- Market trends favor Ethereum as ETF launch nears.

- The report showed a changing landscape in spot trading volume, options, Futures, and perpetual contracts.

Cryptocurrency markets have experienced high volatility over the last two months. Market preferences are shifting, especially since the SEC approved Ethereum [ETH] spot ETFs in May.

With the anticipated launch of ETH spot ETFs, investors are getting increasingly optimistic.

Although ETH ETFs have yet to start trading, a report by Kaiko and a joint report from Block Scholes and Bybit showed changing market preferences.

A change in trends

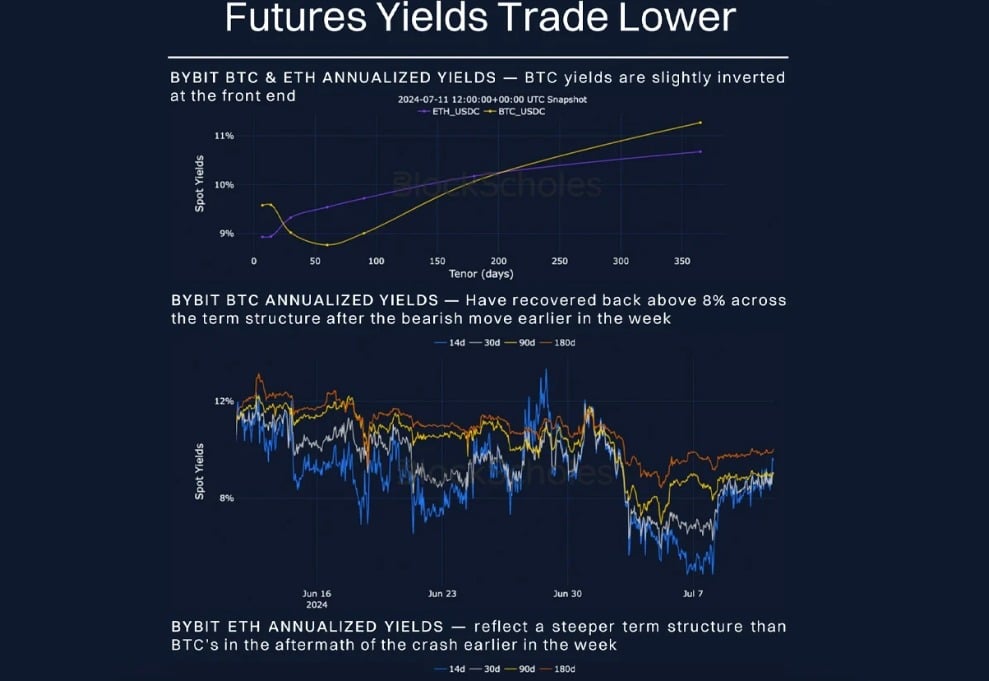

According to the recently released report by Block Scholes and Bybit, there has been a massive landscape shift in spot trading volumes, futures, options, and perpetual contracts.

The report posited that Ethereum enjoyed a better volatility premium over Bitcoin [BTC]. This mainly arose from increased address activity and a positive market sentiment shift towards ETH.

Source: Blockscholes & Bybit

Ethereum gains ground over Bitcoin

The ETH to BTC ratio has sustained a positive value of 0.05 since the approval of spot ETFs. This ratio is considerably higher than pre-approval levels of around 0.045.

The higher ratio shows that when the ETH spot ETFs start to trade, it will continue to outperform BTC.

Source: Kaiko

Overall market sentiment

ETH has gained more than BTC in multiple areas since the approval of ETH spot ETFs in May.

Although the crypto market has experienced high volatility over the past two months, ETH Futures have shown more resilience and quicker recovery than Bitcoin’s Open Interest.

ETH’s faster recovery for its future suggested a rising positive sentiment, with many investors confident in its future.

