- Worldcoin bulls finally appear to be taking over after months of hiatus.

- This resurgence could be fueled by shorts liquidations, and could be temporary.

Worldcoin [WLD] is finally experiencing a demand resurgence after months of continuous downside, which has lasted for roughly five months.

At a glance, this looks like the start of another major rally, but further evaluation signals to a potentially different outcome.

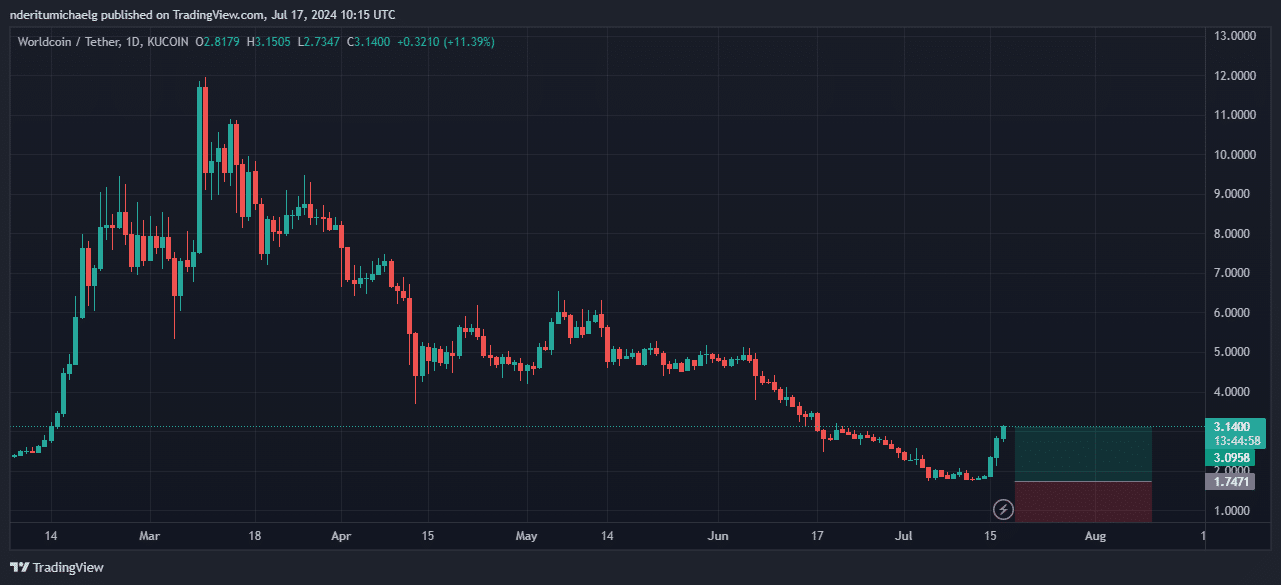

WLD’s price action went parabolic in the last few days after bottoming out in the $1.72-$1.77 price range. This coincided with the overall market sentiment, which mirrored the bullish recovery we observed among the top coins.

Worldcoin exchanged hands at $3.12 at press time, which represented a 77.2% bounce from its current monthly low.

Source: TradingView

WLD’s latest rally is not the first bullish attempt since its epic decline, which started in March.

There was previously another attempt in May, which the bears thwarted, resulting in an overall 89% dip from its 1-year high in March 2024.

Not a typical Worldcoin rally

At first glance, the extended downside, coupled with price falling below its pre-February lows, suggested that the bulls were overdue for a takeover.

This observation may have set the stage for heavy shorts liquidations amid growing bearish sentiments, courtesy of recent announcements.

The Worldcoin foundation announced earlier this month that it had extended its WLD grants reservations. The extended timeline means people can still continue reserving tokens for an extra year.

In addition, the Worldcoin Foundation has also announced that token unlocks for early contributors, team members and investors will commence on the 17th of July. Also, the unlocks schedule went up from three to five years.

There was a surge in the number of short positions on WLD following the token unlocks announcements. This suggested that many traders can expect the higher supply to suppress the price of Worldcoin.

Unfortunately for the shorts, they walked right into a short squeeze trap as sustained demand for WLD pushed prices higher.

Will WLD extend its rally?

The liquidation of aforementioned shorts further extended WLD’s upside, which explains why it has outperformed most other major coins by percentage gains.

While the current Worldcoin rally is eerily similar to the start of its parabolic performance April 2024, things might not necessarily turn out the same.

For starters, unlocks are slated to take place soon, which may still dampen the investor mood and trigger lower demand.

On the other hand, the level of unlocks for the next few weeks might not lead to a severe surge in token supply.

Is your portfolio green? Check the WLD Profit Calculator

Either of the two scenarios may play out, hence we will be keeping a close eye on Worldcoin to see how things turn out.

Meanwhile, if WLD continues rallying, we can expect resistance near the $4.75 price level based on historic performance.

Powered by WPeMatico