- The overall memecoin market plunged, led by DOGE, SHIB, and PEPE.

- Technical analysis shows potential further declines for the altcoin market.

The cryptocurrency market has witnessed significant fluctuations recently, with meme coins experiencing a notable downturn.

These whimsically themed cryptocurrencies, often inspired by internet memes and jokes, have seen a collective market cap reduction to $54.5 billion, a 3.3% decline just in the past day.

Despite their typically volatile nature, the decline has been sharp and influenced primarily by major players such as Dogecoin [DOGE], Shiba Inu [SHIB], and Pepe [PEPE].

After a period of robust growth, where Dogecoin, for instance, surged by 9.8% last week, it along with PEPE faced a downturn exceeding 4% in a single day.

Shiba Inu, on the other hand, has been experiencing a steady decrease over the week, culminating in a 4.5% drop yesterday.

This series of declines has sparked conversations and concerns regarding the sustainability of meme coins in a bearish market.

However, while price performance may bring Shiba Inu as the most red in the top 3 meme coin market, AMBCrypto has recently reported that a projection of $0.000031 being the immediate target for SHIB should the bulls prevail.

Memecoins market shift coming

The downturn in memecoin values coincides with a broader decline in their trading volumes.

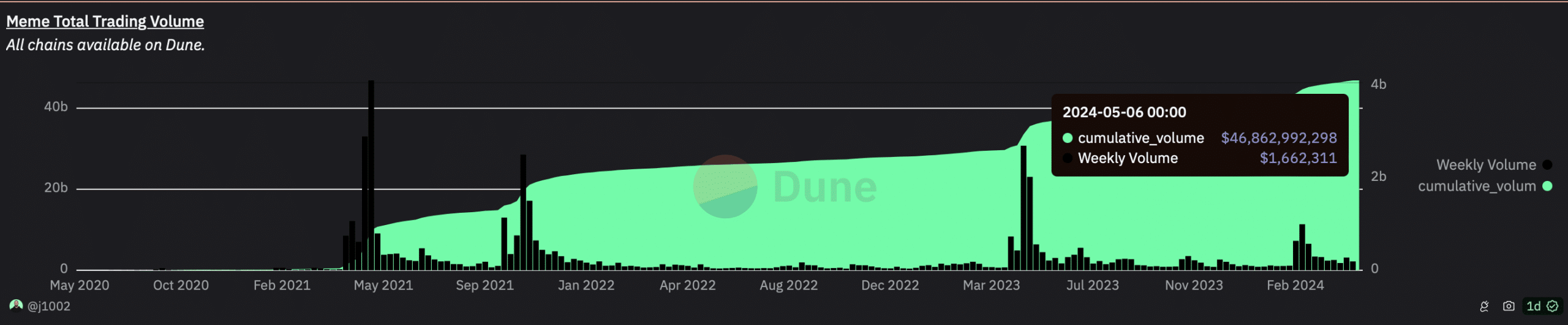

According to Dune Analytics, memecoin transaction volumes across major blockchains such as Ethereum [ETH] and Solana [SOL] have plummeted dramatically.

Source: Dune

From a high of nearly $998.55 million in March, the weekly trading volume has shockingly dropped to just $1.6 million as of the 6th of May.

This stark reduction indicates a significant waning of trader interest and confidence in these digital assets.

Looking more closely, individual meme coins have mirrored this trend.

Dogecoin’s trading volume, for instance, halved by 50% over the last two months, while Shiba Inu and PEPE saw their volumes decrease by over 80% and 50% respectively.

This overall market behavior reflects a broader disinterest from investors.

Implications for the broader crypto market

The downturn in meme coins could be a precursor to wider market challenges. Traditionally, bull markets in the cryptocurrency sector are often propelled by a surge in altcoin activities.

However, the recent downturn across the board suggests that bearish trends may continue to dominate the broader crypto landscape.

