- WIF surged by over 13% in the last 24 hours.

- As sentiment turned positive, bears incurred losses.

Dogwifhat [WIF] has been a dark horse in the recent meme coin rally. Despite this bull run, over the last week, the price of the meme coin fell significantly, which raised questions about the credibility of its rally.

All about WIF’s massive surge

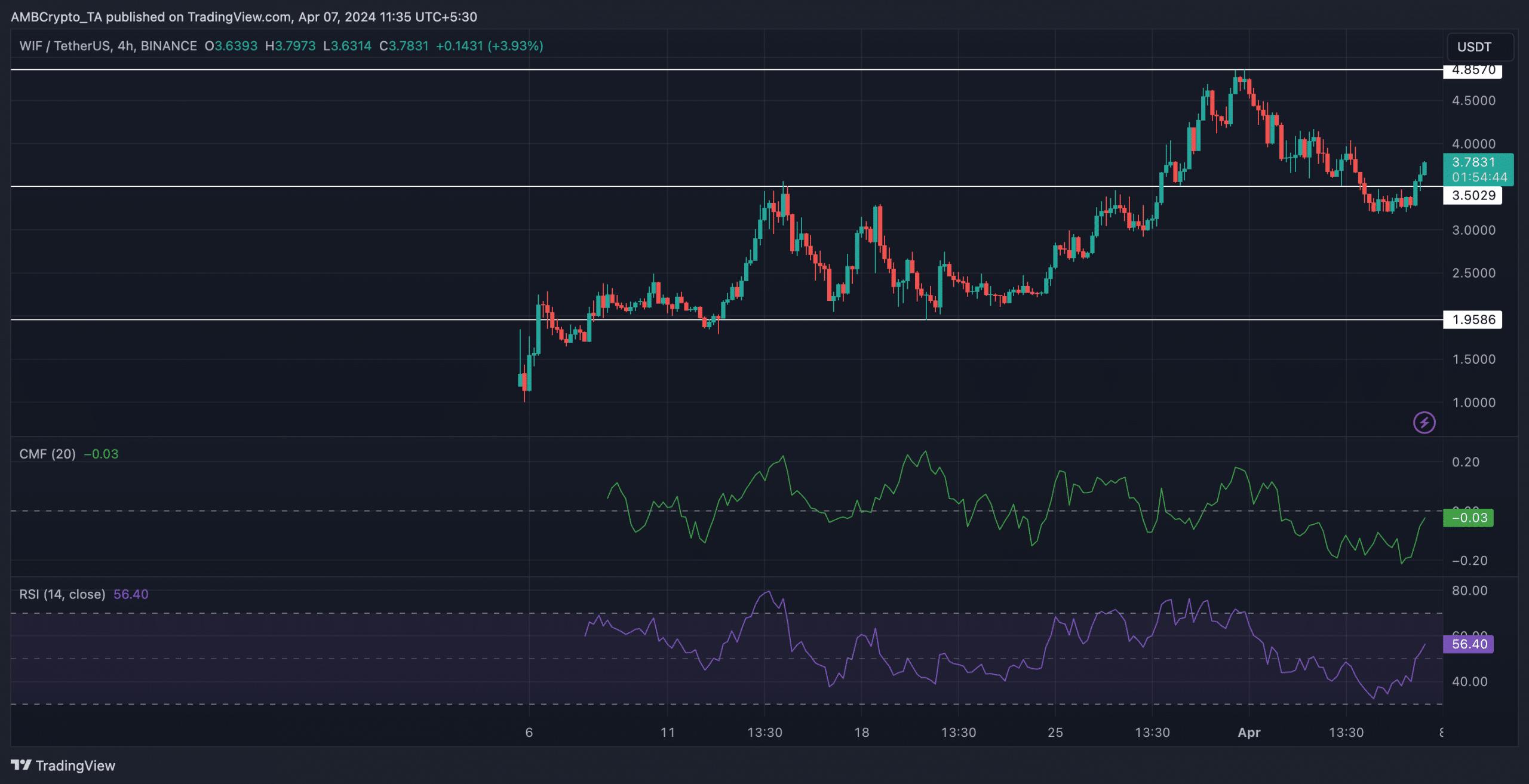

In the last 24 hours, WIF witnessed a massive surge, defying skeptics and growing by 13.70%. The meme coin managed to surpass the $3.5029 resistance level and was trading at $3.7841 at the time of writing.

If bullish momentum around WIF grows, it could retest the previously achieved $4.857 level.

The token’s RSI (Relative Strength Index) was at 56.40 at press time, suggesting that the price movement was relatively balanced. Furthermore, the CMF experienced grew, transitioning from -0.2 to -0.03.

Though the CMF remained negative, the smaller magnitude suggested a less pronounced selling sentiment.

This could imply that the selling pressure on WIF has weakened, potentially signaling a stabilization or a shift towards more balanced market conditions.

