![XRP or Polkadot [DOT] – Which altcoin can lead the altcoin rally now? XRP or Polkadot [DOT] – Which altcoin can lead the altcoin rally now?](https://printhereum.com/wp-content/uploads/2024/04/XRP-and-Polkadot-to-lead-this-altcoin-bull-rally-1200x686-1-1024x585.webp)

- History suggests altcoins usually begin a bull rally after exiting an accumulation phase

- Both tokens’ metrics looked mostly bullish, but XRP seemed to have an advantage

After days of sideways price movement, altcoins have turned bullish as most of their daily charts were green. In fact, the latest analysis suggests that altcoins have already begun their bull rallies. Ergo, it’s worth checking the status of top altcoins like XRP and Polkadot [DOT] to see whether they could lead the altcoin pack.

Green or red?

Mags, a popular crypto-analyst, recently shared a tweet highlighting an interesting development. According to the same, the accumulation phase for altcoins has finished, and they have initiated yet another bull rally as the overall altcoin market capitalization went north. This seemed to be true as multiple top altcoins turned bullish in the last 24 hours.

For instance, according to CoinMarketCap, XRP’s price appreciated by over 2% and was trading at $0.5891. Similarly, Polkadot’s daily chart also turned green as its value spiked by 2.5%. At the time of writing, it was valued at $8.4.

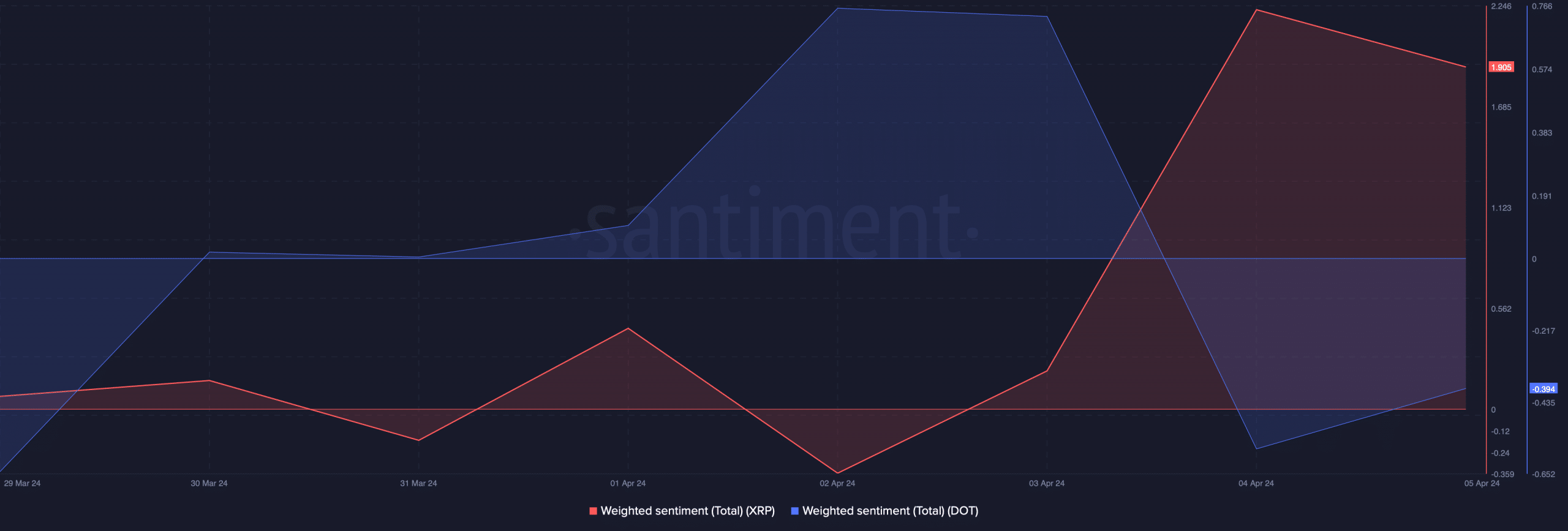

However, despite the recent hike in price, bearish sentiment around DOT remained bearish. The same was evidenced by its negative weighted sentiment. On the contrary, XRP’s case was was different, as the token’s weighted sentiment spiked on 4 April.

Source: Santiment

XRP or DOT— Who will be the winner?

Since both tokens’ registered price upticks, it’s worth assessing which of these tokens can lead the altcoin rally.

