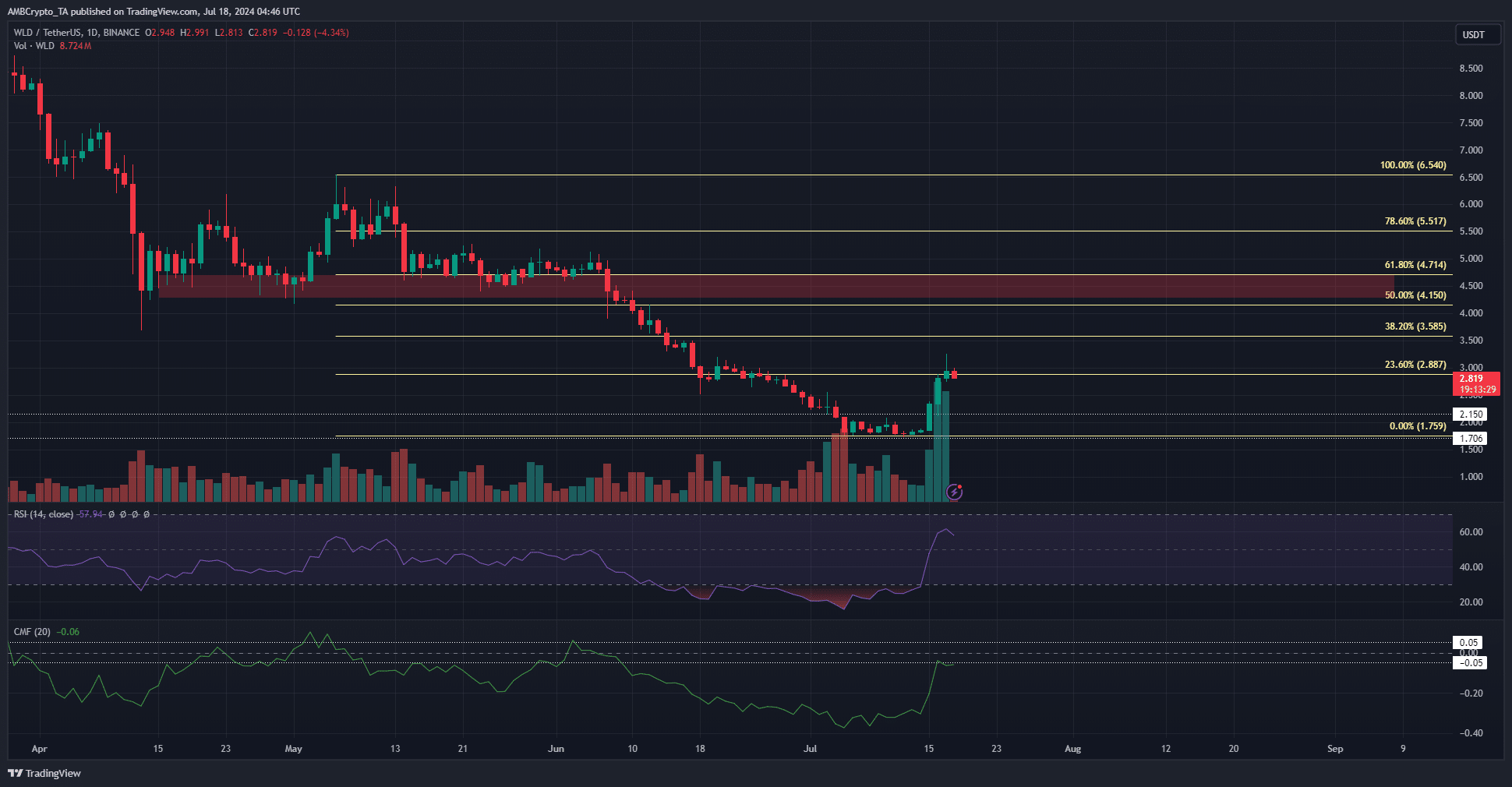

- WLD has a higher timeframe bearish bias despite the near 90% price bounce.

- The February 2024 rally started similarly after a deep retracement- could history repeat itself?

Worldcoin [WLD] bounced 89% from the recent low at $1.72 and triggered a large amount of short liquidations. Traders who expected the downtrend to continue were hurt by a short squeeze which might go even higher.

News that the token unlocks for early investors and team members would commence on the 24th of July meant that a wave of supply would likely reach the markets soon. Will demand manage to outpace the supply?

Prices have been rebuffed from the $3 zone

Source: WLD/USDT on TradingView

Despite the near 100% rally over the past week, WLD has barely cleared the recent lower high at $3.2. The daily session close on Wednesday the 17th of July was at $2.94, below the psychological $3 resistance.

A move past $3.2 would be a sign of a steady rally toward the next significant resistance zone at $4.5. The Fibonacci retracement levels at $5.7 and $5.5 could be pivotal in the next week or two.

While the daily RSI burst past neutral 50 to denote strong bullish momentum, the CMF was still at -0.06. The trading volume has increased over the past four days but the buying pressure has to be consistently high to inflict a bullish trend change.

With the higher timeframe outlook bearish and doubts about the strength of the demand, it remained likely that Worldcoin would continue its downtrend from the $3 or $4.5 resistances.

Market sentiment began to cool in recent hours

Source: Coinalyze

The strong price bounce caught many short traders offside over the past few days. This was evidenced by the rise in short liquidations, and the rising Open Interest showed sentiment had flipped bullish in the short term.

This began to fade over the past 24 hours after the rejection at $3. The price slump saw a hefty number of long liquidations on the 17th, punishing the overeager bulls.

Read Worldcoin’s [WLD] Price Prediction 2024-25

The spot CVD has not broken its previous downtrend.

Overall, it is possible that Worldcoin will make some bullish headway this month, but would likely resume its downtrend near the $4.5 supply zone.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico