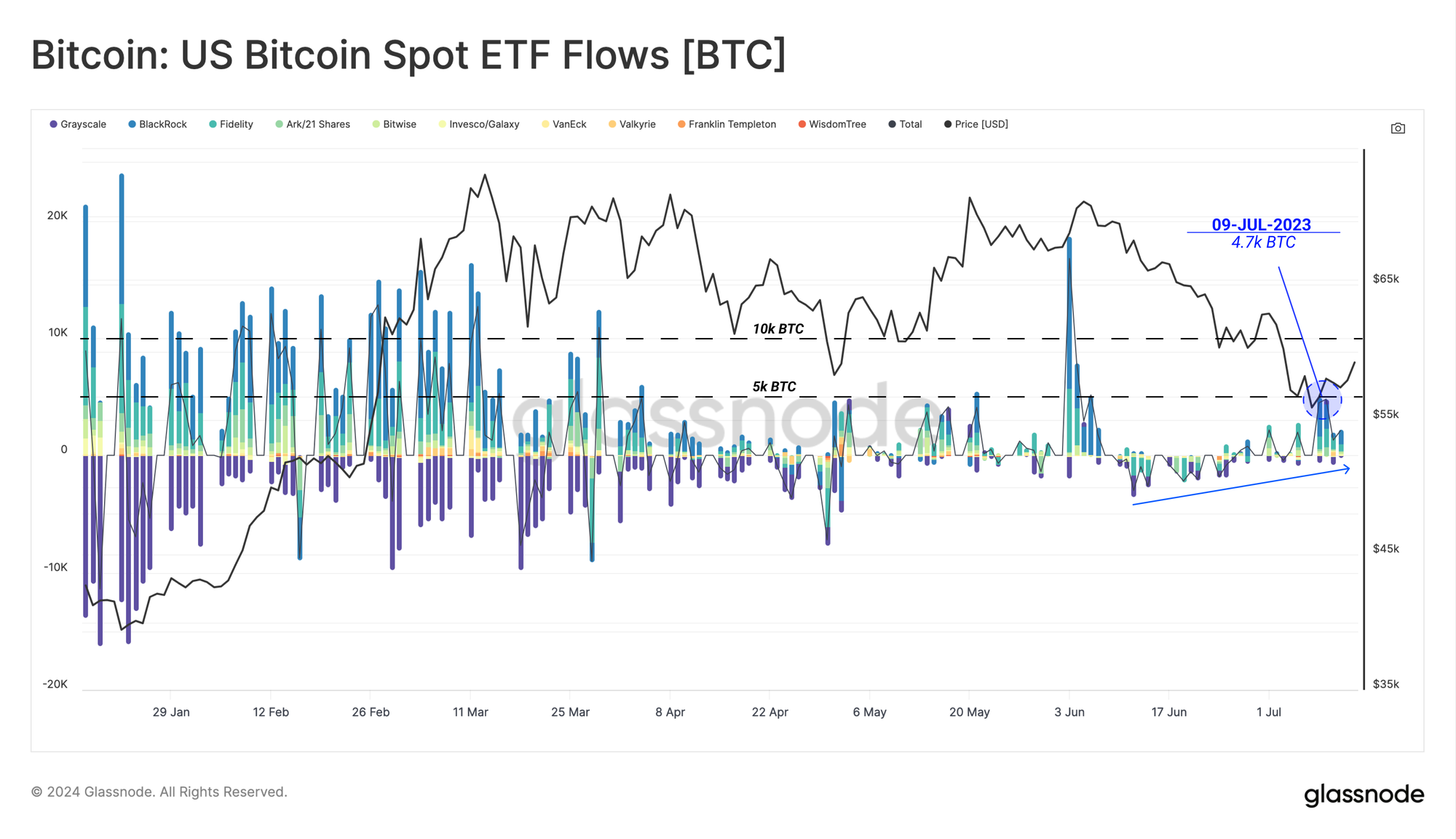

Further support for the price came from a significant influx of funds into Bitcoin spot ETFs, marking the first notable increase in interest since early June.

Over $1 billion flowed into these funds last week alone, aligning with Bitcoin’s price recovery and supporting the notion that the market might have reached a sell-side exhaustion point.

