- An increase in investor interest backed by large transactions fueled the increase.

- The decline in network activity could stop DOGE’s attempt to revisit $0.22.

After AMBCrypto predicted that Dogecoin [DOGE] might jump before the weekend runs out, the price climbed by 9.40% in the last 24 hours. At press time, DOGE changed hands at $0.19.

The coin’s value did not only increase but as it has done in recent weeks, it outperformed all other cryptocurrencies in the top 10. However, we were able to identify some reasons for the appreciation.

DOGE caught in the chitchat

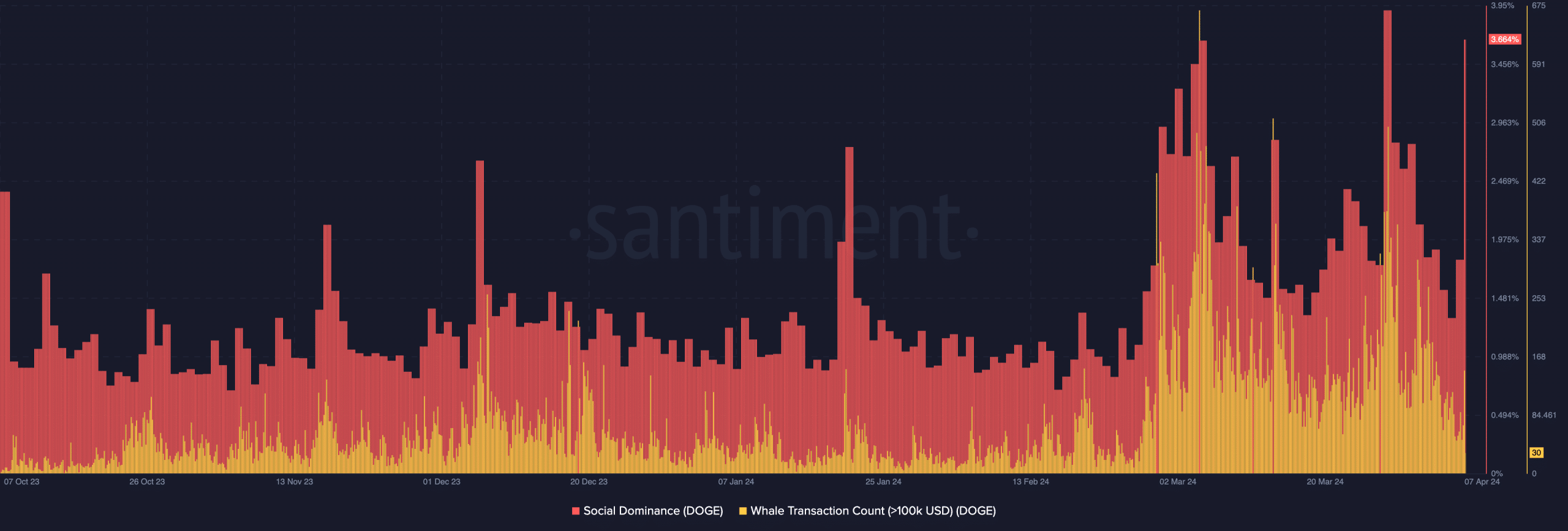

From an on-chain lens, Santiment showed Dogecoin’s Social Dominance soared to 3.664% despite trailing at 1.324% on the 6th of April.

A significant boost in social dominance implied that discussion around the coin improved.

It also serves as a sign of renewed investor interest. When a situation like this arises, interest in the coin could trigger demand, and it seems that was the case with DOGE.

Adding power to the source, whales’ transactions also spiked. As of this writing, on-chain data showed that there were 30 transactions valued within the $100,000 range.

Source: Santiment

However, it was uncertain if these transfers reeked of accumulation, but historical data suggests that an increase in the metric foreshadows higher prices.

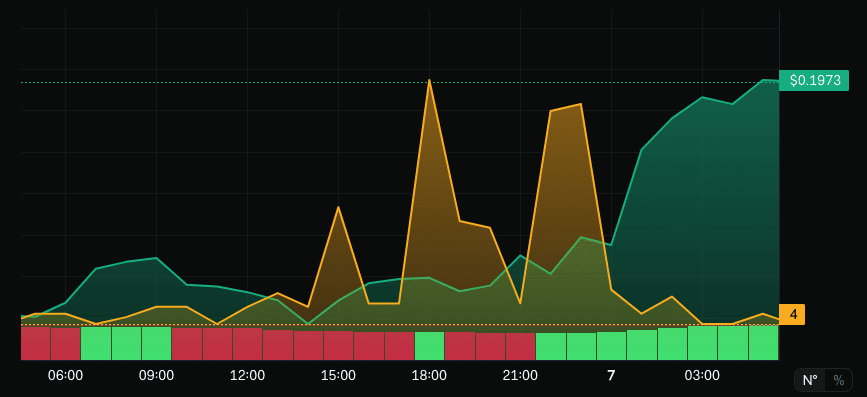

Despite these improvements, DOGE dropped three places per AltRank. AltRank is a metric created by social intelligence platform LunarCrush.

