- TON was the least affected as its value dropped by only 4.4%

- Buying pressure on XRP, and TON rose on the back of Bitcoin’s correction

The crypto-market turned bearish over the last 12 hours, causing most crypto-prices to crash. XRP, Toncoin [TON], and Polkadot [DOT] were also affected by this, with each one of them shedding a lot of their market capitalizations.

Bitcoin, the world’s largest cryptocurrency, crashed on the back of traditional markets tanking amidst geopolitical uncertainty associated with Iran possibly attacking Israel. Owing to its significant market dominance, the rest of the market was affected in a major way.

XRP, TON, and DOT investors are worried

CoinMarketCap’s data revealed that most tokens registered double-digit declines. While XRP’s value dropped by over 10% in the last 24 hours, DOT’s price plummeted by over 14%. At press time, XRP and DOT were trading at $0.5481 and $7.3, respectively. While this happened, both tokens’ trading volume surged by triple digits.

AMBCrypto had reported previously that XRP flipped USDC to become the 6th largest crypto in the rankings. However, because of the latest market crash, USDC reclaimed its spot.

As far as DOT is concerned, a popular crypto-analyst recently shared a tweet suggesting DOT might have reached a cycle bottom. In doing so, he hinted at a bull rally. However, the market crash has invalidated that proposition and DOT’s cycle bottom might not be here yet.

For its part, Toncoin held its ground well, compared to the rest, as its value dropped by only 4.4% in the last 24 hours. At press time, it was valued at $6.8 with a market cap of over $23 billion. The possible reason behind TON’s relatively stable price action could have been its weekly gains. The token’s value pumped considerably last week, earning it a spot on the top-10 list as it flipped Cardano [ADA].

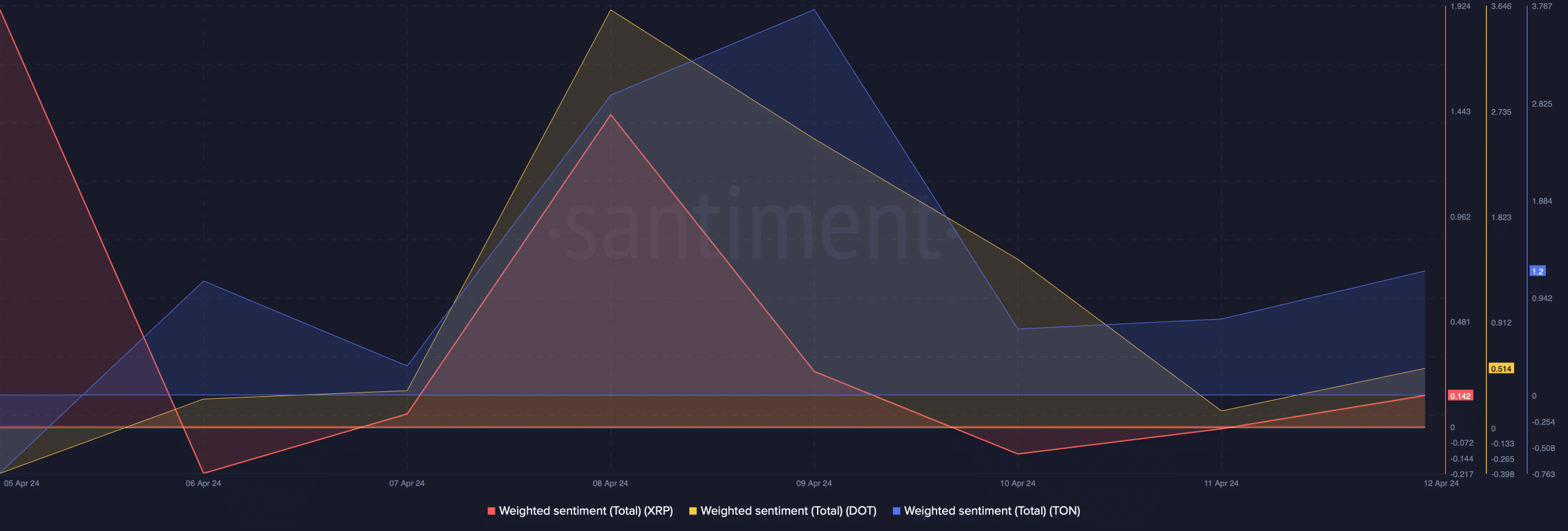

The drop in value also had a major impact on market sentiment around these tokens. AMBCrypto’s analysis of Santiment’s data revealed that XRP, DOT, and TON’s weighted sentiment dropped sharply, suggesting that bearish sentiment around these tokens rose.

