- Data showed that the latest upgrade could tank BNB Chain’s revenue.

- Broader trader sentiment was positive, suggesting that BNB’s price can retest $600.

On the 20th of June, BNB Chain, the decentralized blockchain ecosystem released a major update. According to the chain, through BEP 336, users on the network can make transactions with a 90% fee reduction.

The disclosure is synonymous with Ethereum’s Dencun upgrade, which brought about a decrease in gas fees. Interestingly, BNB Chain did not deny that the EIP4844 inspired it. Concerning this it explained that,

“BEP 336 significantly lowers the cost of transactions on the BSC network by eliminating the need for permanent storage of certain data types.”

Will this affect revenue?

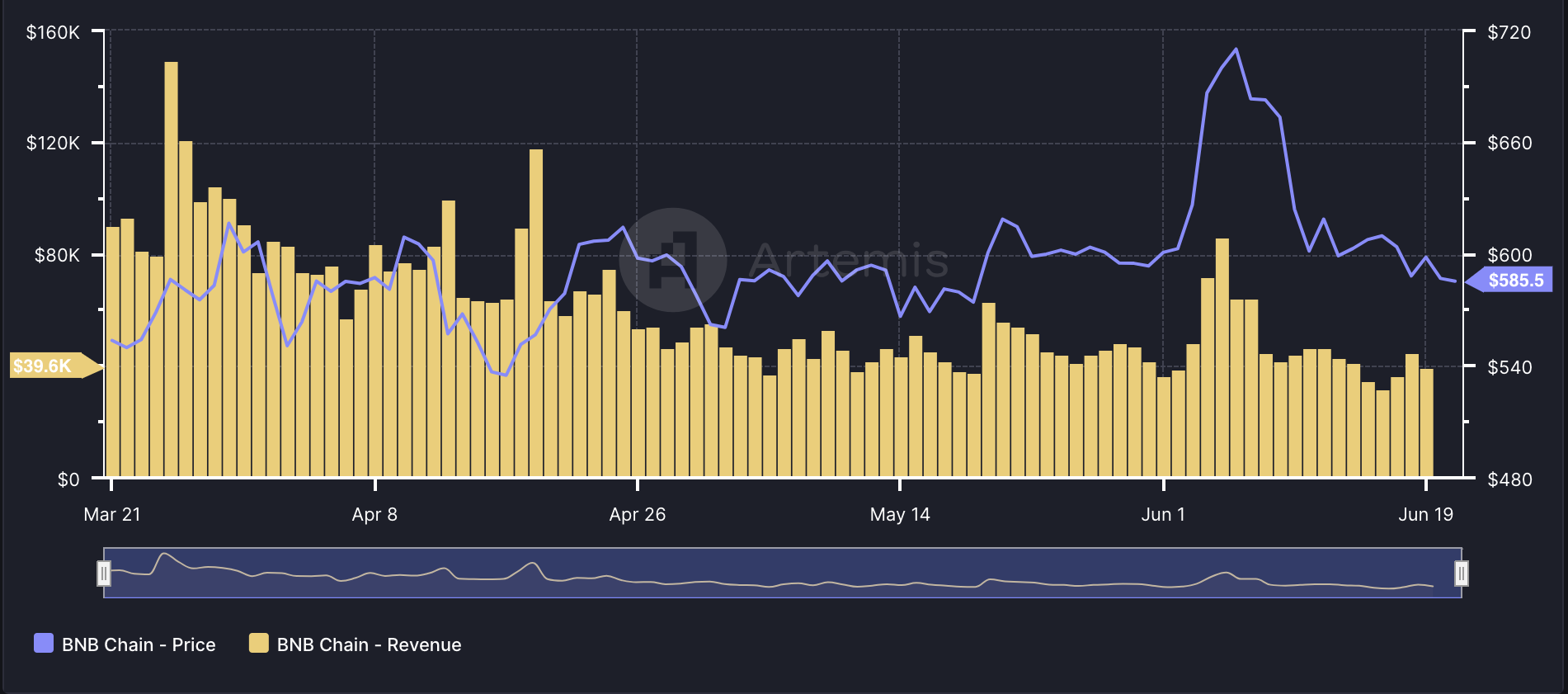

However, it is important to mention that the development could affect BNB Chain’s revenue. At press time, AMBCrypto observed that the project’s revenue decreased from what it was on the 19th, according to Artemis data.

Source: Artemis

Notably, fees gotten from transactions contribute a major quota to the revenue. Therefore, a further reduction could lead to another drop. BNB’s price is another metric that the development could influence.

At press time, BNB changed hands at $585.37. This was a notable decrease from the all-time high it reached weeks ago.

However, reduced transaction fees could mean increased demand for the BNB cryptocurrency. Should this be the case, the price of the coin might be able to approach its all-time high of $720.67 again.

