- XRP might find it hard to compete with other altcoins’ performances

- Two metrics supported a bounce, but data revealed that it might be brief

XRP’s price has been hit hard over the last 30 days, with its value dropping by 11.71%. Needless to say, other altcoins have fallen on the charts too. However, XRP’s case seems different, especially considering how it has been one of the worst-performing cryptocurrencies this year.

This underwhelming show raises the question— Should you sell your XRP? Here, AMBCrypto will look at several metrics and developments that might give you an idea of the token’s future performance.

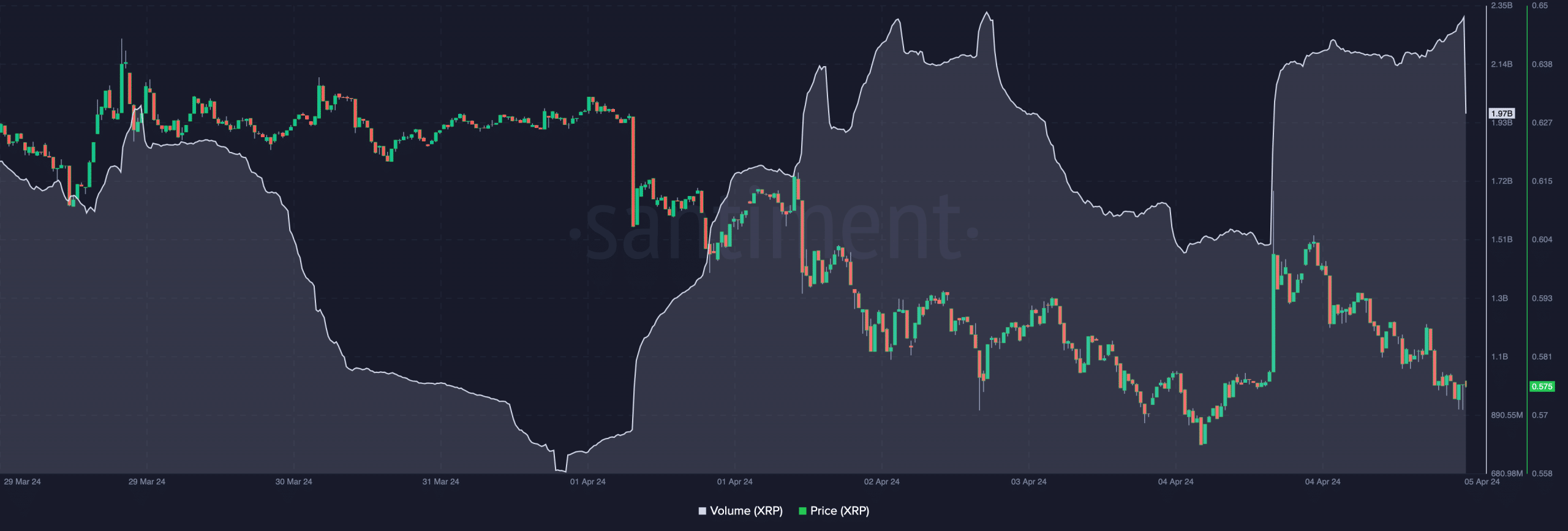

Let’s look at trading volume first – On 5 April, XRP’s volume jumped past $2 billion. Funnily enough, this period was also when the price fell to $0.57.

Source: Santiment

Keep the token out

Rising volume and declining prices do not mean well for traders bullish on the price action. Instead, the trend suggests that the value of the token might continue to fall. However, AMBCrypto found that Ripple’s announcement that it is introducing a stablecoin was one of the reasons the volume rose. Even so, is this really bullish news for XRP?

It can be argued otherwise. This, because a stablecoin on Ripple’s network could make XRP less competitive with other altcoins.

Also, the cryptocurrency might no longer achieve the “global reserve token” goal the firm had in mind for it. Should XRP succumb to the statement above, it might be deprived of liquidity. Hence, the price might fail to put a bull market kind of performance.