Source: Trading View

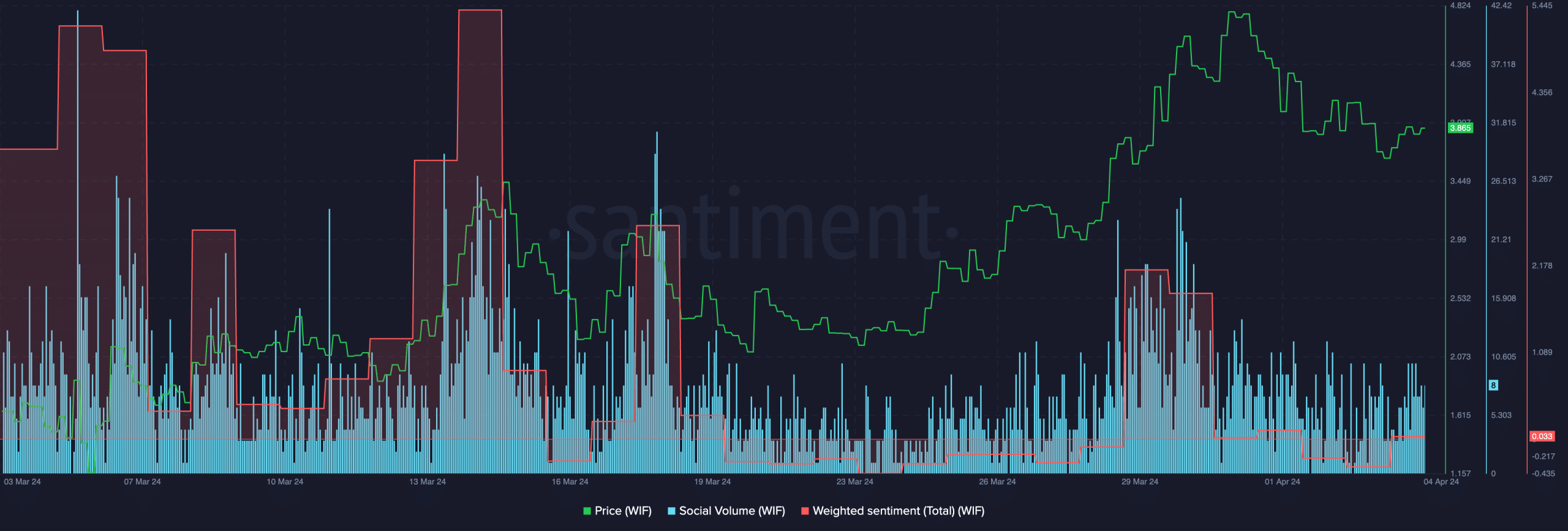

Activity on the social front will also play a great role in determining the future of WIF’s price. AMBCrypto’s analysis of Santiment’s data revealed that the token’s Social Volume had fallen materially.

This indicated that WIF was losing out on popularity across social media platforms.

Moreover, the Weighted Sentiment indicator recently turned positive, indicating that positive comments had started to outnumber the negative ones.

Source: Santiment

Looking at the state of traders

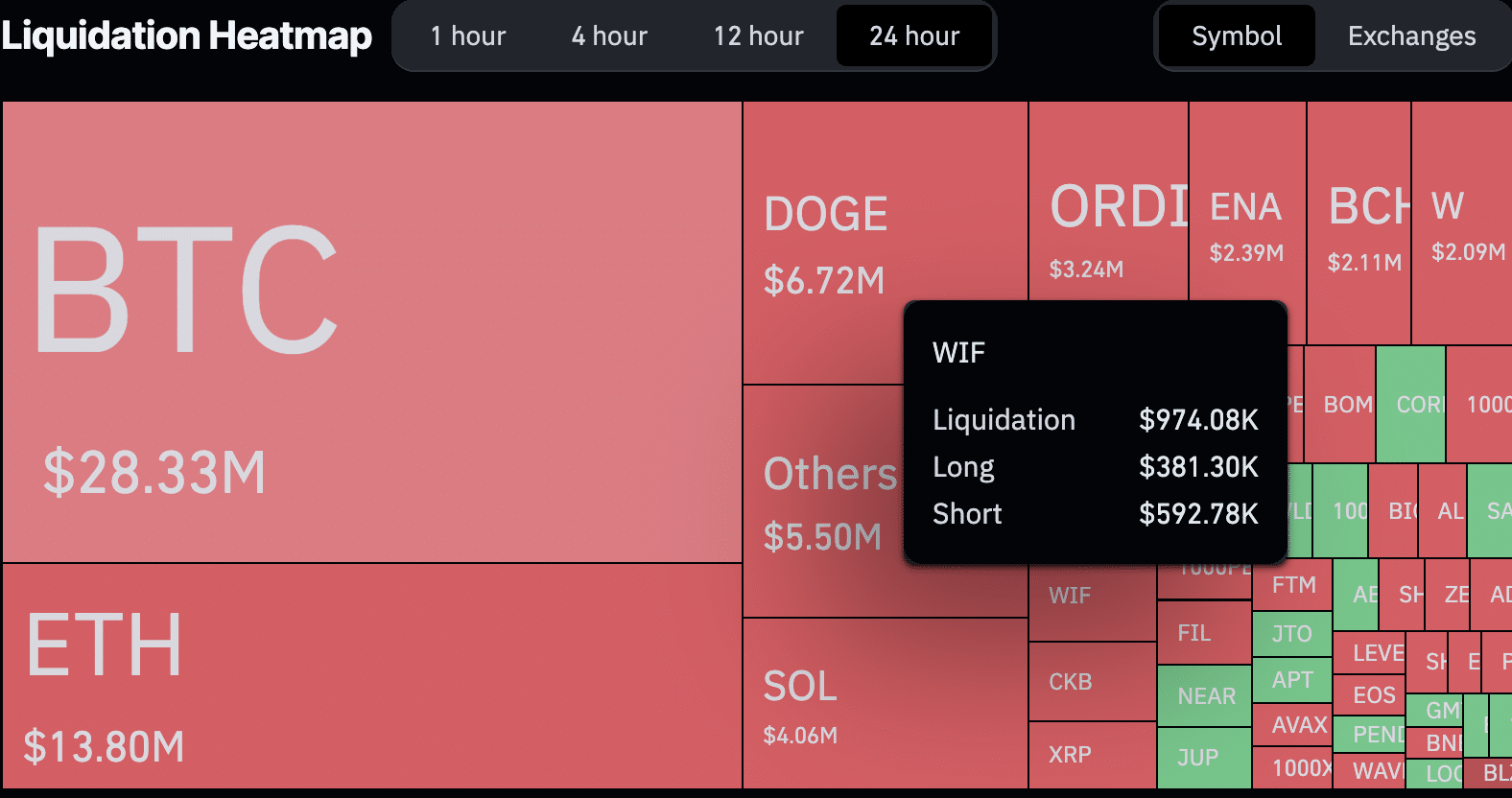

Coming to the state of the traders, AMBCrypto marked that around $970,000 worth of liquidations had occurred until press time. The bears had faced the brunt of this movement, incurring losses of $592,780.

Source: Coinglass

Realistic or not, here’s WIF’s market cap in BTC’s terms

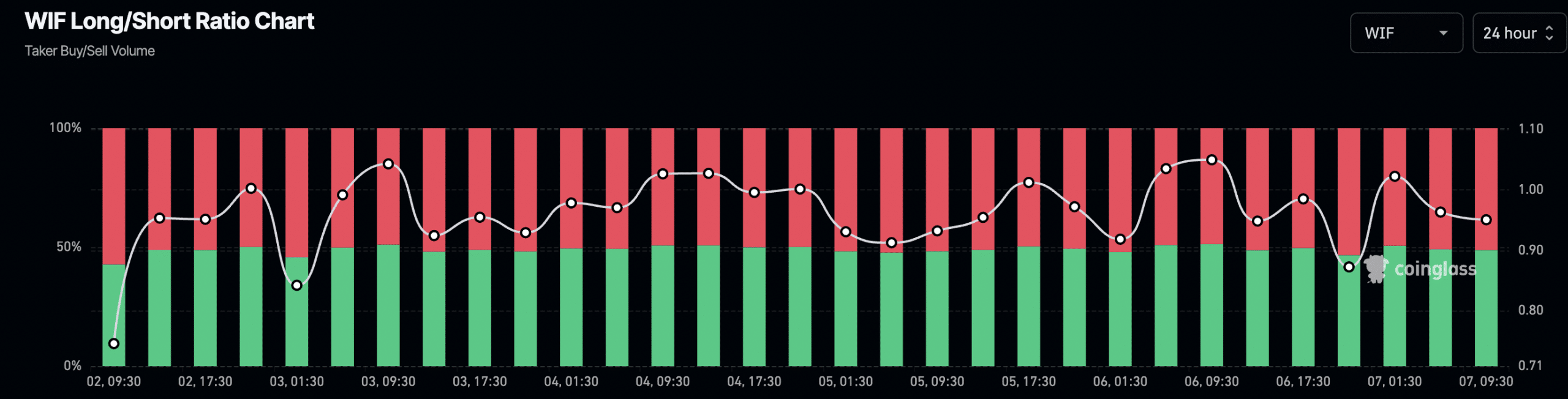

Despite being liquidated, bears remained skeptical of WIF’s price movement. AMBCrypto’s analysis of Coinglass’ data revealed that the percentage of short positions taken against WIF was 51.6%.

It remains to be seen whether these bears turn out to be right.

Source: Coinglass

Powered by WPeMatico