Previously, the coin occupied the top spot. But a 7.2% drop in interactions across social media platforms ensured that other assets outside the top 10 overtook it.

Interestingly, two of the cryptocurrencies that flipped Dogecoin were meme coins. One was ORDI [ORDI], a BRC-20 token. The other was MAGA [TRUMP], a token built on Ethereum [ETH].

Source: LunarCrush

Not all areas are green

It is noteworthy to mention that both tokens outperformed DOGE in terms of price. Despite the bullish picture and historical reference, some indicators painted a bearish outlook.

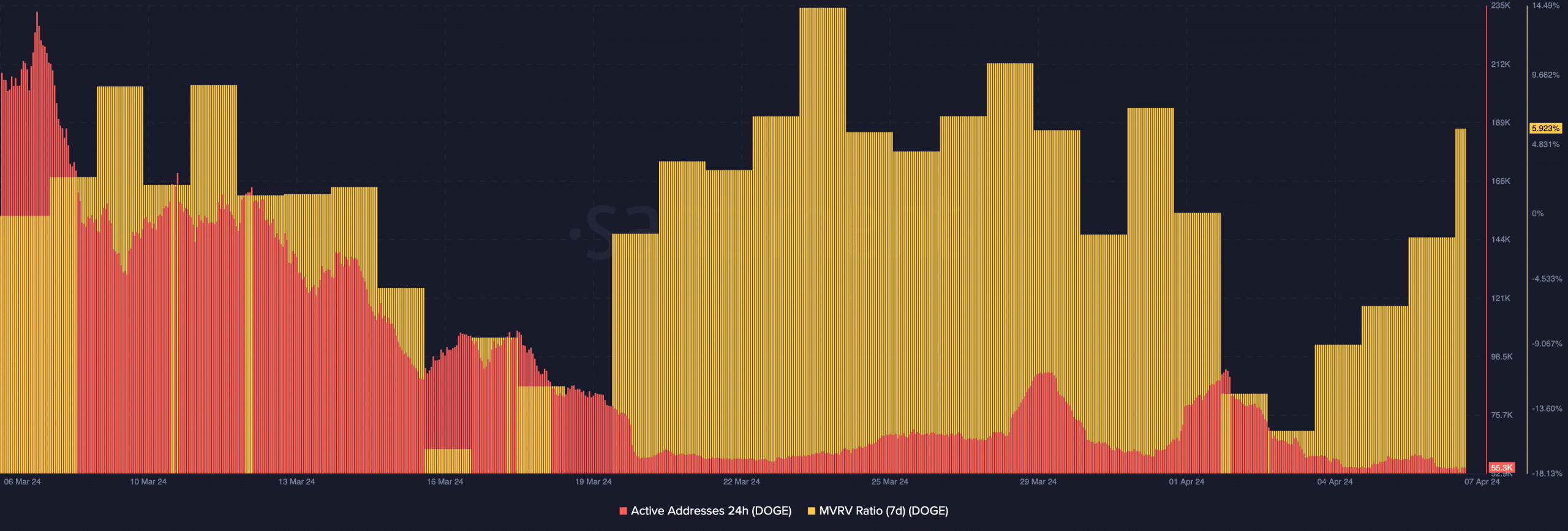

One of them was Dogecoin’s active addresses. On the 2nd of April, the 24-hour active addresses almost hit 100,000. However, at press time, the metric had declined to 55,300.

Active addresses track the number of users interacting with a network. If it increases, then it implies a good level of utility. Conversely, a decrease suggests that participation with the underlying token was fizzling.

For DOGE, it was the latter. Should activity on the network fail to pick up, Dogecoin’s uptrend might stall. However, if the opposite happens, the price of the coin might climb toward $0.22.

Source: Santiment

AMBCrypto also analyzed the Market Value to Realized Value (MVRV) ratio. At press time, the seven-day MVRV ratio had increased to 5.923%.

Is your portfolio green? Check out the DOGE Profit Calculator

This indicates that the market value within the period has been higher than the realized value.

In addition, the increase also meant that investors might be enticed to sell. At the same time, some might wait for better appreciation as the reading still makes DOGE undervalued.

Powered by WPeMatico