Source: Glassnode

In addition to the easing of sell-side pressures, there has been a notable uptick in institutional demand which has helped counterbalance the earlier outflows.

This demand is reflected in the substantial decrease in Bitcoin exchange flows, which are crucial indicators of market liquidity and investor sentiment.

Exchange flows have significantly declined from their all-time highs in March, finding a new baseline at approximately $1.5 billion daily.

Source: Glassnode

The decline in exchange flows generally indicates a reduction in selling pressure, as fewer holders are moving their Bitcoin to exchanges for sale. This, combined with the renewed institutional interest, suggests a healthier market outlook.

Upward move to be extended?

While Glassnode has revealed that the current rally in BTC’s price is due to complete exhaustion from sellers, it is worth looking at BTC fundamentals to gauge the sustainability of this upward trend.

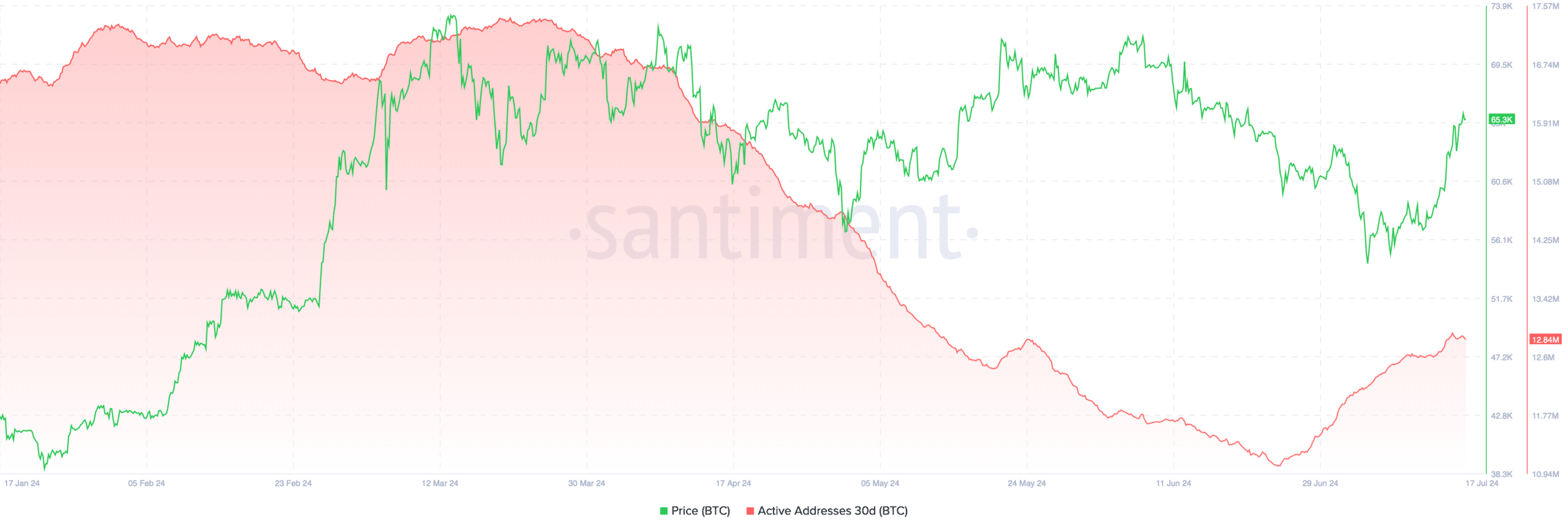

Santiment data indicates a recovery in Bitcoin’s active addresses; from a drop to 11 million in late June from 17.35 million in March, the count has risen to 12.84 million.

This rebound suggests growing retail interest which could potentially support a continued rise in Bitcoin’s price.

