- Bitcoin saw a slight recovery after the decline.

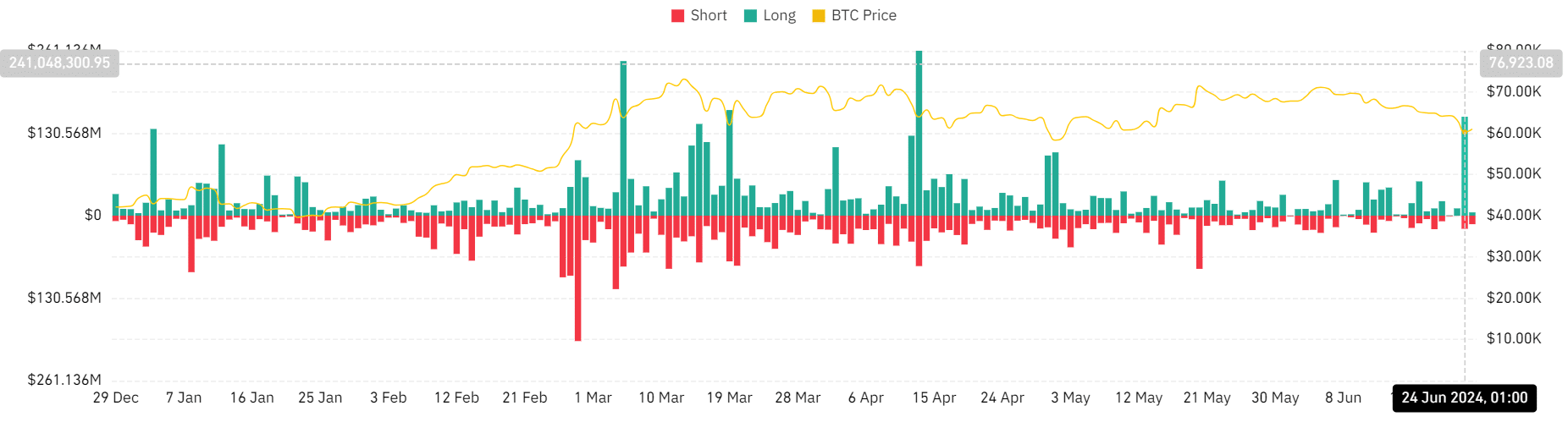

- Liquidation has tapered off after the price decline caused a spike.

Bitcoin [BTC] experienced a significant drop in the last trading session, which resulted in a surge in liquidations. Due to this decline, traders who purchased Bitcoin in the past 30 days are now facing losses.

Bitcoin liquidations spike

AMBCrypto’s analysis of Bitcoin’s liquidation chart on Coinglass revealed a significant increase in liquidation volume on the 24th of June. The spike was primarily triggered by a sharp drop in Bitcoin’s price.

It resulted in substantial liquidations, especially among long positions, which accounted for over $156 million.

In contrast, short positions saw liquidations amounting to around $21 million, indicating that traders who had bet on a price increase were the most affected.

Source: Coinglass

As of this writing, although there had been a slight increase in Bitcoin’s price, short positions were experiencing more liquidations.

The volume of short liquidations was around $13.5 million, while long liquidations were lower, at around $5.2 million.

This shift suggested that traders who anticipated a continued price decline were now facing losses due to the price rebound.