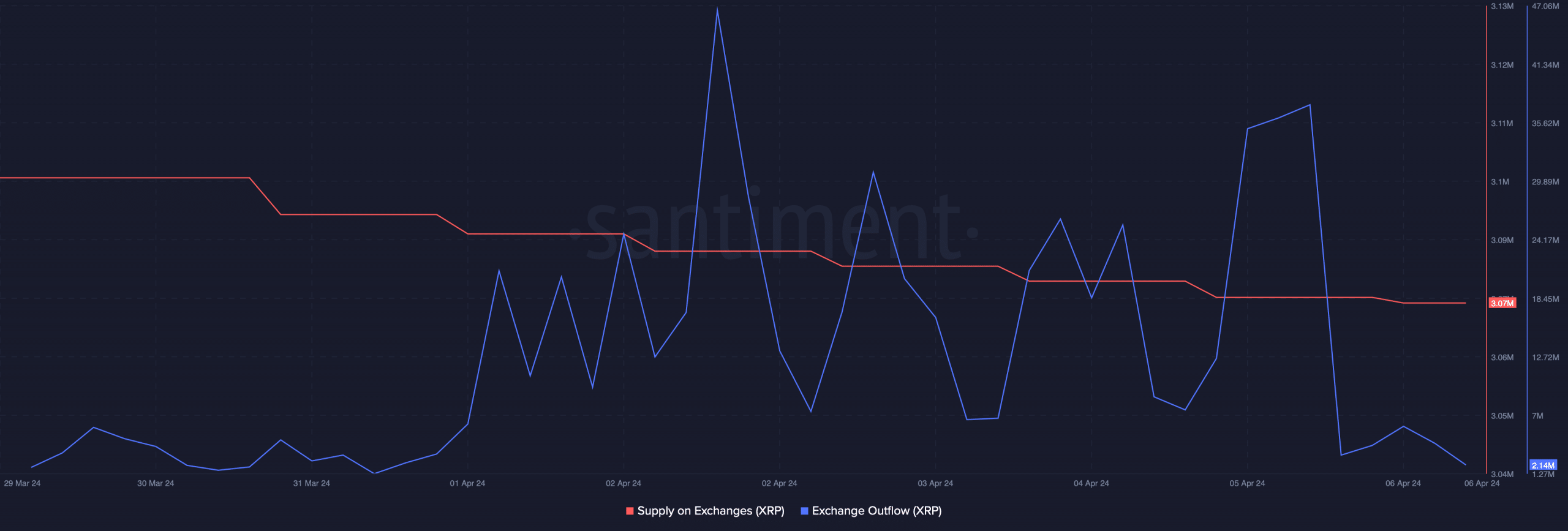

AMBCrypto found that buying pressure on XRP remained high as its supply on exchange graph went down over the last few days. The fact that buying pressure was high was further proven by its exchange outflows, which spiked multiple times last week.

High buying pressure might propel further growth and allow XRP’s price to rise further in the coming days.