Source: Blockscholes & Bybit

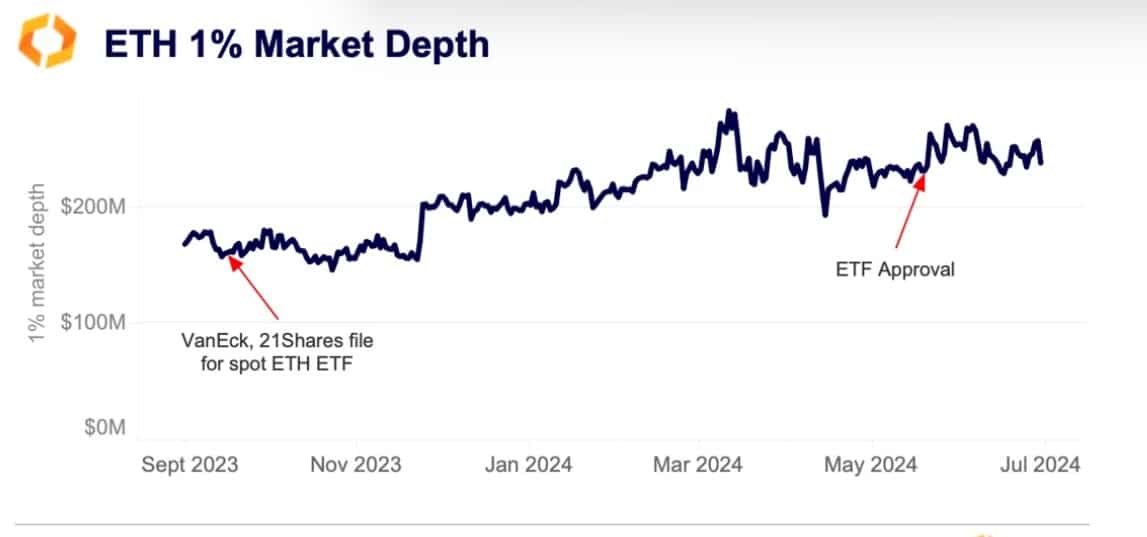

ETH’s trading volume has been sustained within the same range since May. According to Kaiko, ETH’s liquidity has been sustained with 1% depth and a consistent range of $250M.

The ETF approval seems to have changed the trend after dipping below $200M and reversed the trend after SEC’s approval. Therefore, the ETF anticipation has played a critical role in improving liquidity.

Source:Kaiko

Additionally, ETH perpetual contracts have experienced increased trading volume. The increase showed that investors were willing to pay a premium to hold long positions, which showed confidence in crypto’s future potential.

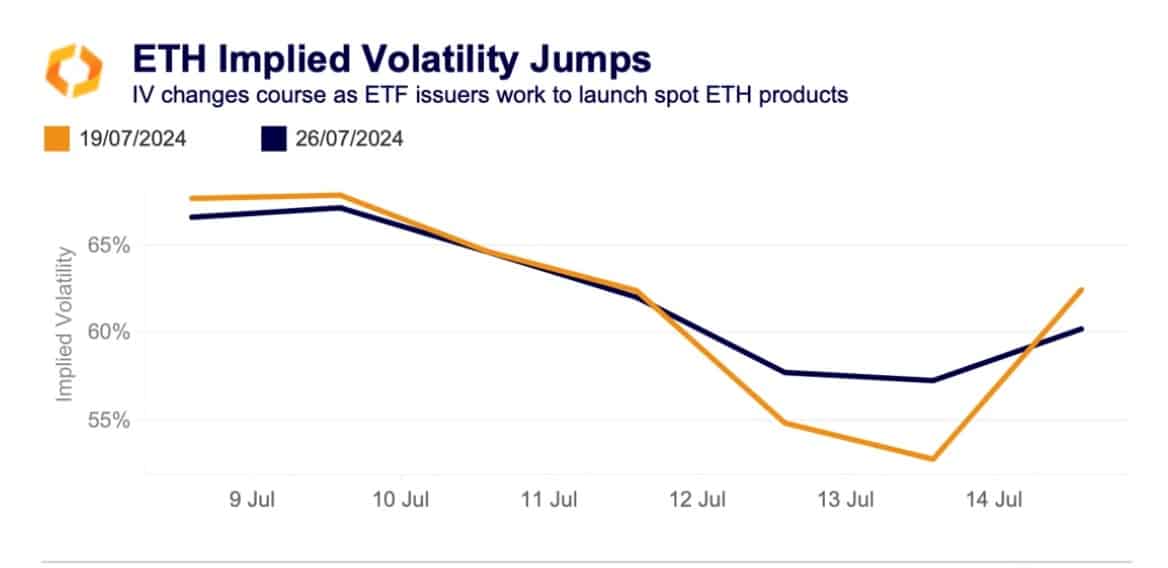

As reported by Kaiko, Implied Volatility surged over the past seven days. For instance, ETH options set to expire this Friday surged from 53% on the 13th of July to 62% at press time.

Read Ethereum’s [ETH] Price Prediction 2024-25

The surge in these contracts implied that investors were paying short positions to protect themselves against price hikes in the short run.

This market sentiment shows considerable optimism over ETH’s future, especially with upcoming ETFs this week.

Source: Kaiko

Powered by WPeMatico