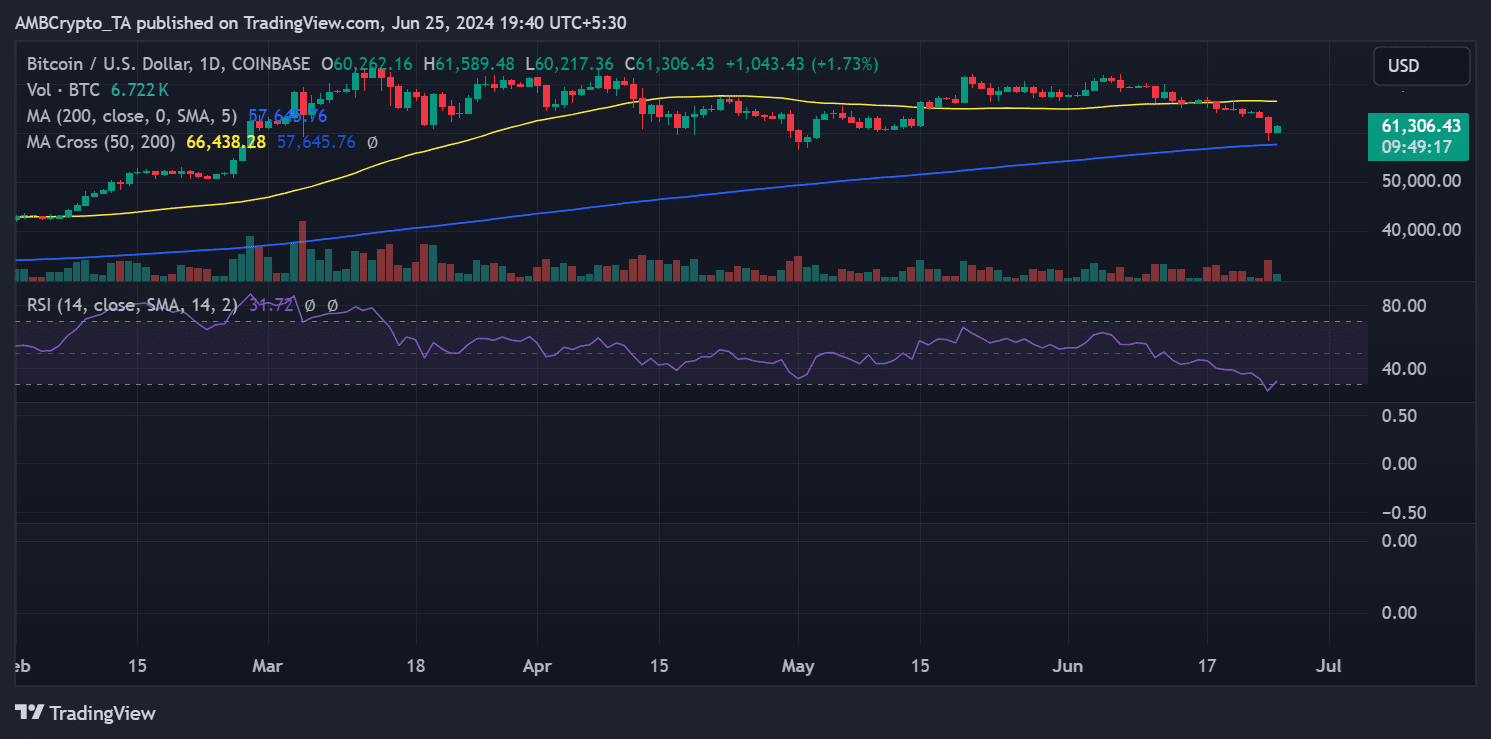

Bitcoin sees a slight increase

AMBCrypto’s look at Bitcoin’s price trend revealed a notable drop on the 24th of June, with its value plunging to a low of $58,414 during the trading session.

By the session’s close, it had partially recovered to around $60,263 yet still recorded a 4.60% decline from its opening value. This drop triggered significant liquidations in the market.

Source: Trading View

As of this writing, its price had risen to approximately $61,300, reflecting an increase of around 1.70%. During the decline, the Relative Strength Index (RSI) for Bitcoin fell below 30, signaling a strong bearish trend.

Although the RSI has slightly recovered above this critical threshold, it suggested that while there has been a minor improvement, BTC still predominantly exhibited strong bearish momentum.

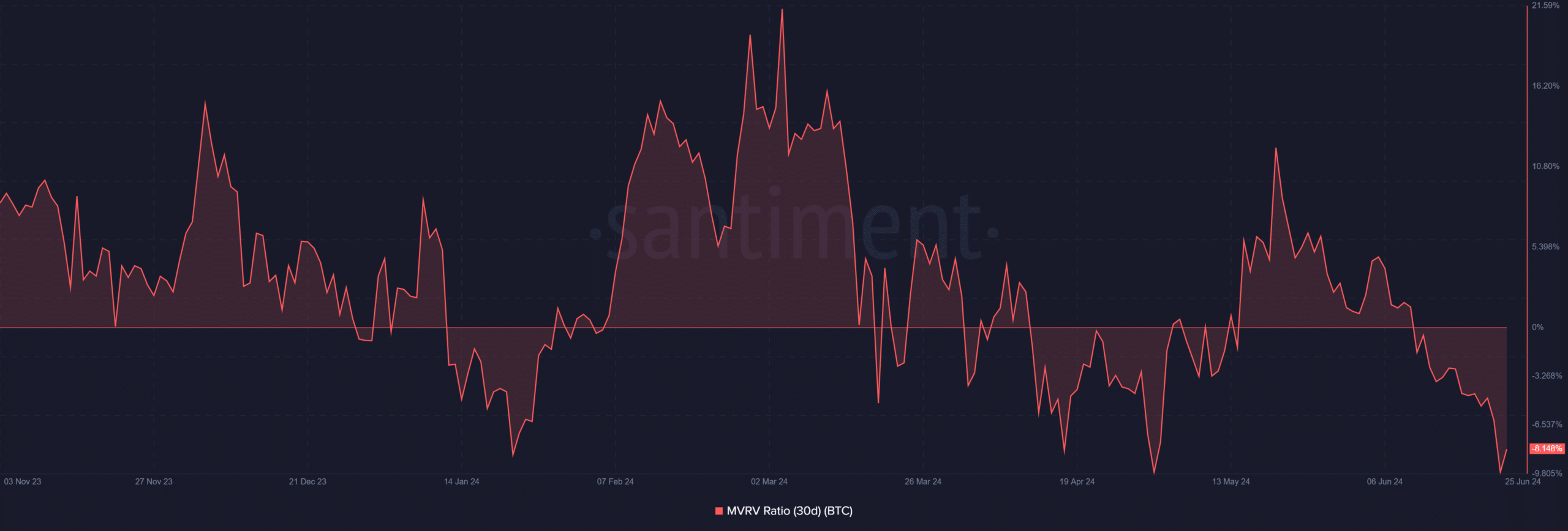

BTC holders at a loss

The analysis of Bitcoin’s 30-day Market Value to Realized Value (MVRV) ratio, as reported on Santiment, revealed a concerning trend of decline.

This ratio, which compares the market value of an asset to its realized value, dipped below zero around the 10th of June.

The dip indicated that the average market participants were holding Bitcoin at a value lower than their purchasing price.

The recent price drop exacerbated this situation, with the MVRV ratio plummeting to approximately -9.7% on the 24th of June.

Source: Santiment

As of this writing, there had been a slight recovery in the MVRV ratio to around -8.14%, yet it remained negative.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This ongoing negative value suggested that traders who acquired Bitcoin over the past 30 days were still facing losses on their investments.

A negative MVRV ratio is often viewed as an indicator that the asset is undervalued and that current holders have bought at higher prices than the current market is willing to pay, maintaining a bearish sentiment in the market.

Powered by WPeMatico