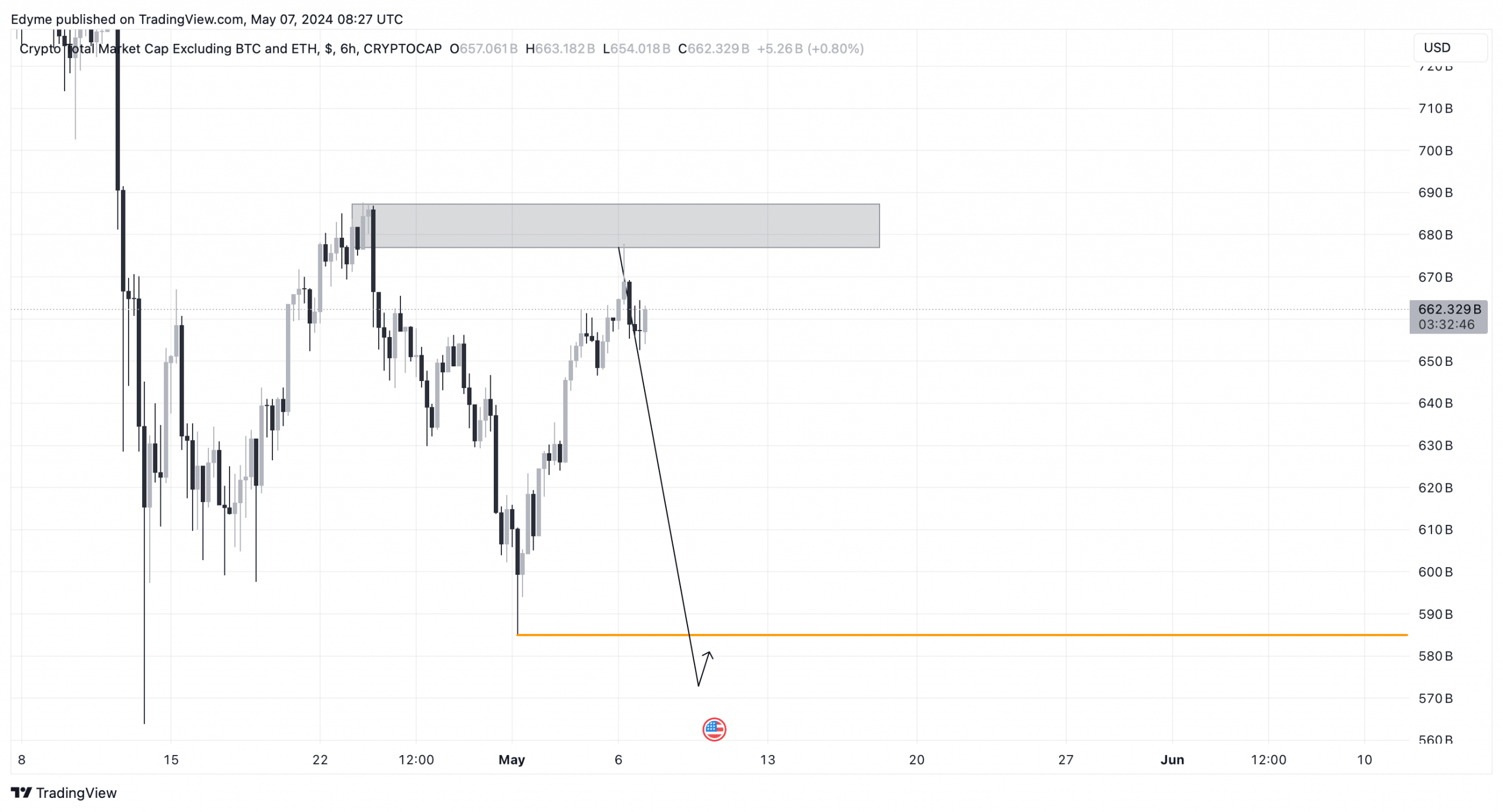

In technical terms, the TOTAL3 chart — the total market cap of all cryptocurrencies excluding Bitcoin [BTC] and Ethereum, has demonstrated multiple structural breaks to the downside.

This indicates a possible prolonged bearish phase for altcoins.

Source: TradingView

Is your portfolio green? Check out the BTC Profit Calculator

Furthermore, the altcoin market has recently tested a significant supply zone on the 6-hour chart, marked by a shooting star followed by a bearish engulfing candlestick pattern closing below the shooting star.

This sequence suggests that the altcoin market may continue to face downward pressure until a swing low has been taken out, then, then a potential reversal to the upside might be possible.

Powered by WPeMatico