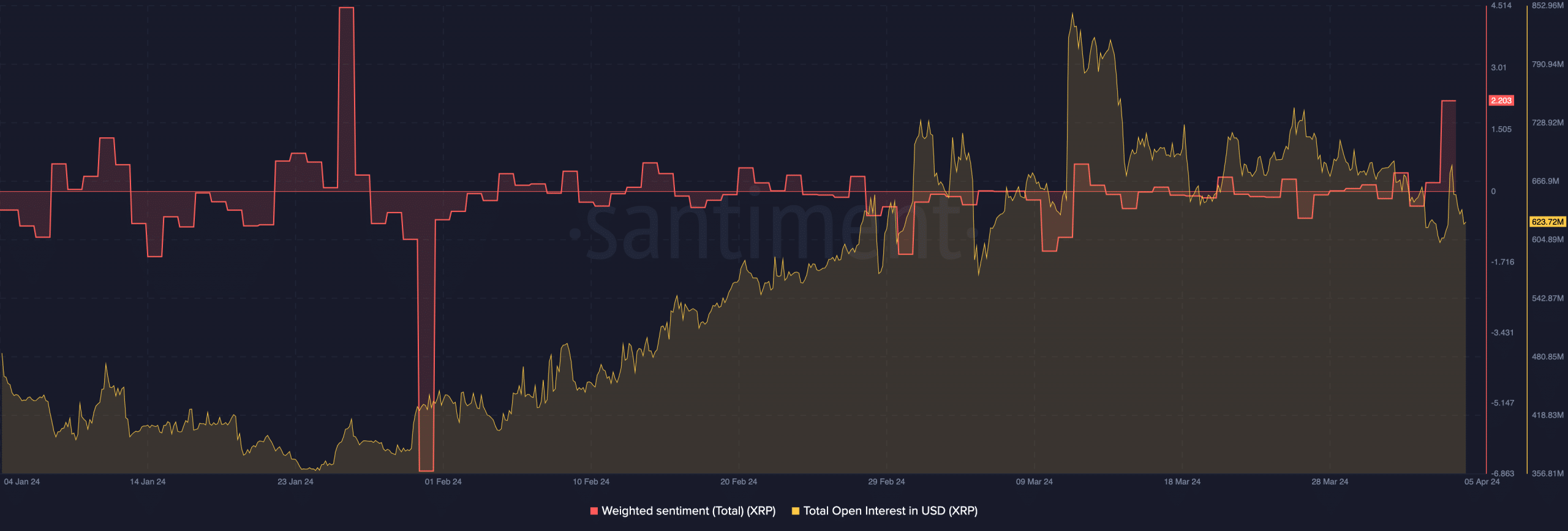

Another metric worth looking at is Weighted Sentiment. According to AMBCrypto’s on-chain analysis, XRP’s Weighted Sentiment climbed, and it hit its highest point since 26 January.

Potential rise may be temporary

This hike suggested that market participants might be bullish on the price action. However, it is also important to look at what happened to the price in January.

When the sentiment spiked at that time, XRP’s price was $0.54. Days later, the value of the token tanked to $0.49. If history repeats itself, then XRP might climb towards $0.59.

Source: Santiment

However, the potential increase could be short-lived, and a 9.25% fall could appear in the short term.

Apart from the Weighted Sentiment, AMBCrypto evaluated the Open Interest (OI) too. At press time, XRP’s OI fell, indicating that traders have been increasingly closing their net positions. A reasonable inference from the decline would be that sellers are more aggressive.

If the decline continues to decrease like the price, a rebound could be next. However, as the historical data implied, the possible bounce might not last.

Read Ripple’s [XRP] Price Prediction 2024-2025

From a long-term perspective, XRP might be one of the least-performing assets this cycle. If you are someone who expects parabolic returns, the token might not be able to offer that.

Powered by WPeMatico