Source: Santiment

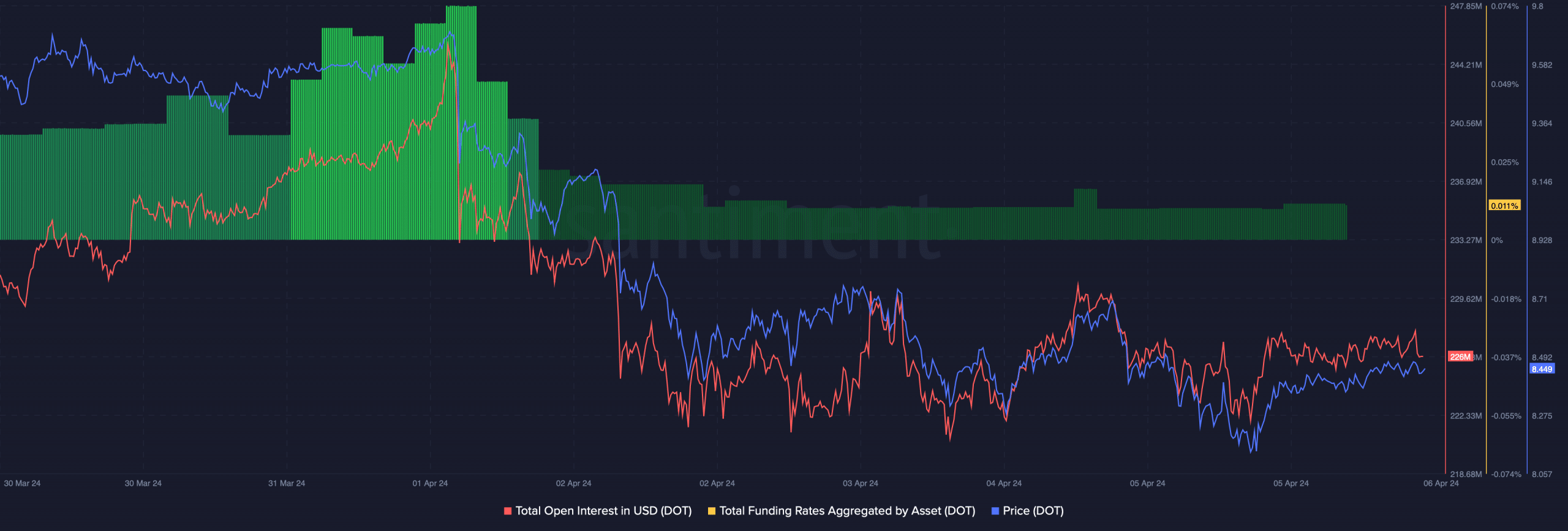

For Polkadot too, the charts looked pretty optimistic.

For instance, DOT’s open interest, after a decline, rose slightly along with its price. Whenever the metric rises, it indicates that the chances of the on-going price trend continuing are high. Usually, prices tend to move in a different direction than funding rates. Fortunately, DOT’s funding rate dropped – A sign of a sustained price hike.

Source: Santiment

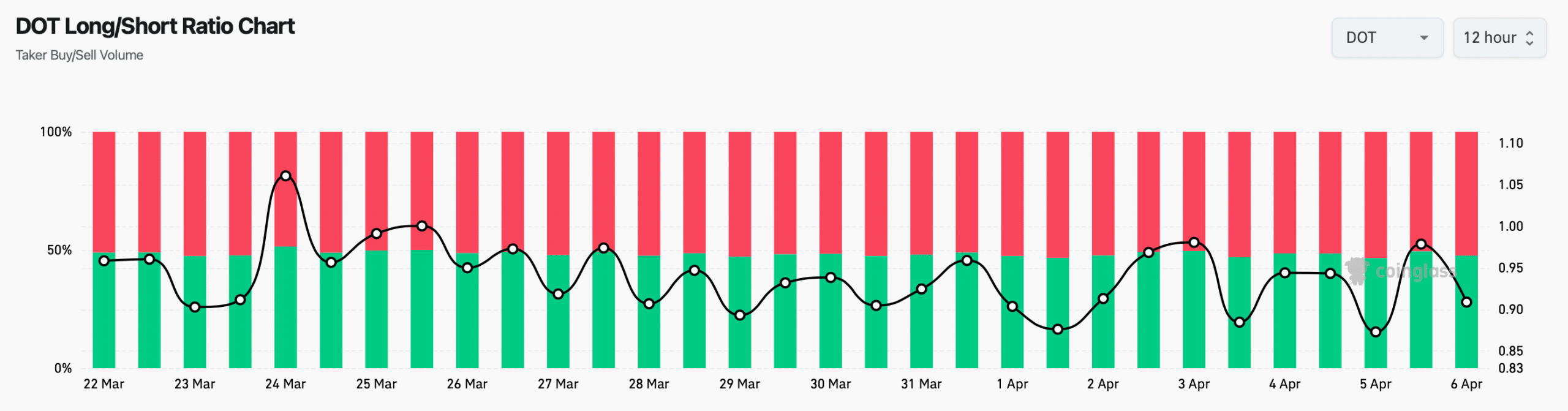

However, when AMBCrypto checked Coinglass data, we found a red flag for DOT. As per our analysis, DOT’s long/short ratio registered a decline in the last few hours.

A low long/short ratio indicates that there are fewer long positions than short positions in the market. This is a sign of bearish sentiment and potentially lower prices.

Source: Coinglass

Read Polkadot’s [DOT] Price Prediction 2024-25

Therefore, at press time, the chances of XRP taking the lead seemed higher. However, considering the unpredictable nature of the crypto-market, it’ll be interesting to see how well both of these tokens perform.

Powered by WPeMatico