Source: Santiment

Buying pressure is rising

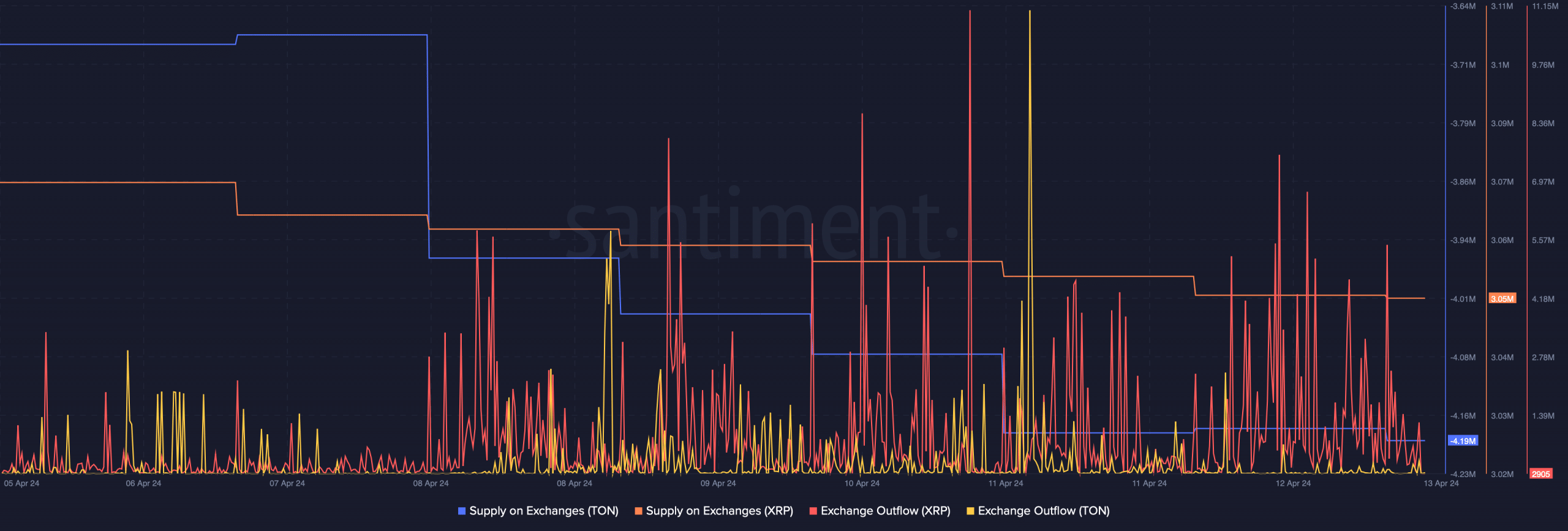

While the market crashed, investors might have used the opening to accumulate more. Our analysis of Santiment’s data revealed that both XRP and TON’s exchange outflows increased in the last few days. On top of that, both tokens’ supply on exchanges also dropped sharply.

These two metrics clearly suggested that buying pressure on these tokens has been high lately.

Source: Santiment

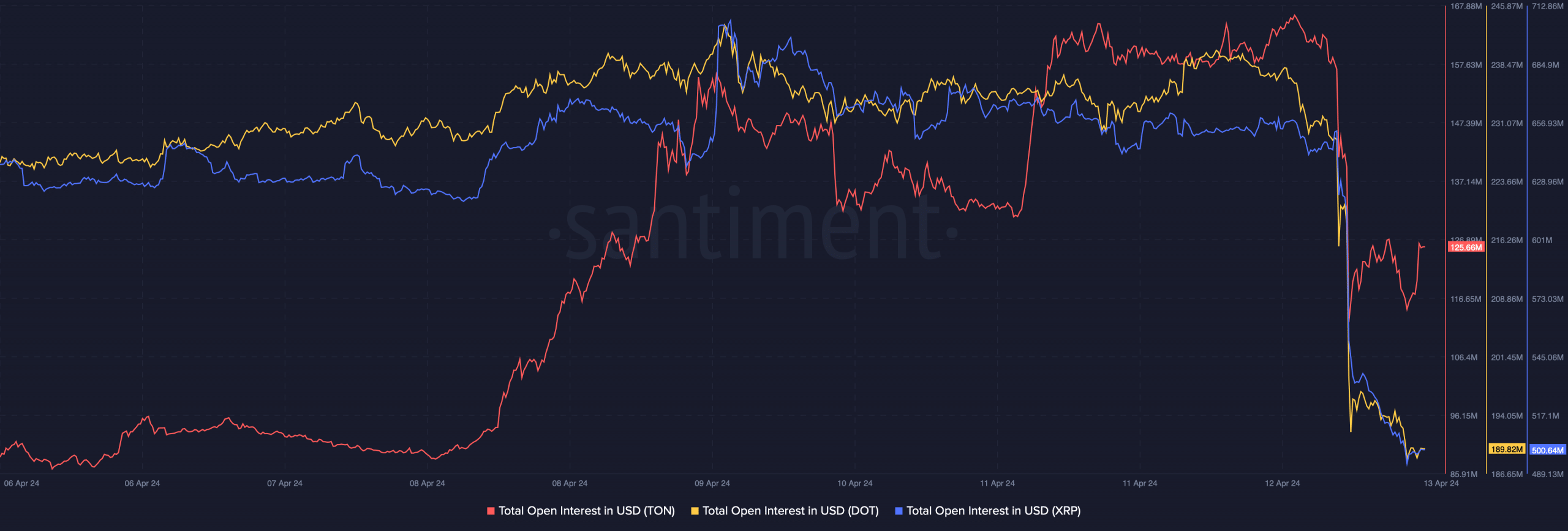

The hike in buying pressure might as well translate into a trend reversal, if metrics are to be believed. Our analysis revealed that while these tokens’ prices sank, their open interests also followed the trend and went down.

Read XRP’s Price Prediction 2024-25

A decline in the metric usually indicates that the ongoing price trend might change. Therefore, the possibility of a trend reversal, which would allow XRP, DOT, and TON to recover their lost market caps, can’t be ruled out yet.

Source: Santiment

Powered by WPeMatico