Source: Santiment

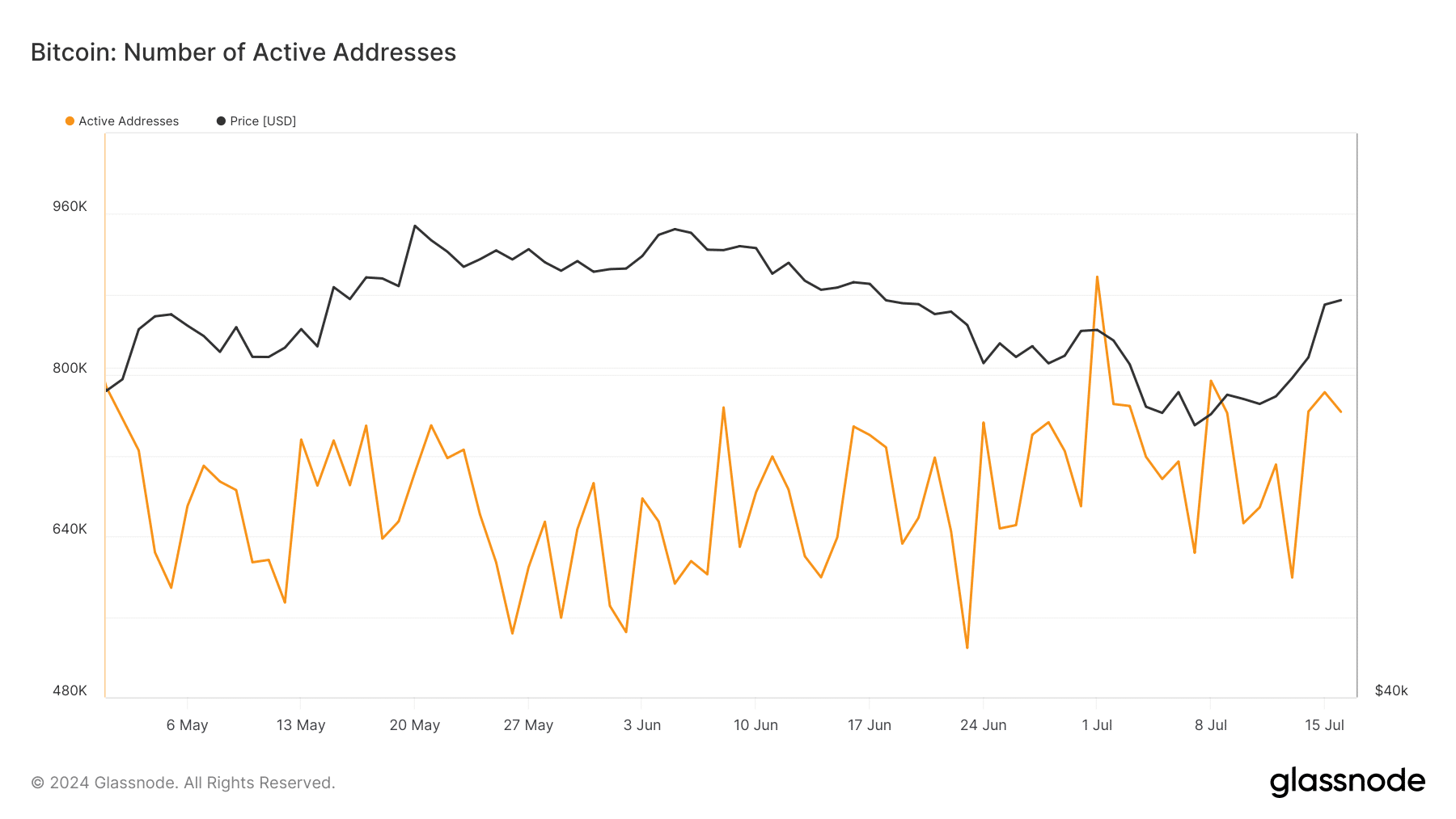

Additionally, Bitcoin’s new address creation from Glassnode, underscores this positive sentiment. After dipping below 600,000 in late June, the number of new addresses climbed to 897,000 on 1st July, before settling at 763,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite this slight pullback, the consistent increase in active and new addresses may indicate a strengthening market presence, likely setting the stage for further price stabilization or gains.

Source: Glassnode

Supporting this outlook, AMBCrypto recently reported that Bitcoin’s ability to convert resistance levels into support could signal an impending stabilization or an upward price trajectory if it remains above key thresholds.

Powered by WPeMatico