- The increase in development activity had little to no effect on XRP’s price.

- A good buying opportunity might have presented itself, on-chain data revealed.

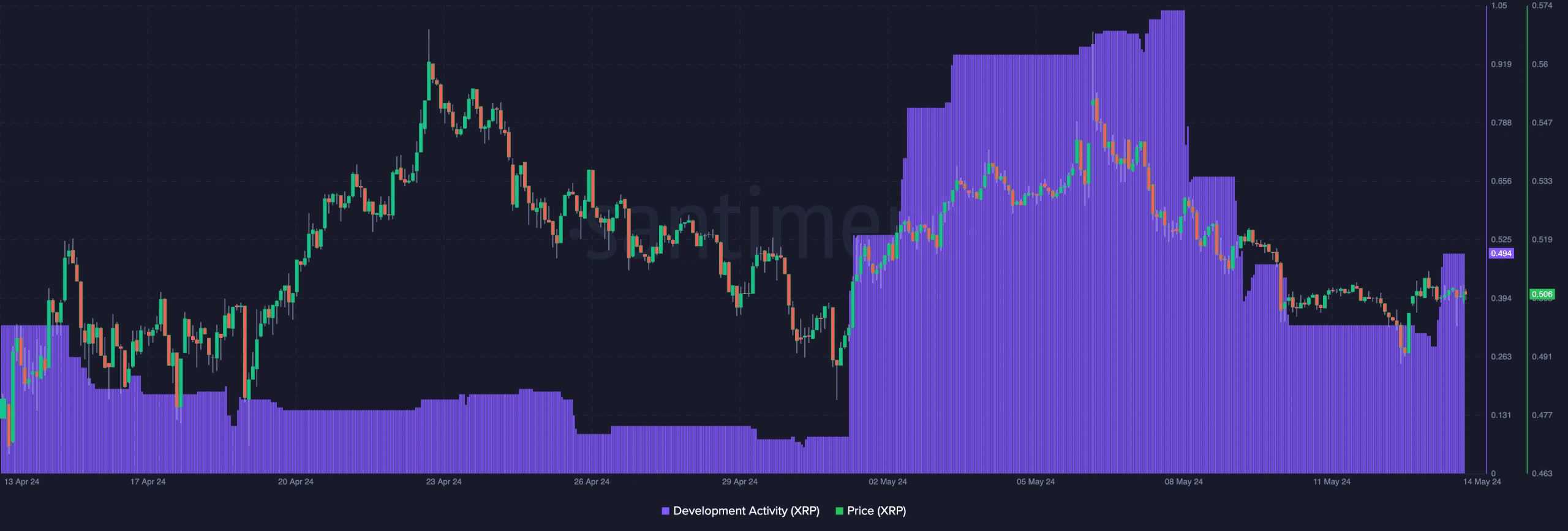

Development activity on the XRP Ledger (XRPL) improved after an initial decline on the 13th of April.

Using on-chain data provided by Santiment, AMBCrypto observed that the metric dropped to 0.28 before its recent recovery to 0.49.

XRPL is the decentralized public blockchain that allows the transfer of XRP, fiat currencies, and a few other digital assets.

When development activity increases, it means that work done to ensure the proper functioning of the ledger has improved.

Dedication does not equal higher prices

On the other hand, a decline in development activity suggests a decrease in public GitHub repositories. Therefore, this rise implied that features were shipped out to maintain a good record of XRP transactions.

But did this affect the price of the token? At press time, XRP’s price was $0.50— almost the same value that it was 24 hours ago.

Source: Santiment

Historically, upgrades on the ledger have hardly been a determinant for the token’s price action. Sometimes, XRP’s price increases when the metric jumps.

Other times, the price stalls or declines. In the meantime, AMBCrypto looked at some other things happening on the network. The next indicator we checked was active addresses.