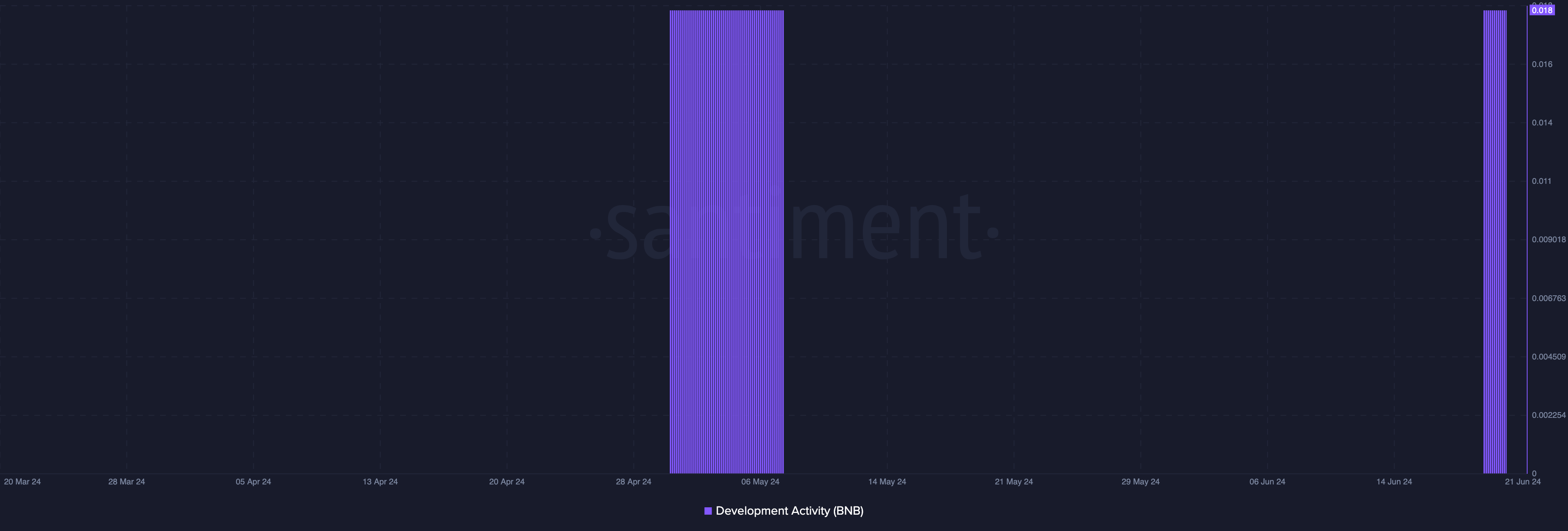

Regardless, it is important to assess what is happening on the network. As of this writing, AMBCrypto looked at the development activity.

Development improves while traders plan to take advantage

Development activity measures the work done in public GitHub repositories of a project. If the metric increases, it means that developers are committing more codes to ensure shipping of new features.

However, a decrease implies that commitment to polishing the network is not at its peak. According to. data from Santiment, BNB ‘s development activity jumped to its highest level since the 6th of May.

Source: Santiment

This implied an improvement in developer dedication. For the price, this rise could be bullish for the coin. Another indicator to evaluate is Funding Rate.

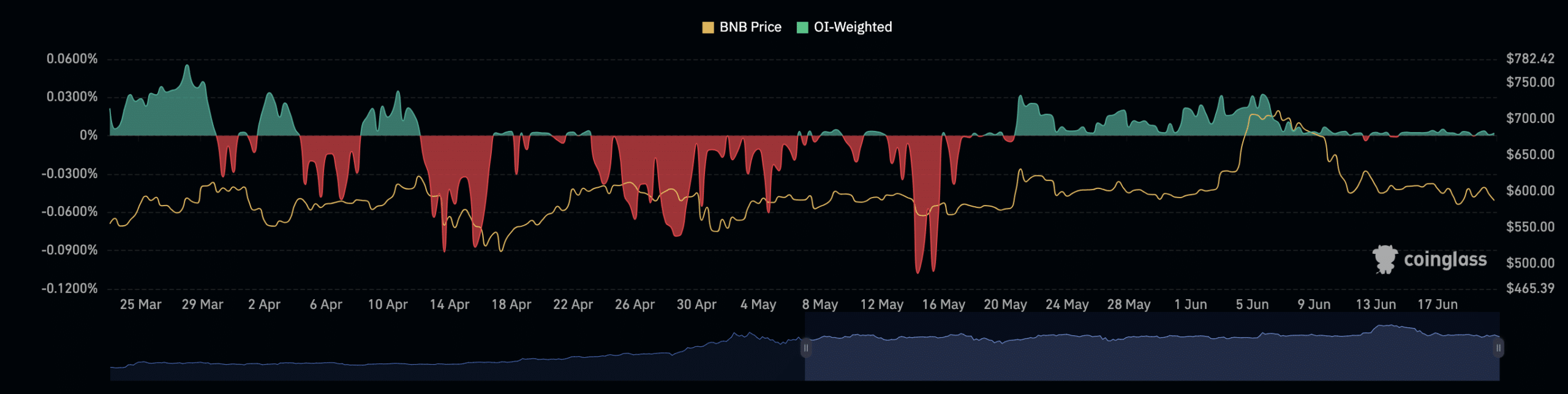

The idea behind assessing this indicator is to see if traders view the upgrade as a catalyst to drive a price increase or not.

According to Coinglass, BNB’s Funding Rate was 0.0020%. Positive values of the indicator implies that the contract price is trading at a premium to the spot price. In this case, trader sentiment is bullish.

On the other hand, a negative reading implies that the perpetual price is at a discount. Therefore, the broader trader sentiment is bearish.

Thus, the Funding Rate at press time, implies that longs are paying shorts a fee to keep their position open. Hence, the average trader expects BNB’s price to increase.

Source: Coinglass

Read Binance Coin [BNB] Price Prediction 2024-2025

But for the price to increase, buying pressure in the spot market has to be increase.

If this happens, BNB’s price can surpass $600 in the short-term. But if invalidated, the price of the coin might drop to $570.

Powered by WPeMatico