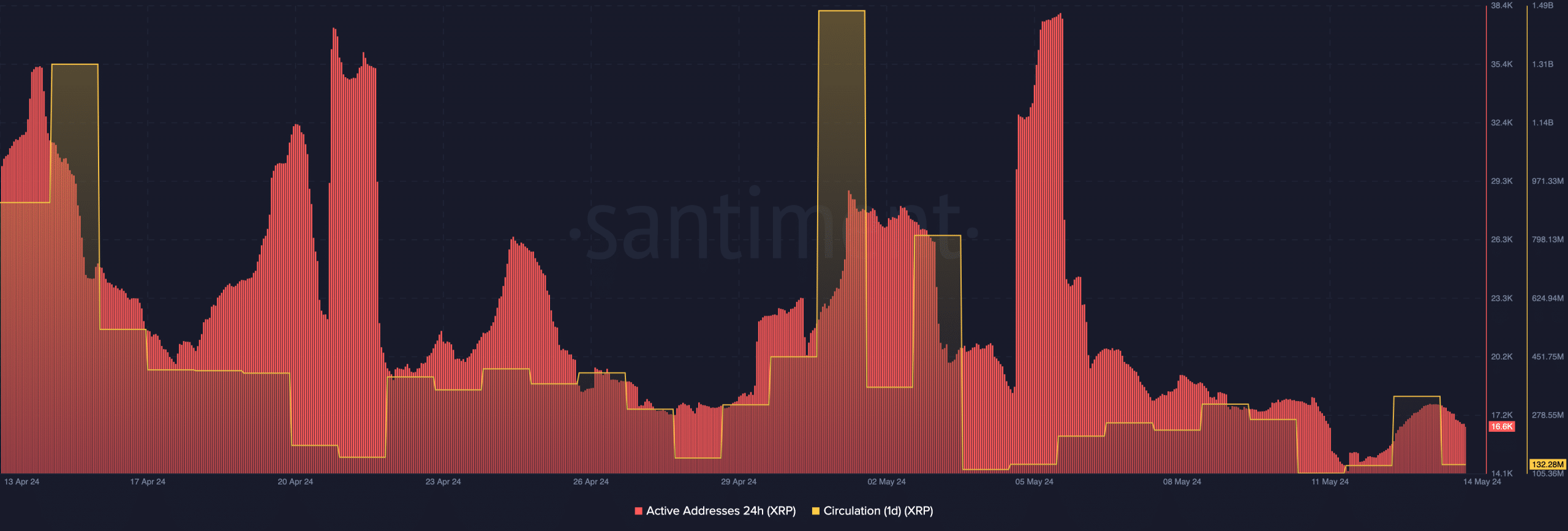

This metric tracks the level of user transactions. An increase in active addresses implies that successful transactions have increased.

Meanwhile, a decrease in the metric suggests that participation in sending or receiving tokens is on the low side.

Network activity on the ledger drops

As of this writing, the 24-hour active addresses on the XRPL were down to 16,600. This implied that addresses involved in interacting with XRP had decreased.

Evidence of this appeared in the one-day circulation. According to Santiment, the XRP’s one-day circulation was 132.28 million.

A notable decrease from over 1 billion on the 1st of May suggests that traders are avoiding the cryptocurrency like a plague.

Source: Santiment

However, this could be good news for those who plan to hold the token in the long term. This is because some predictions expect XRP to hit $3 this cycle.

If that is the case, buying at the $0.50 price could be a steal. At the same time, there is no guarantee that the price will hit the aforementioned target.

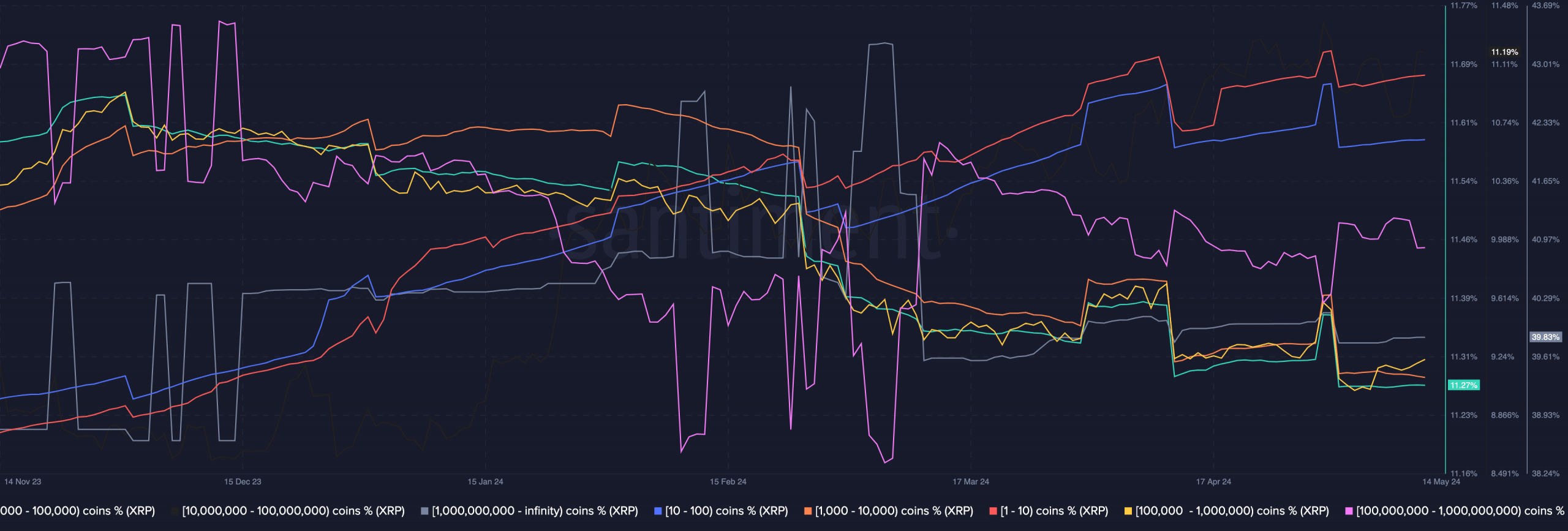

In addition, we checked if holders of the token considered accumulating the token at the current price. To do this, AMBCrypto looked at the balance of addresses.

Is your portfolio green? Check the XRP Profit Calculator

At the time of writing, those holding 1 to 100 XRPs increased the number of tokens they had. However, it was not the same for the 1000 to 1 billion coins cohort.

Source: Santiment

From our observation, this group decreased the value of XRP held. Therefore, it seems that retail participants were the ones bullish on XRP in the short term. The same cannot be said for the big players in the market.

Powered by WPeMatico